AAA weekly

2024-02-02

Copyright FOURIN, Inc. 2025

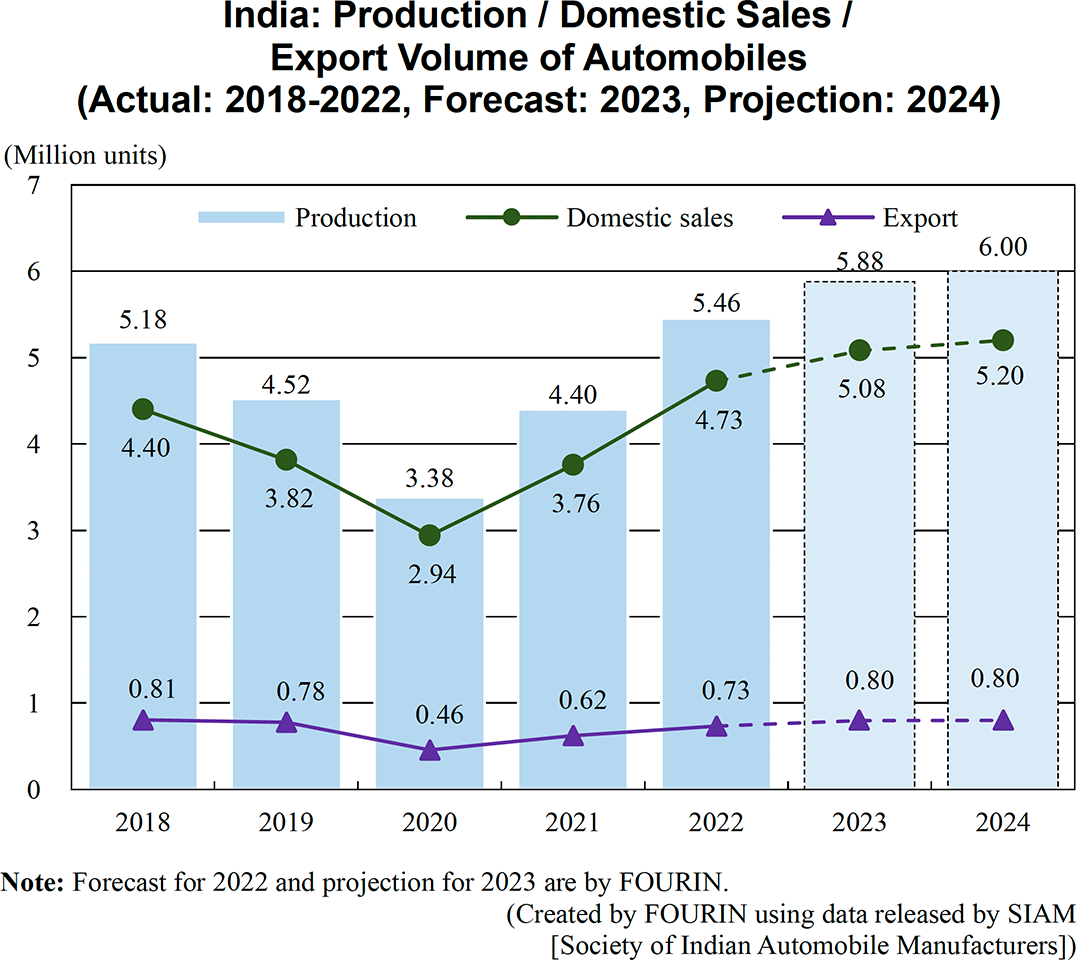

Projection of India’s Automobile Market in 2024

The Indian automobile market in 2023 is expected to reach a new record high for the second consecutive year, exceeding 5 million units for the first time, reaching 5.08 million units, an increase of 350,000 units compared to the previous year. On the other hand, although sales are expected to reach a new record high in 2024, the growth pace of the automobile market is expected to slow down to around 5.2 million units.

In 2023, semiconductor supply constraints eased, so the supply of automobiles recovered. As a result, the backlog of orders was cleared. In addition, driven by strong domestic demand, the real GDP growth rates (preliminary figures) for January to March 2023, April to June 2023, and July to September 2023 reached high levels of 6.1%, 7.8%, and 7.6%, respectively, supported by the strong economy. In addition, the concentrated introduction of new models by the top-selling brands in the growing SUV segment in 2022 and 2023 also supported the record high level.

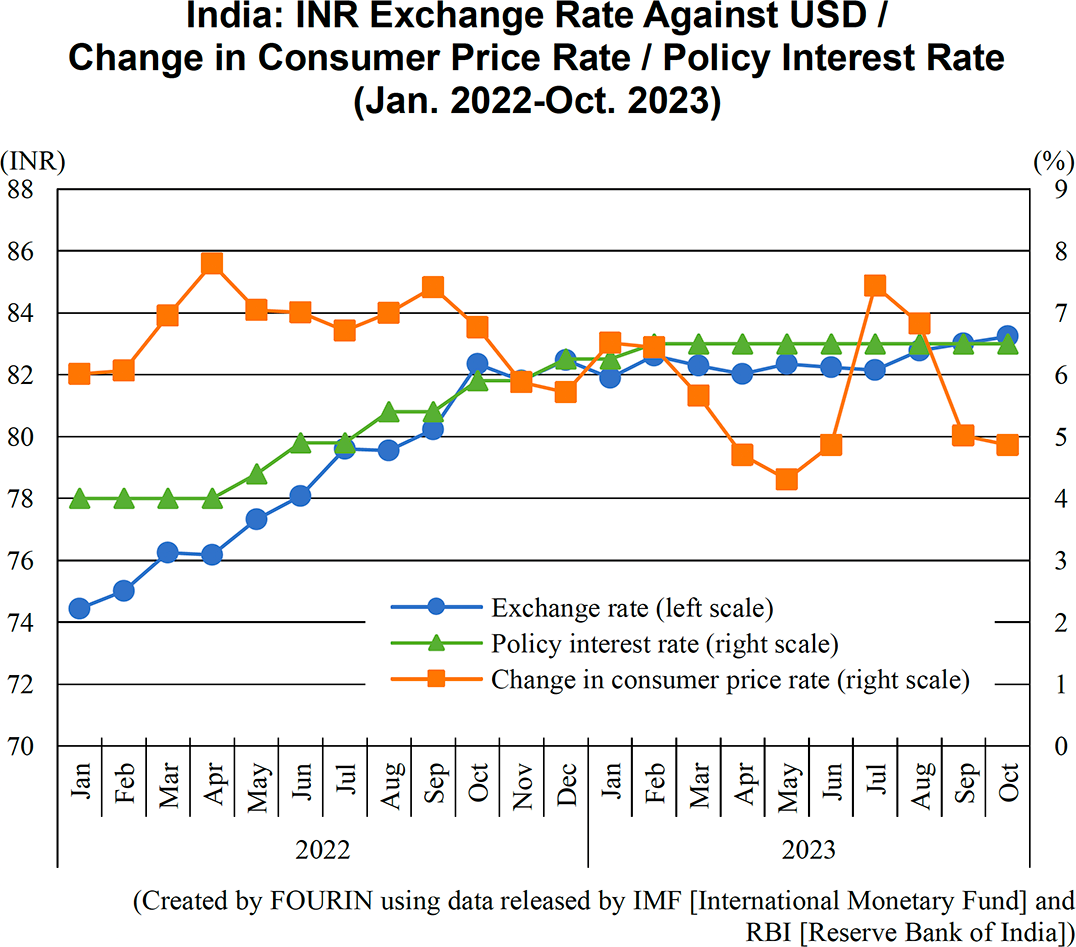

A robust economy is expected in 2024 as well. The IMF expects real GDP growth rates to continue at 6.3% and in the 6.0% range in FY 2023 (ending March 2024) and FY 2024, respectively. Additionally, the Reserve Bank of India (RBI) expects consumer price inflation to settle within the RBI’s inflation target of 5.4% in FY 2023 and 4.7% in FY 2024.

On the other hand, excessive lending has been pointed out as a cause for concern. Bank loan growth in August 2023 increased by double digits year-on-year for the 17th consecutive month, suggesting that there is a risk that the economy will cool down due to loan tightening. As there is a possibility that auto loan screening will become stricter, it is expected that sales to settle at around 5.2 million units in 2024.