AAA weekly

2024-02-07

Copyright FOURIN, Inc. 2025

Projection of Indonesia’s Automobile Market in 2024

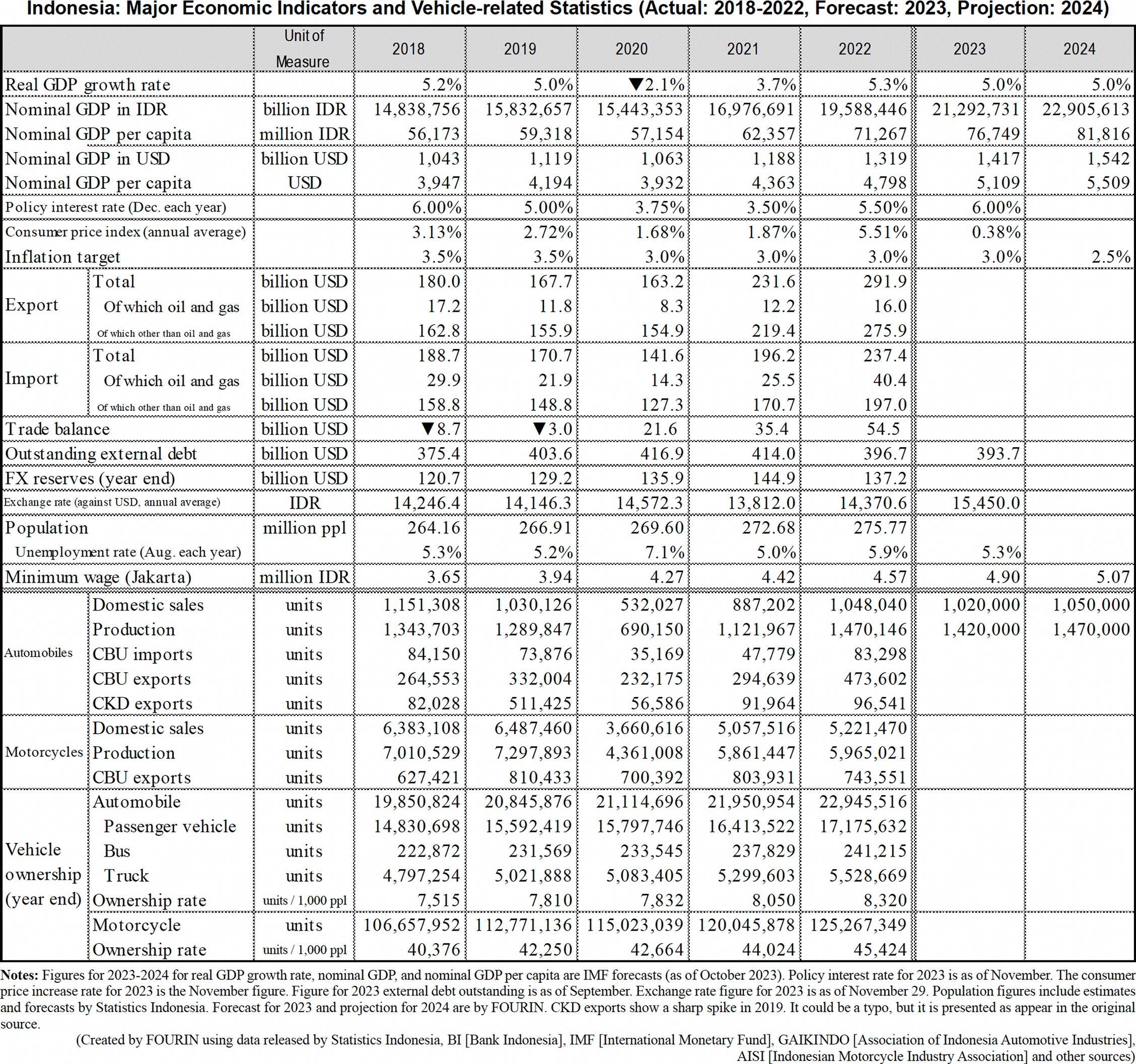

FOURIN (owner of this website) predicts that the Indonesian automobile market will shrink to around 1.02 million units in 2023, down 2.7% from the previous year. In addition to the depreciation of the rupiah and the accompanying rise in interest rates, the uncertainty surrounding the presidential election scheduled for February 2024 coupled with a wait-and-see mood, pushed down sales from the same month of the previous year since the second half of 2023. Although economic recovery from the coronavirus pandemic is progressing, it is still affected by the global economy.

As of October 2023, the Indonesian automobile industry association GAIKINDO was predicting 1.05 million units as the full year forecast for 2023, a slight increase from the previous year. However, automobile sales from January to October 2023 was 836,000 units, 1.8% lower than the same period last year. Monthly sales were expected to increase toward the end of the year, so it is unlikely that sales will fall below 1 million units.

In January 2023, the Indonesian central bank raised interest rates for the sixth consecutive month, bringing the policy rate to 5.75%. The interest rate remained unchanged until October when it was raised to 6.00% to stabilize the rupiah’s exchange rate. Meanwhile, the IMF forecasts that Indonesia’s nominal GDP per capita will reach 5,109 USD in 2023, exceeding the milestone of 5,000 USD.

FOURIN forecasts that automobile sales in 2024 will increase by 2.9% from the previous year to around 1.05 million units. Continuing depreciation of the rupiah and high interest rates are negative factors, but the IMF predicts that the real GDP growth rate will be 5%, and the economy is expected to benefit from recovery, and replacement demand is expected as five years have passed since 2018, when the new automobile market exceeded 1.15 million units. Given the nominal GDP per capita of over 5,000 USD and the low level of automobile ownership, it is considered that the country is on the eve of motorization, but due to factors such as income disparity and traffic congestion, the market will likely remain stuck at a level of just over 1 million cars for some time to come.