AAA weekly

2020-11-09

Copyright FOURIN, Inc. 2025

NEV Battery Supplier Farasis Boasts Top-level R&D Expenses in 2019

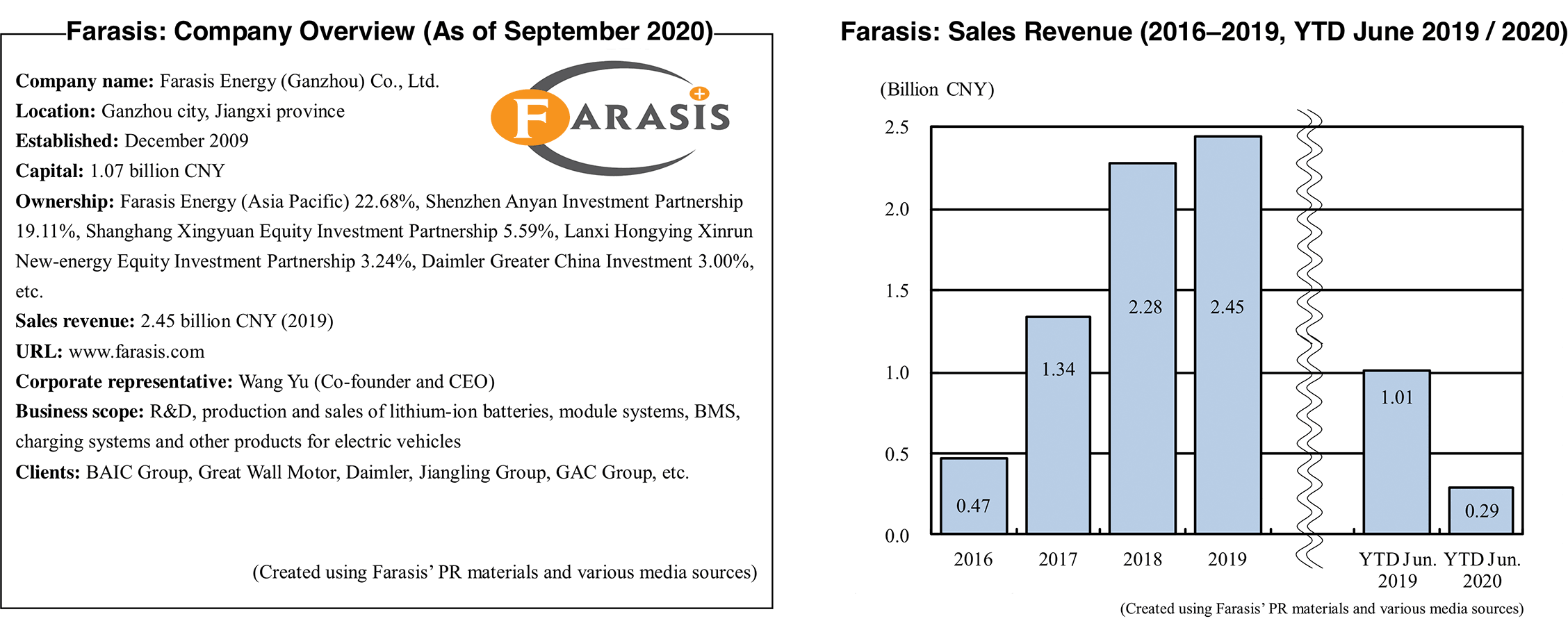

Farasis Energy (Ganzhou) Co., Ltd. is a Chinese supplier engaged in the manufacture and sale of cells and modules of lithium-ion batteries (LiB) for automobiles and the development of large-scale power storage systems. It specializes in R&D and manufacturing of ternary battery packs, and has achieved rapid growth in recent years, supported by the promotion of new-energy vehicles (NEV) by the Chinese government.

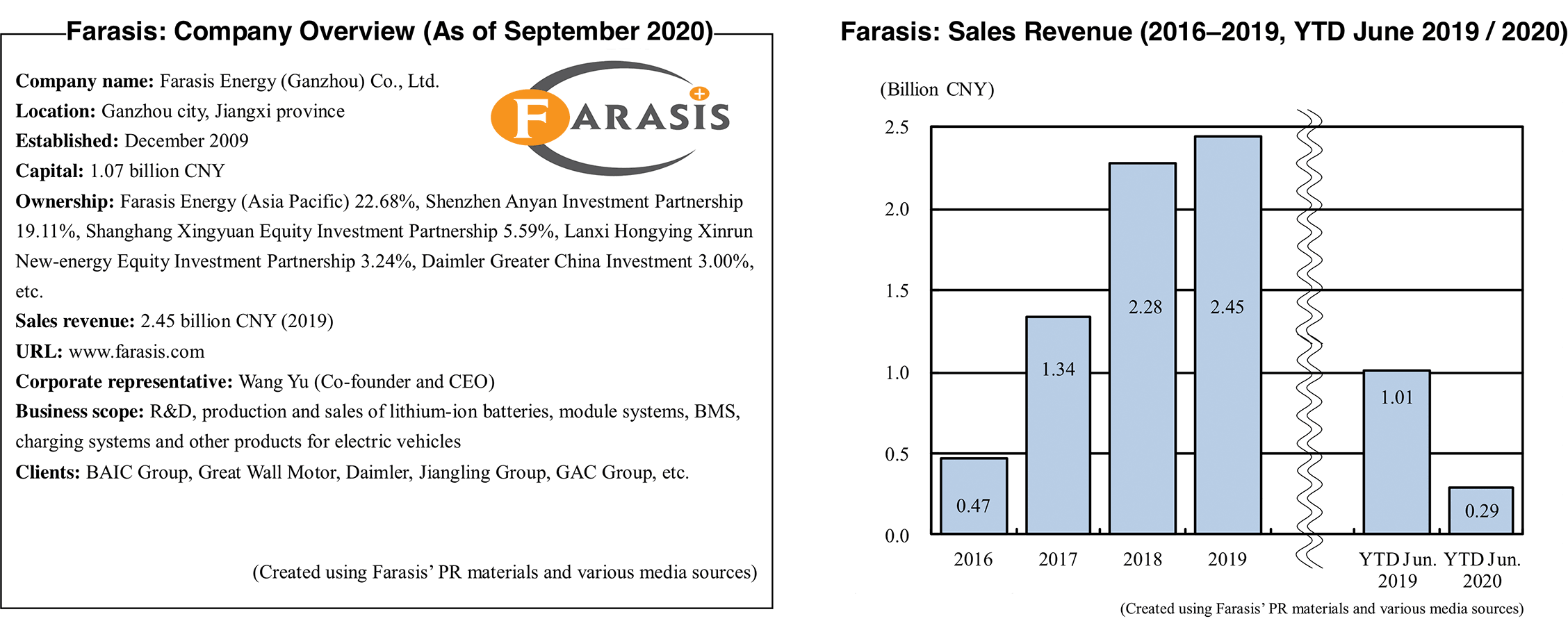

Sales of Farasis in 2019 increased 7.7% from the previous year to 2.45 billion CNY. The operating profit was 140 million CNY. Although NEV sales were sluggish nationwide, the company performed well. However, sales in the first half of 2020 were affected by the spread of coronavirus infection, resulting in a significant decrease of 71.8% year-on-year. Demand for NEV batteries also fell sharply, as automobile manufacturers postponed the launch of new models.

While the impact of the pandemic is far from over, Farasis went public on the Shanghai Stock Exchange in July 2020, raising about 3.43 billion CNY. Part of the funds will be used for the third expansion of the company’s Zhenjiang plant. The company signed a long-term large-scale contract with Daimler in effect until 2030 in 2018, attracting global attention. In August 2020, Farasis announced that it has become a supplier of Dongfeng Motor Group’s subsidiary Voyah Automobile Technology which placed an order worth 4 billion CNY. The contract will be in effect for seven years.

Behind the recent advancement of Farasis is R&D specializing in ternary battery packs. Farasis’s R&D expenses in 2019 reached 270 million CNY, accounting for 13% of all sales, the highest level in the industry. Farasis makes battery cells with an energy density of 285Wh/kg. It is the highest among mass-manufactured batteries. In the next five years, the company plans to increase energy density to 350Wh/kg.

While currently Farasis is performing well, some are worried about the future. One of the issues is the limited number of clients. The company’s main customers are BAIC Group, Great Wall Motor and Daimler. However, the top five clients account for more than 90% of all sales. In the face of sluggish sales in the NEV market, suppliers are forced to cut production. For this reason, the diversification of sales channels has become an issue.

Some say that in an effort to avoid heavy dependence on long-term contracts, Farasis must secure short-term and medium-term contracts as well. In addition, since Farasis specializes in the manufacture of ternary batteries, some have pointed out that cobalt, which is an essential material for the batteries, must be stably secured.

Farasis: Recent Business Trends (As of September 2020)

Financial Performance

Sales increased nearly 8% in 2019

・In July 2020, Farasis announced that its 2019 sales increased 7.7% year-on-year to 2.45 billion CNY. The operating profit was 140 million CNY, turning into a surplus from the previous year’s 100 million CNY deficit.

– Orders received from Great Wall Motor, a major customer, increased 3.4 times from the previous year to 560 million CNY, boosting sales and profits.

– Sales of battery module-related products increased 3.7 times year-on-year to 770 million CNY, which also contributed to the increase in sales.

Operating loss of 240 million CNY in H1 2020 due to the pandemic

・In August 2020, Farasis announced that sales in the first half of 2020 were 290 million CNY, a significant drop of 71.8% from the same period of the previous year. The operating loss was 240 million yuan.

– In the first three months of 2020, due to the outbreak of the coronavirus infection, automobile manufacturers were unable to draw up annual production and sales plans which resulted in a significant decrease in orders which in turn led to deterioration in business performance.

– Farasis has been recovering since the second quarter of 2020, but it is difficult to say whether sales will exceed the previous year’s result for the whole year.

Shanghai Listing

Raising 3.43 billion CNY on the Shanghai stock exchange

・In July 2020, Farasis announced that it went public on the Shanghai Stock Exchange and raised 3.43 billion CNY.

– Of the proceeds, 2.44 billion CNY will be used to fund the construction of the third phase of the Zhenjiang plant in Jiangsu province. The remaining 600 million CNY will be used as working capital.

Daimler acquires 3% stake in Farasis

・In July 2020, Daimler announced that it had acquired a 3% stake in Farasis ahead of its listing in Shanghai.

– The acquisition amounted to 900 million CNY, making Daimler the fifth largest shareholder of Farasis.

Production Expansion

Completing expansion of Ganzhou factory

・In August 2020, Farasis announced that the production expansion work at its Ganzhou plant in Jiangxi Province was completed at the end of 2019. The annual production capacity of the plant was raised to 5GWh.

– Due to the pandemic, adjustments are being made for full-scale operation after the expansion work.

Zhenjiang factory’s annual capacity reaches 16GWh

・In August 2020, Farasis announced that the first phase of expansion work of the Zhenjiang plant in Jiangsu province was completed at the end of 2019. At the same time, it was revealed that the second phase of expansion work had started a test run for operation. Each phase is designed to have an annual production capacity of 8GWh, raising combined capacity to 16GWh.

– Due to the pandemic, the start of operations has been delayed, and the official launch date is undecided.

Please

register or subscribe to view this report for free.

If you’re already a subscriber, sign in.

Credit card information is not needed for free trial registration.

You are eligible to view one report for free.

Additional reports require subscription.