AAA weekly

2024-03-15

Copyright FOURIN, Inc. 2025

Thailand’s Automobile Sales Results in 2023

Thailand’s automobile sales decreased by 8.7% from the previous year to 775,783 units in 2023. Factors behind this drop include a decline in consumer purchasing appetite due to rising interest rates and an increase in household debt, as well as financial institutions becoming stricter with car loans and rising loan interest rates. On the other hand, new BEV vehicle registrations in 2023, which the Thai government is focusing on promoting, increased 8.2 times to 74,433 units, accounting for 9.3% of all new vehicle registrations. The top three brands were all Chinese, BYD with 30,662 units was followed by NETA with 12,777 units and MG with 11,995 units.

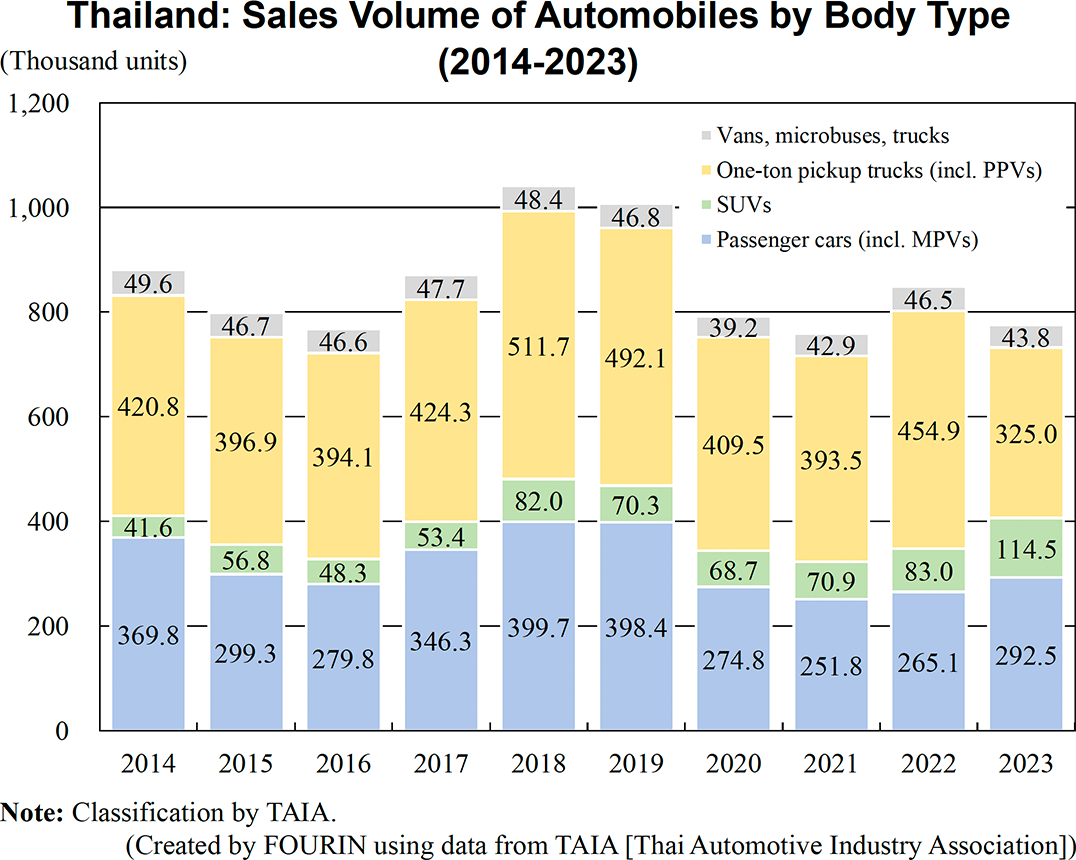

Looking at vehicle sales in 2023 by body type, sales of passenger cars, including MPVs, increased by 10.4% (up 27,000 units) compared to the previous year. Passenger car sales of BEV exclusive brands NETA and BYD were 13,836 units and 11,219 units, respectively. Solid BEV sales were driven by incentives such as subsidies. On the other hand, sales of commercial vehicles decreased significantly by 17.3% (down 101,000 units) to 483,278 units. Sales of SUVs increased by 38.0% (up 32,000 units) to 114,490 units, exceeding 100,000 units for the first time. On the other hand, sales of one-ton pickup trucks decreased by 31.8% (down 124,000 units) to 264,738 units. The decline was due to stricter loan screening and higher lending interest rates. Sales of light trucks and large commercial vehicles also decreased double digits.

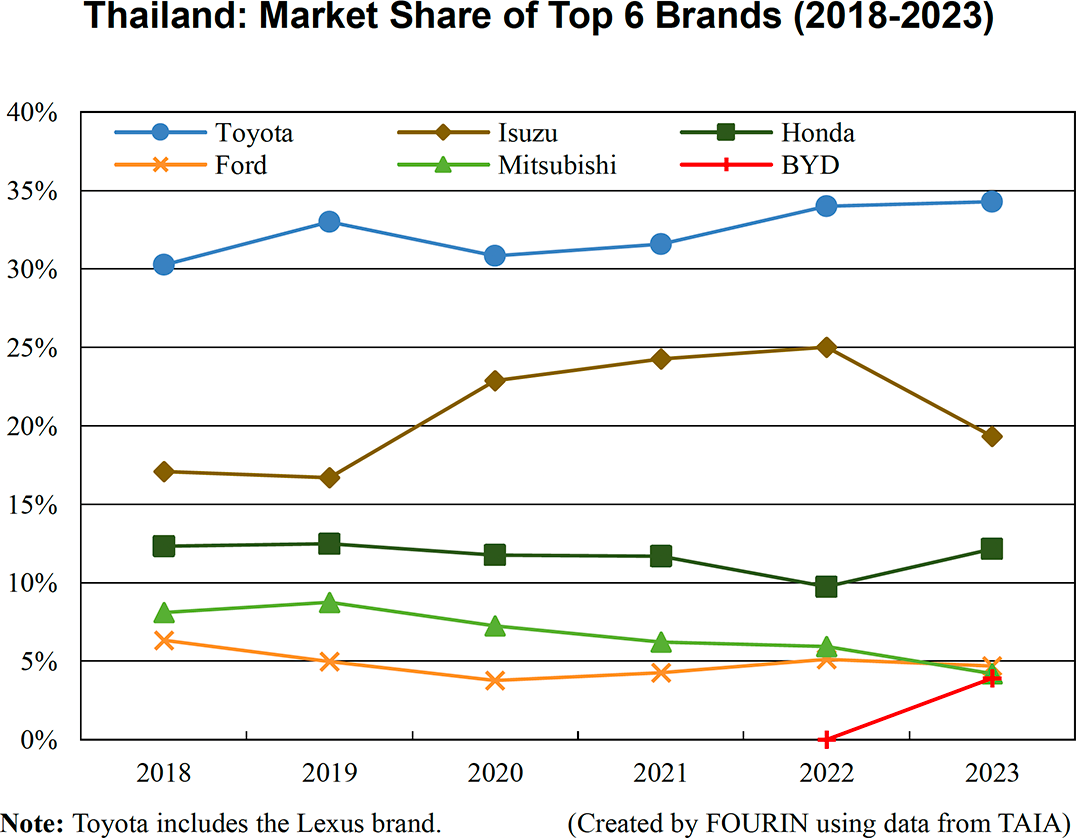

There was no change in the rankings of the top three brands. Thailand’s leading brand Toyota (including Lexus), saw sales decrease by 7.9% from the previous year to 265,952 units. Toyota’s sales of passenger cars increased by 22.0%, and SUVs rose by 24.4%, but sales of one-ton pickup trucks dropped by 28.0%. Isuzu, which came in second place, was also affected by the slump in sales of one-ton pickup trucks, resulting in a 29.5% decline in sales to 149,873 units. Honda, in third place, saw a 13.9% increase in sales to 94,336 units, led by the HR-V, which is available only with a HEV powertrain. Mitsubishi Motors, whose sales of one-ton pickups fell 40% year-on-year, fell from 4th to 5th place, while Ford rose from 5th to 4th place.

Toyota predicts that the Thai automobile market will recover moderately in 2024, with sales increasing by 3.1% from the previous year to 800,000 units. In addition to the government’s efforts to stimulate the economy, one-ton pickup trucks are expected to recover thanks to new models entering the market.