AAA weekly

2020-04-13

Copyright FOURIN, Inc. 2025

Pakistan’s Automobile Market in 2019: Overall Sales Decreased 27.1% to 193,000 Units

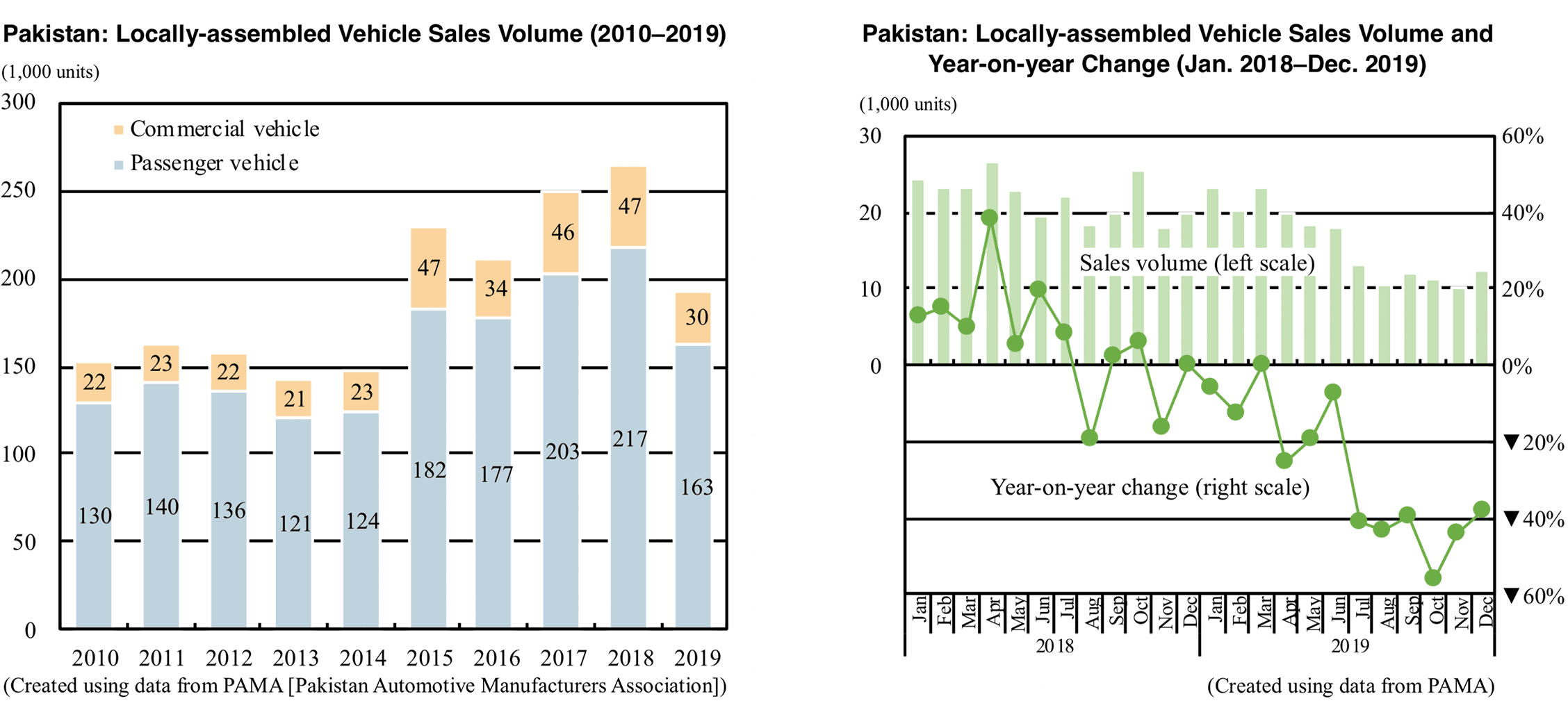

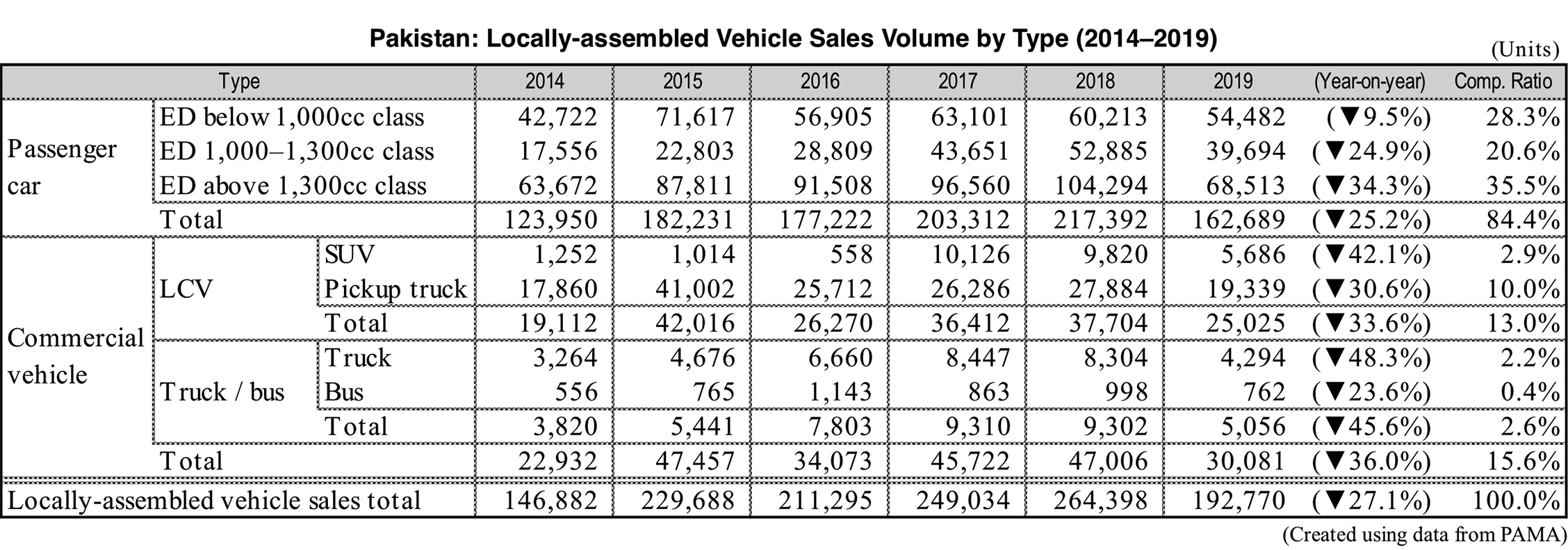

Pakistan’s locally-assembled vehicle sales (PAMA members only) fell sharply in 2019, going down 27.1% year-on-year to 193,000 units. The Pakistani market reached a record high level for two consecutive years in 2017 and 2018, and demand was expected to continue to grow to 300,000 units, but the government’s abrupt tightening of regulations on car purchases and tax hikes ended growing sales. As a result, demand fell below 200,000 units for the first time in five years.

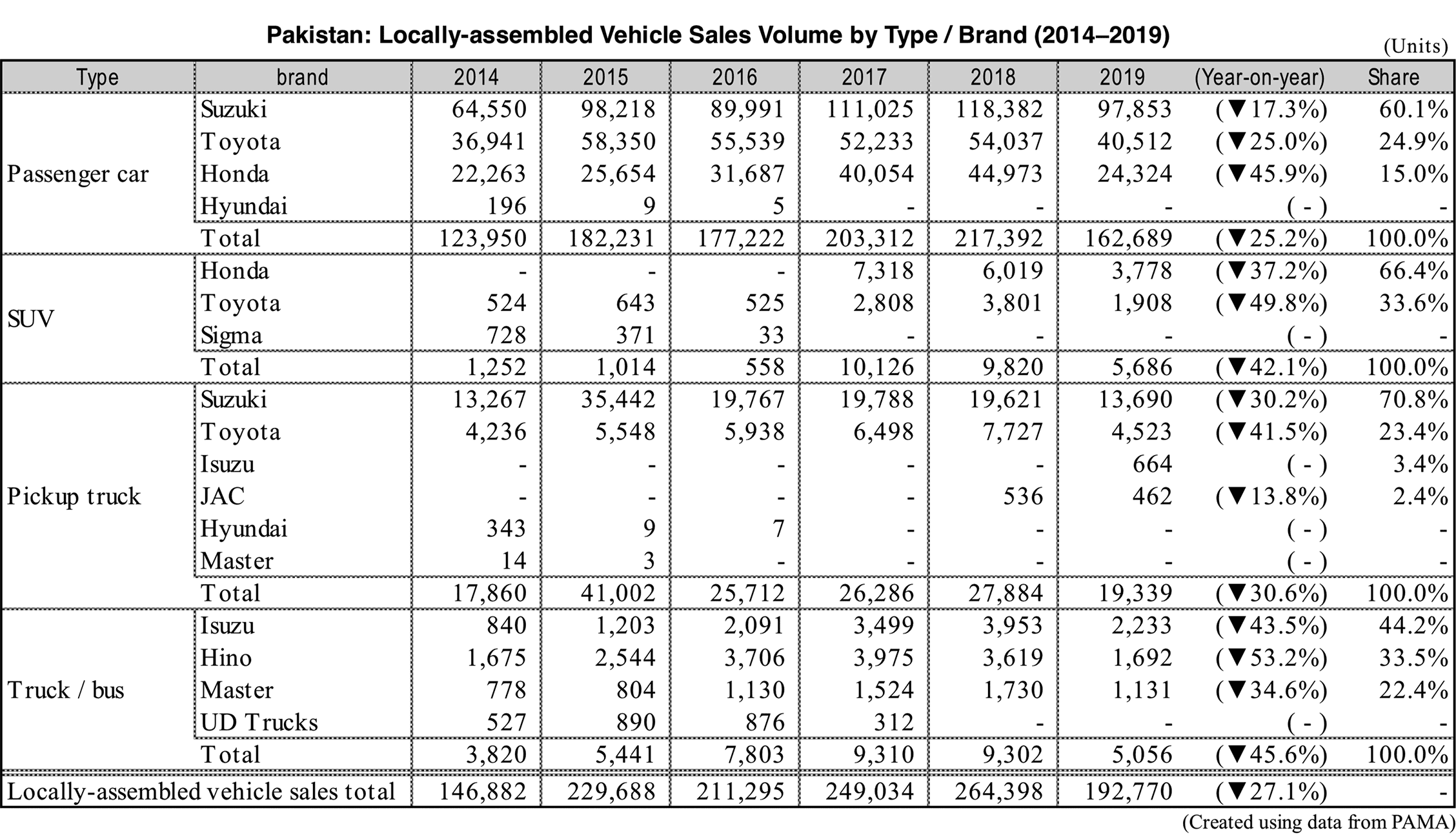

The following factors are believed to be behind the market contraction in the second half of 2018 and 2019: 1 Significant increase in vehicle prices following rapid depreciation of the Pakistani rupee. 2 Prohibition of car purchase by non-taxpayers. 3 Introduction of higher taxes on locally-assembled vehicles. The worsened market environment due to the weakened rupee combined with vehicle purchase restrictions and higher taxes led to a sharp decline in sales. Looking at sales by brand, market-leader Suzuki declined 19.2% to 112,000 units. While all models dropped double digits, the launch of the new Alto in June 2019 added some 25,000 units to Suzuki’s total sales. As a result, Suzuki’s rate of decline was smaller compared to other automakers, enabling Suzuki to increase its market share 5.7 percentage points to 57.9%. The following two automakers after Suzuki sharply declined. Toyota saw a 28.4% decrease to 47,000 units and Honda witnessed a 44.9% drop to 28,000 units.