AAA weekly

2023-11-17

Copyright FOURIN, Inc. 2025

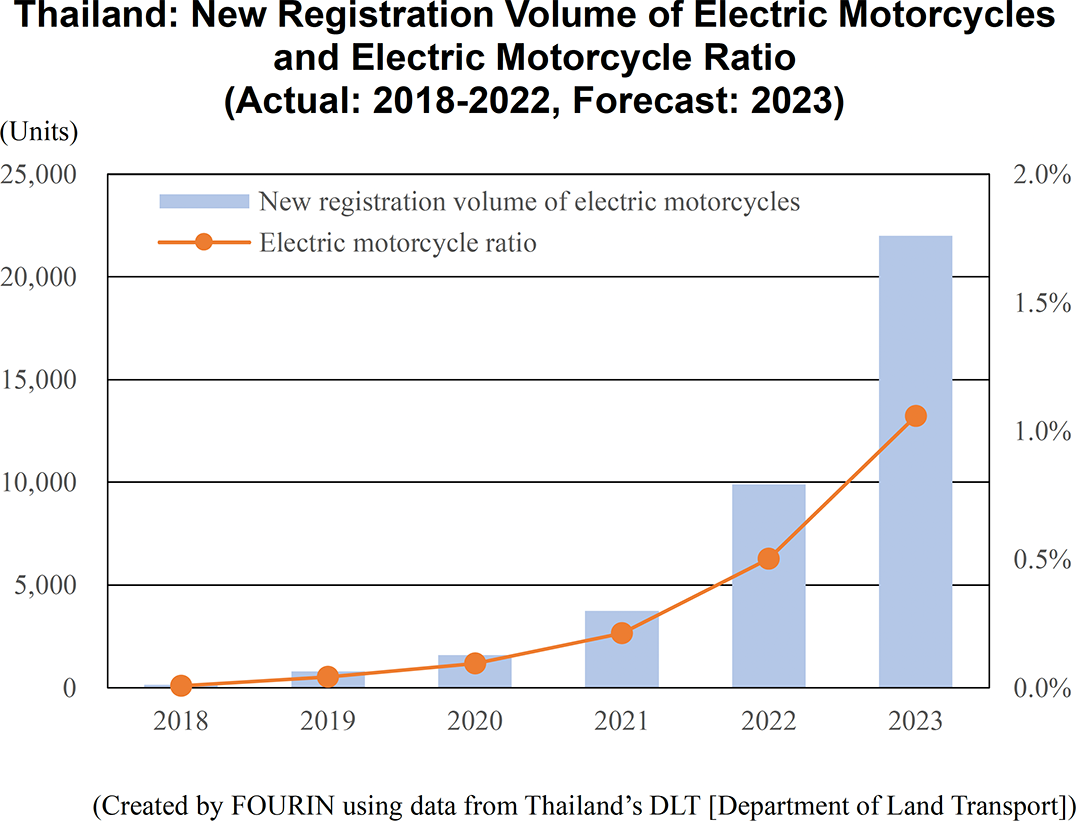

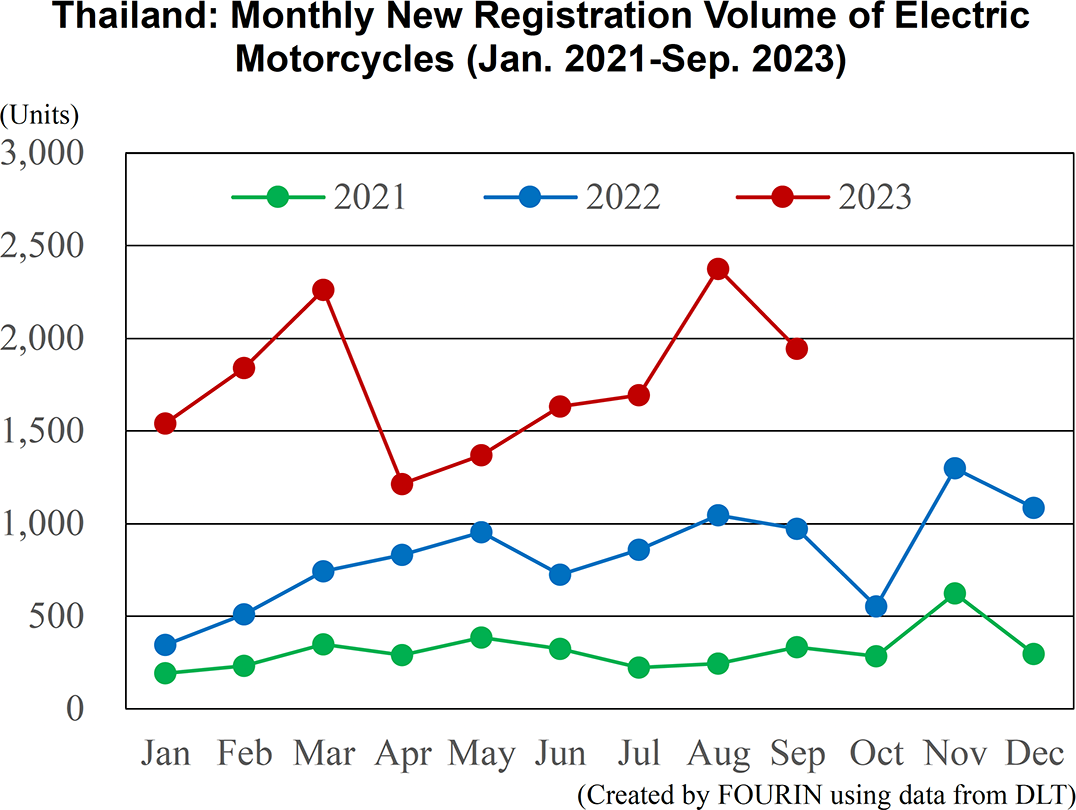

In Thailand’s BEV Motorcycle Market, Moderate Demand Driven by Subsidies

In Thailand, a new BEV promotion policy was approved by the government in February 2022. Even for electric motorcycles, a flat fee of 18,000 THB will be paid to manufacturers or import wholesalers for products with a suggested retail price of 150,000 THB or less.

In addition to companies that carry our local vehicle assembly such as Deco Green Energy Co., Ltd. (DECO) and H Sem Motor Co., Ltd. (H SEM), wholesaler businesses such as AJ EV Bike (AJ) and Nong Bua Lamphu Enterprise Co., Ltd. (NBLE), which distributes the HAONAIQI and LION brands, are also eligible for subsidies. Apart from H SEM, all other brands are taking advantage of government subsidies to expand sales of electric vehicles. Currently the top five brands are DECO, AJ, H SEM, HAONAIQI, and LION.

DECO used to be an import and sales company for Taiwanese electric vehicle manufacturer Laike E Bike, but since 2015 it has started locally assembling BEV scooters. As a leading manufacturer of electric scooters, DECO was quick to benefit from subsidy policies and has become the top seller of electric motorcycles. Its main product, the electric scooter Hannah, has a suggested retail price of 49,900 THB, but with the application of subsidies, the price drops to 30,640 THB, making it the highest-selling electric motorcycle model in Thailand. DECO sold 6,772 units from January to September 2023, rapidly expanding its market share from 28.8% in 2022 to 42.7%.

AJ is an electric motorcycle company, established in 2021 by AJ Advance Technology PCL, a Thai home appliance sales company, and is selling electric scooters in partnership with Yadea, the largest electric motorcycle manufacturer in China. Sales in 2022 were at a low level of 362 units, but from January to September 2023, sales of its main product the C-Like (based on Yadea G5) were strong, reaching 1,920 units, ranking second in sales by brand after DECO.

H SEM is a subsidiary of the Hua Heng Lee Group, a major local agricultural machinery manufacturer. It was established in October 2016 to manufacture and sell gasoline-powered tuk-tuks, electric golf carts and electric sightseeing vehicles among other products. In addition to running a battery swapping business, the company also manages a rental company of electric motorcycles. H SEM sold 1,593 electric motorcycles from January to September 2023, but its share has declined from 16.4% in 2022 to 10.0%.

NBLE was established in 2004 as an import and sales company for children’s toys and electric bicycles. It began importing and selling HAONAIQI brand electric scooters in 2022 and LION brand electric scooters in 2023. From January to September 2023, NBLE sold 1,392 units of the HAONAIQI brand and 1,189 units of the LION brand, acquiring shares of 8.8% and 7.5%, respectively. The total sales volume of both brands was 2,581 units, with a market share of 16.3%, making NBLE the second largest electric motorcycle business in the industry after DECO.

The average price of mass-market electric motorcycle products in Thailand is 30,000 to 50,000 THB after subsidies. Compared to the suggested retail price of 49,900 THB of the 110 cc Honda Scoopy, the country’s best-selling model of gasoline-powered scooter, the price of electric motorcycles is almost the same or even less. However, the sales volume of the best-selling electric scooter the Hannah from January to September 2023 was a mere 2,035 units, while the Honda Scoopy sold 13,839 units in September 2023 alone, suggesting that demand for electric scooters is still quite limited.