AAA weekly

2020-05-18

Copyright FOURIN, Inc. 2025

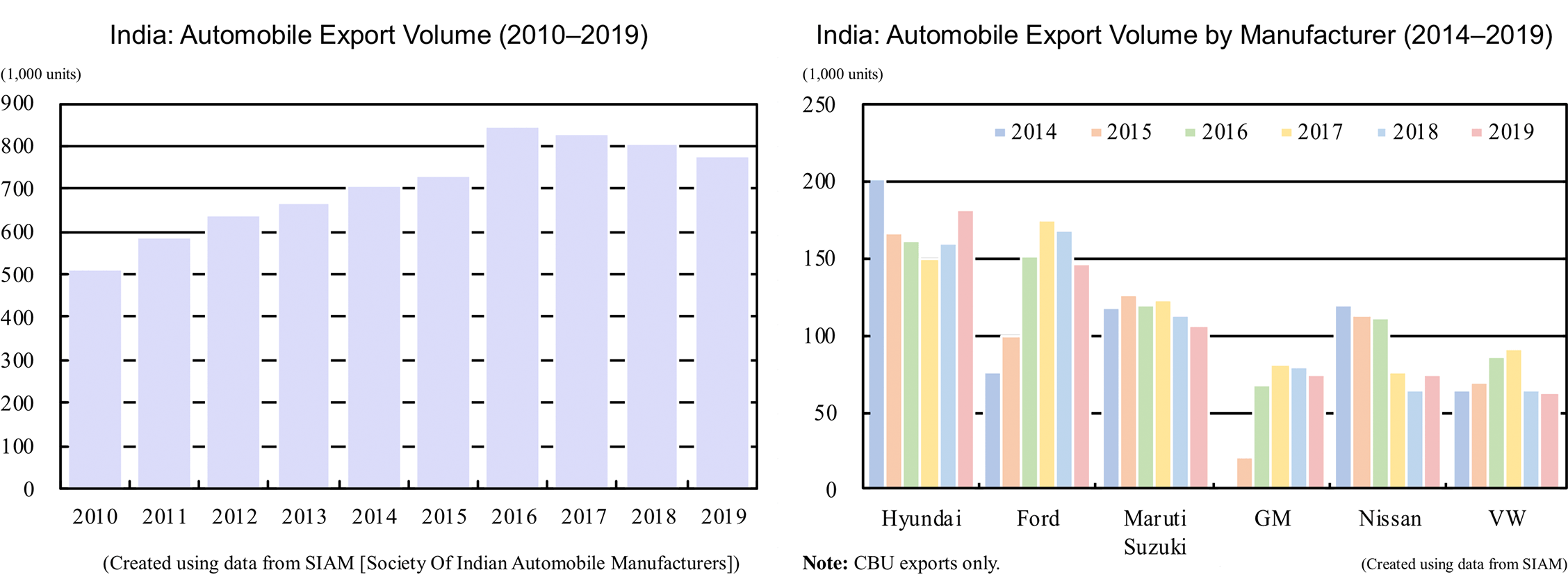

India’s CBU Exports Decline in 2019 for the Third Consecutive Year

India’s automobile exports dropped 3.6% year-on-year to 777,000 units (CBU exports only) in 2019, decreasing for the third consecutive year since its peak of 850,000 units in 2016. The decline is due to reduced exports of Ford, GM and VW which use India as an export base of B segment vehicles, and also due to a 30% drop in commercial vehicle exports.

Looking at exports by vehicle type, passenger vehicles increased 0.7% to 706,000 units. Of which utility vehicles, which include SUVs, went up 4.2% to 172,000 units. On the other hand, passenger cars, which include sedans and hatchbacks, dropped 0.4% to 531,000 units. Commercial vehicles nosedived 32.3% to 71,000 units. The sharp decline is due to significant decrease in exports by Tata Motors and Mahindra & Mahindra.

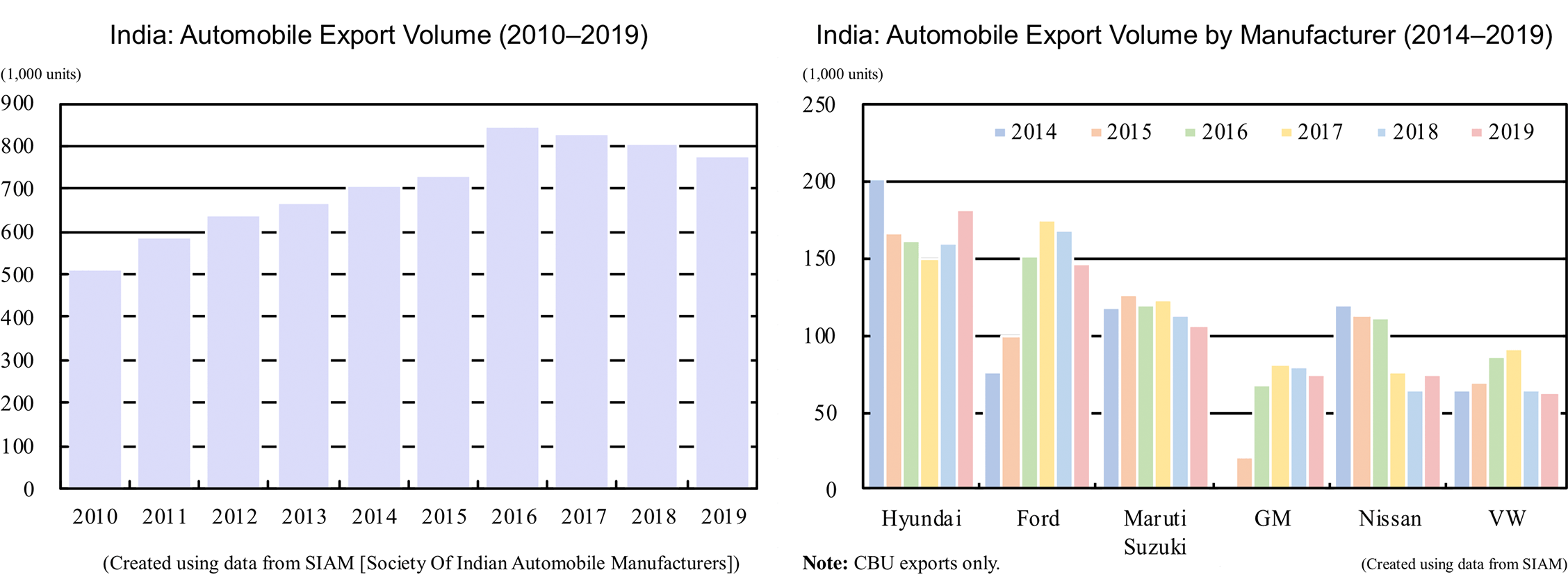

Looking at exports by automaker, India’s largest automobile exporter Hyundai increased 13.2% to 181,000 units. Hyundai surpassed Ford for the first time in three years, becoming India’s top exporter. Rising exports were driven by the Verna (sold as the Accent outside India), which went up twofold to 64,000 units, thanks to rising demand in Saudi Arabia. The other member of the Hyundai Motor Group, Kia began exports from India in October 2019, exporting a total of 12,000 units within the year.

Ford, ranked second in 2019, dropped 12.1% to 148,000 units. Of which the EcoSport, which had the largest export scale as a single model in 2019, fell 2.2% to 90,000 units. Exports of the EcoSport to the US, which started in 2018, remained solid, but it appears that exports were reduced due to a decline in sales at other destinations. In 2019, exports of the Figo (sold as the Ka+ in Europe) to Europe, which had been the main destination of the model from India until now, was discontinued by the end of the year.

As for other major exporters Maruti Suzuki, GM and VW witnessed a single-digit decline in 2019, while Nissan increased double digits, going up 15.9% to 75,000 units. Exports were powered by increasing demand for the Sunny in Saudi Arabia and the Datsun Go in South Africa.

India: Recent Developments Related to Automobile Exports

Passenger Vehicle Export Trends by Destination

・As of 2019, the main export destinations of passenger vehicles from India were Central and South America, the Middle East, Africa and the US.

・As a reference, the top five export destinations of passenger vehicles from April 2019 to January 2020 were Mexico, South Africa, Saudi Arabia, the US and the UAE.

– Brands (models) exported to India’s largest export destination Mexico were GM’s Chevrolet (Beat), VW (Polo, Vento), Hyundai (Grand i10, Creta), Ford (Figo, Aspire) and Maruti Suzuki (Ciaz).

– Saudi Arabia saw a sharp increase in exports in 2019. Saudi Arabia granted women the right to drive in mid-2018 which increased demand for small passenger vehicles. As a result, exports of the Hyundai Verna increased some 80% to approx. 40,000 units and that of the Nissan Sunny went up some 60% to approx. 20,000 units in 2019.

Export Trends of Major Automakers

Maruti Suzuki

・As of fiscal year ending March 2019, Maruti Suzuki exported automobiles in CBU form to 95 countries.

– In the same fiscal year, Maruti Suzuki’s top five export destinations were Chile (17,637 units), Indonesia (14,921 units), South Africa (12,159 units), Nepal (6,502 units) and Uruguay (4,608 units). The total number of vehicles exported, including other destinations, decreased 13.7% from the previous year to 108,749 units.

・As of the beginning of 2020, Maruti Suzuki was planning to expand the number of export destinations.

– Maruti Suzuki's vehicle exports have been around 100,000–130,000 units since 2011 due to the automaker’s priority of increasing production for the domestic market and also due to Suzuki Motor’s global strategy.

– Maruti Suzuki plans to increase the scale of exports in the future. According to various media reports in February 2020, Maruti Suzuki is in talks with Suzuki Motor regarding the expansion of destinations and the expansion of production of left-hand-drive vehicles for exports.

・Other major export trends

– In September 2019, the cumulative number of vehicles exported by Maruti Suzuki through the Mundra Port in Gujarat state reached 1 million units. Simultaneously, Maruti Suzuki’s cumulative exports from India surpassed 1.8 million units.

– In January 2020, Maruti Suzuki began exporting the S-Presso in CBU form to Asia, Central and South America, and Africa.

Hyundai

・In 2019, Hyundai began exporting the Venue in CBU form to South Africa, Nepal, Bhutan, Mauritius and Seychelles among other markets.

・As of the beginning of 2020, Hyundai was exporting automobiles in CBU form to 88 countries.

– Looking at the regional breakdown of the destinations, 33 countries (and regions) in Central and South America, 28 in Africa, 26 in Asia-Pacific and one in Europe.

・In January 2020, Hyundai’s cumulative exports from India surpassed 3 million units.

– Hyundai began exports from India in 1999.

– Cumulative exports reached 100,000 units in October 2004, 500,000 units in March 2008, 1 million units in February 2010 and 2 million units in March 2014.

Kia

・In October 2019, Kia began exports from India.

– Kia began production in India in August 2019. The first model going into production was the Seltos.

Ford

・In 2019, Ford discontinued production of the Figo (sold as the Ka+ in Europe) for the European market.

– Ford has decided to discontinue sales of the Ka+ by 2020 according to the automaker’s midterm European business strategy which was released in June 2019. Along with this, it appears that production for export in India ended by the end of 2019.

– The Ka+ sold 48,000 units in 2018 and 49,000 units in 2019 in Europe. Since Europe accounted for the majority of the Figo’s exports from India, exports of the model are expected to shrink significantly in 2020.

GM

・In 2020, GM plans to discontinue automobile exports in CBU form from India and end operations in India.

– After ending sales in India in 2017, GM manufactured automobiles for exports at its Talegaon plant in Maharashtra state. The automaker exported the Chevrolet Beat to Central and South America until. In January 2020, GM announced to transfer the Talegaon plant to Chinese automaker Great Wall Motor. The procedure is scheduled to be completed in 2020.

(Created using data from SIAM, India’s MOCI [Ministry of Commerce and Industry], company PR materials and various media sources)

Please

register or subscribe to view this report for free.

If you’re already a subscriber, sign in.

Credit card information is not needed for free trial registration.

You are eligible to view one report for free.

Additional reports require subscription.