AAA weekly

2023-09-04

Copyright FOURIN, Inc. 2025

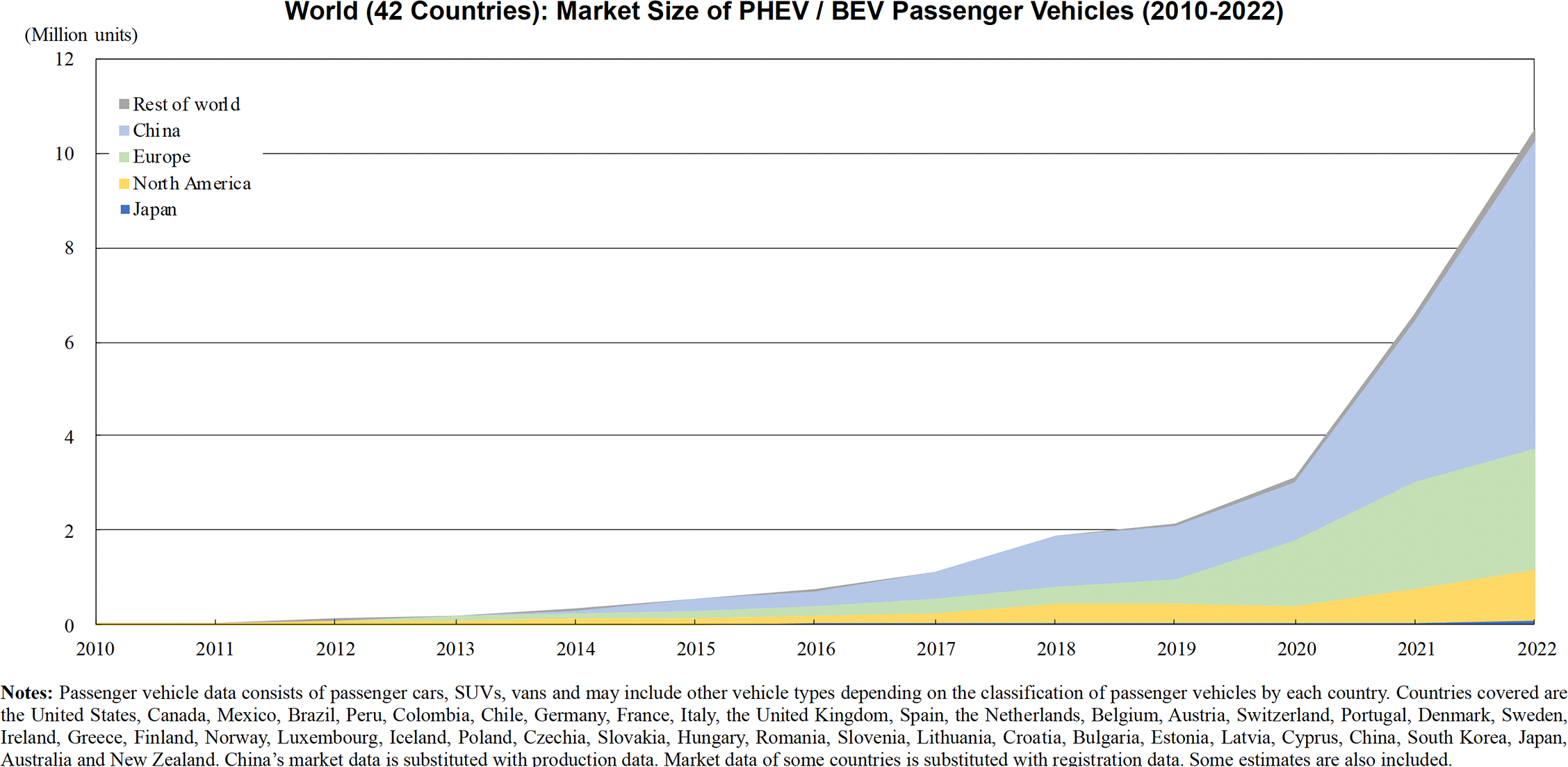

Global PHEV / BEV Passenger Vehicle Sales Surpassed 10 Million Units in 2022

The PHEV / BEV passenger vehicle market in 42 countries around the world is estimated to have reached over 10 million units in 2022, up 60.7% year-on-year. The global market size has been estimated based on production and sales data released by national automobile manufacturers' associations and public relations materials of automakers. The 42 countries covered by this report account for about 85% of the global automobile market. Although the rate of growth slowed down from the previous year (2.1-fold in 2021), the market scale exceeded 10 million units for the first time.

Looking at the PHEV / BEV market by country / region, China is driving the overall growth with 6.5 million units, up 94.3% yearon- year. The ratio of PHEVs / BEVs in the total passenger vehicle market increased by 12.1 pp (percentage points) to 27.8%, reaching a scale of one out of every four vehicles sold in China is PHEV / BEV. In Western Europe, the market continued to expand, up 14.1% year-on-year to 2.5 million units, while the PHEV / BEV ratio increased by 4.0 pp to 24.8%. Meanwhile, although the PHEV / BEV ratio is expanding in other markets as well, it is still in the single-digit range, 6.7% in the United States, up 2.4 pp, 5.7% in Central and Eastern Europe, up 1.7 pp and 2.8% in Japan, up 1.6 pp.

The PHEV market increased by 47.9% year-on-year to 2.8 million units. In terms of market size, China and Western Europe accounted for around 90% of the market in 2022. China was the largest market with 1.5 million units, up 2.5-fold from the previous year. Sales in Western Europe continued to decline, down 3.0% to 991,000 units. The ratio of PHEVs to the entire passenger vehicle market went up by 3.6 pp to 6.4% in China and by 0.1 pp to 9.8% in Western Europe. Although these numbers appear to be small, they are still higher compared to 1.3% in the United States, up 0.1 pp, 2.0% in Central and Eastern Europe, up 0.3 pp and 1.1% in Japan, up 0.5 pp.

The BEV market grew 65.8% year-on-year to 7.7 million units, about 2.8 times larger than the PHEV market. As the focus of environmental regulations in China, Europe and the United States is shifting to BEV products, the gap between the PHEV and BEV markets is expected to widen in the medium to long term. Looking at results by country / region, sales in China increased by 81.7% year-on-year to a little over 5 million units, surpassing 5 million units for the first time in terms of BEV sales alone. Sales in Western Europe rose by 28.8% year-on-year to 1.5 million units. The top two markets, China and Western Europe, combined account for about 85% of the global total. Adding the United States (739,000 units, an increase of 60.8% year-on-year) to this figure makes it about 95%, revealing that the three markets mentioned above, which are particularly focused on environmental regulations, are at the center of the global BEV market. The BEV ratio to the total passenger vehicle market rose by 8.5 pp to 21.4% in China, by 3.9 pp to 15.1% in Western Europe, and by 2.3 pp to 5.4% in the United States. On the other hand, in Japan, BEV sales increased 2.5-fold to 59,000 units, but the ratio to the overall passenger vehicle market remained at a low level of 1.7%, an increase of 1.1 pp. Partly because the government has not clearly indicated policies focused on BEVs, it is expected that the gap in the ratio of BEVs in the total market with China, Europe and the United States will further widen.