AAA weekly

2020-10-19

Copyright FOURIN, Inc. 2025

China’s MPV Market in 2019

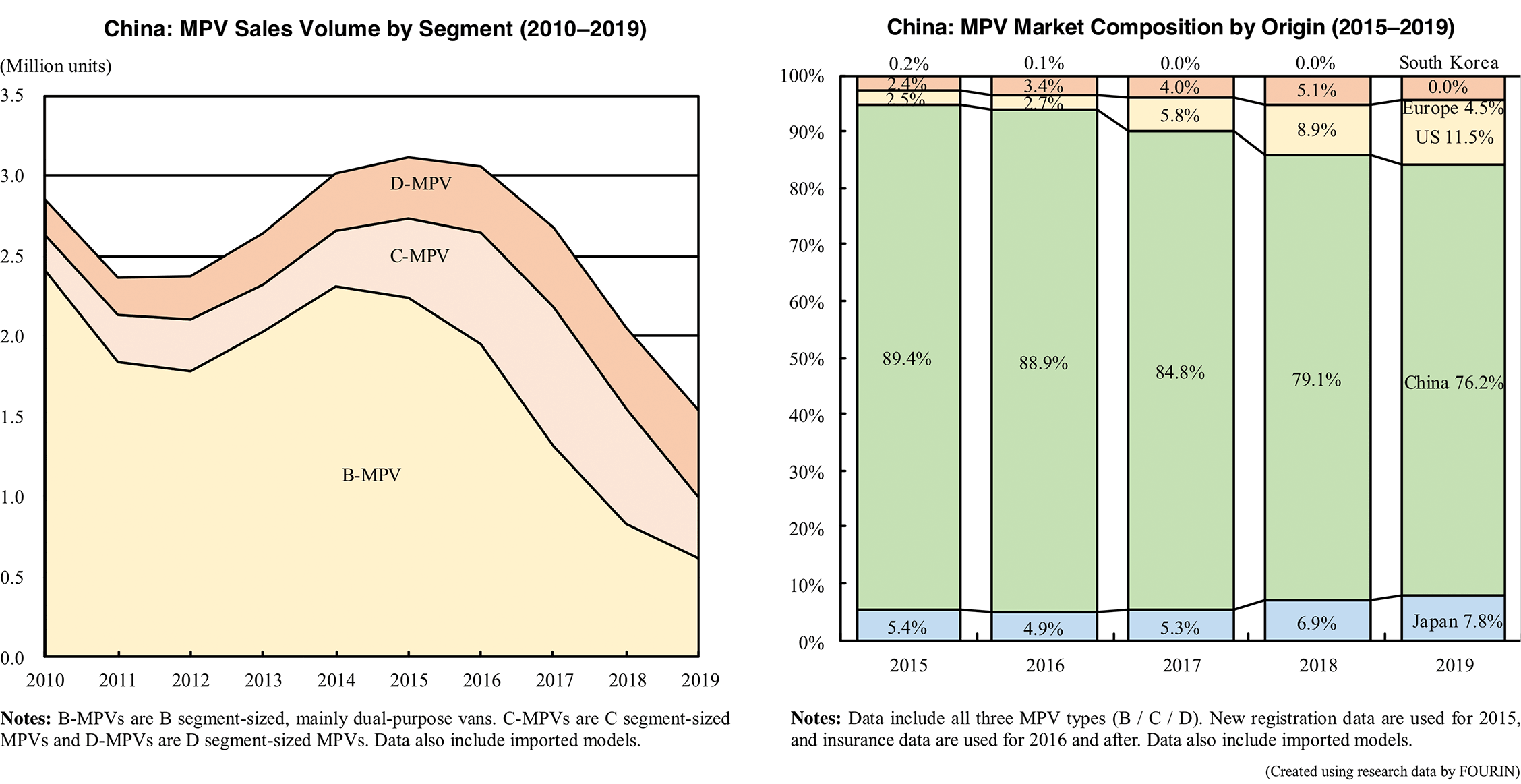

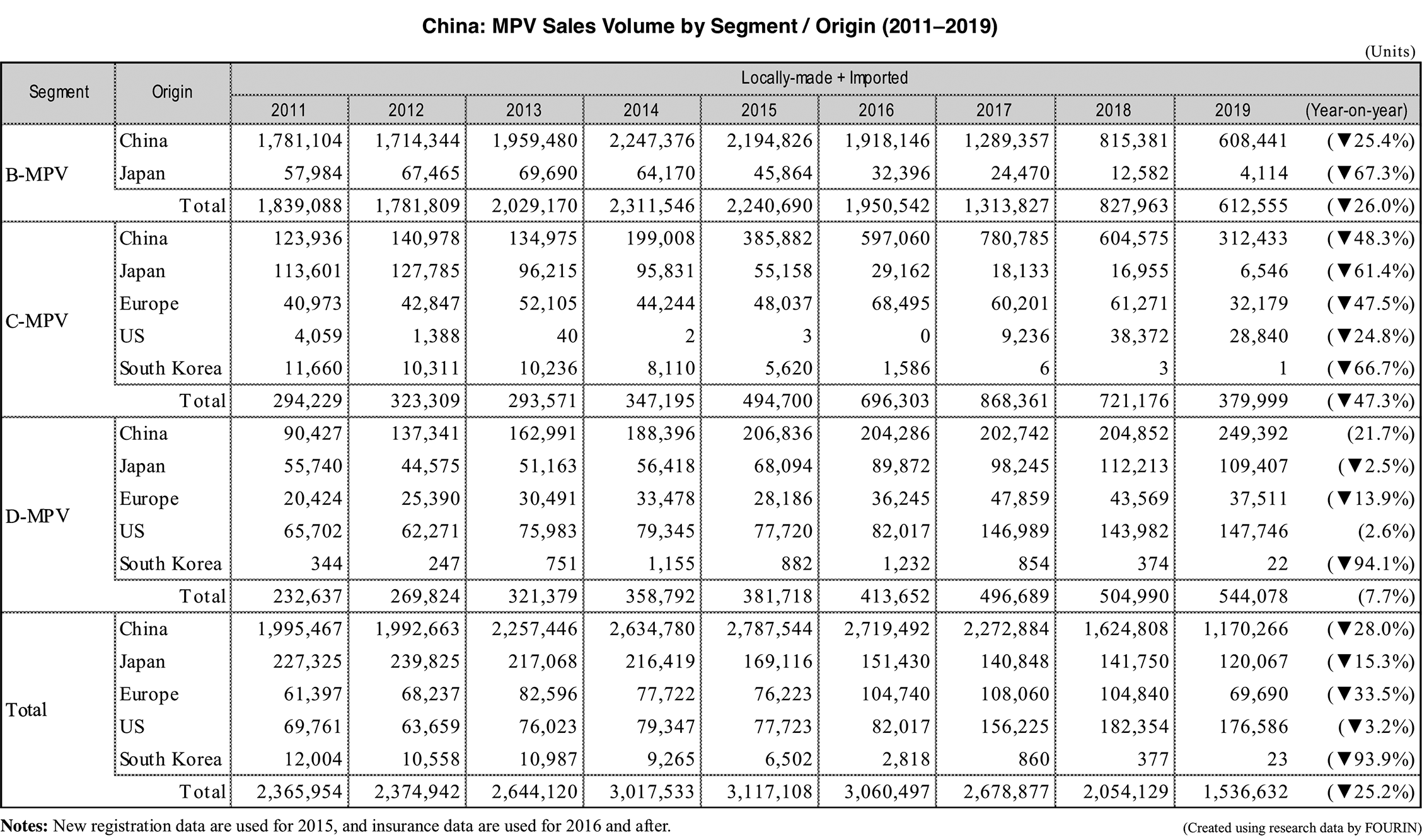

In China, the MPV market has been shrinking in recent years due to the slump in the new automobile market as a whole and the strong popularity of SUVs. In 2019, MPV sales declined 25.2% year-on-year to 1.53 million units, overall share of the passenger vehicle market dropping 2.0pp to 7.1%. The share of B-MPVs (B segment-sized, mainly dual-purpose vans) of the overall MPV market dropped from 40.3% to 39.9%. Meanwhile the share of C-MPVs (C segment-sized MPVs) fell from 35.1% to 24.7%. In contrast, the share of D-MPVs (D segment-sized MPVs) increased from 24.6% to 35.4%. Similarly to market share, the sales of B-MPVs and C-MPVs declined, going down 26% and 47.3% respectively. On the other hand, sales of D-MPVs, whose main customers are high-income earners, who are said to be less affected by the economy, increased 7.7%.

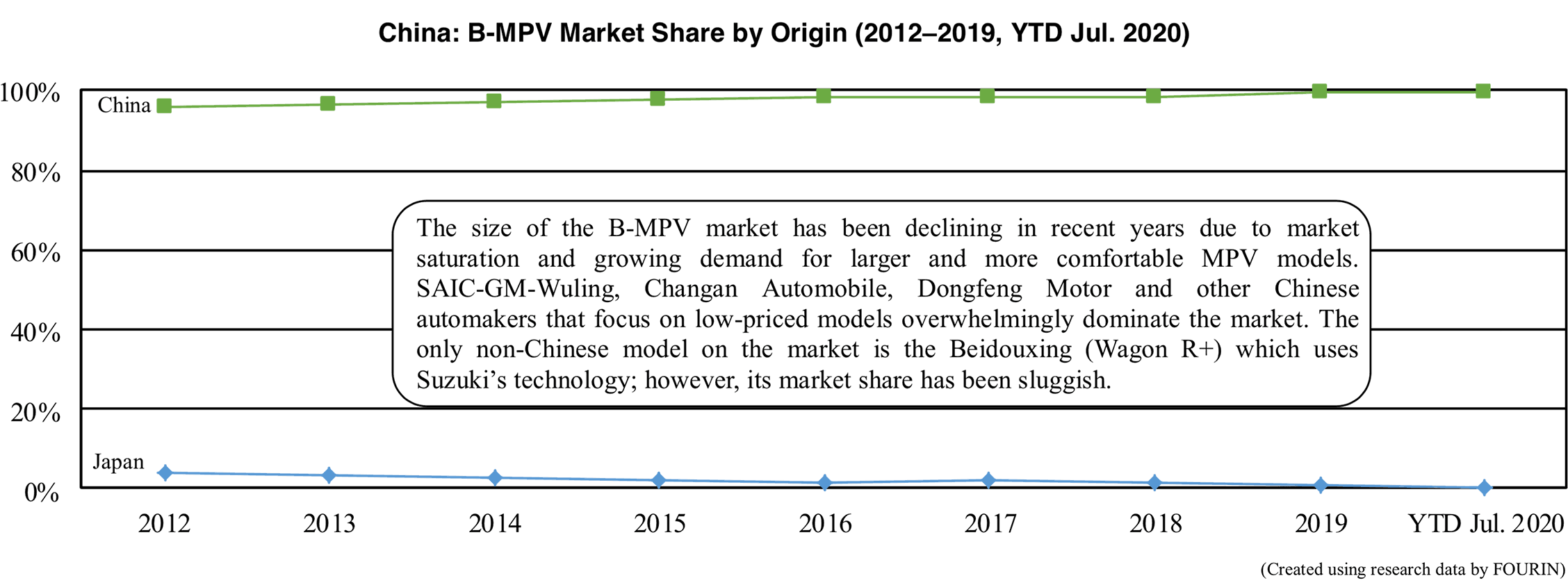

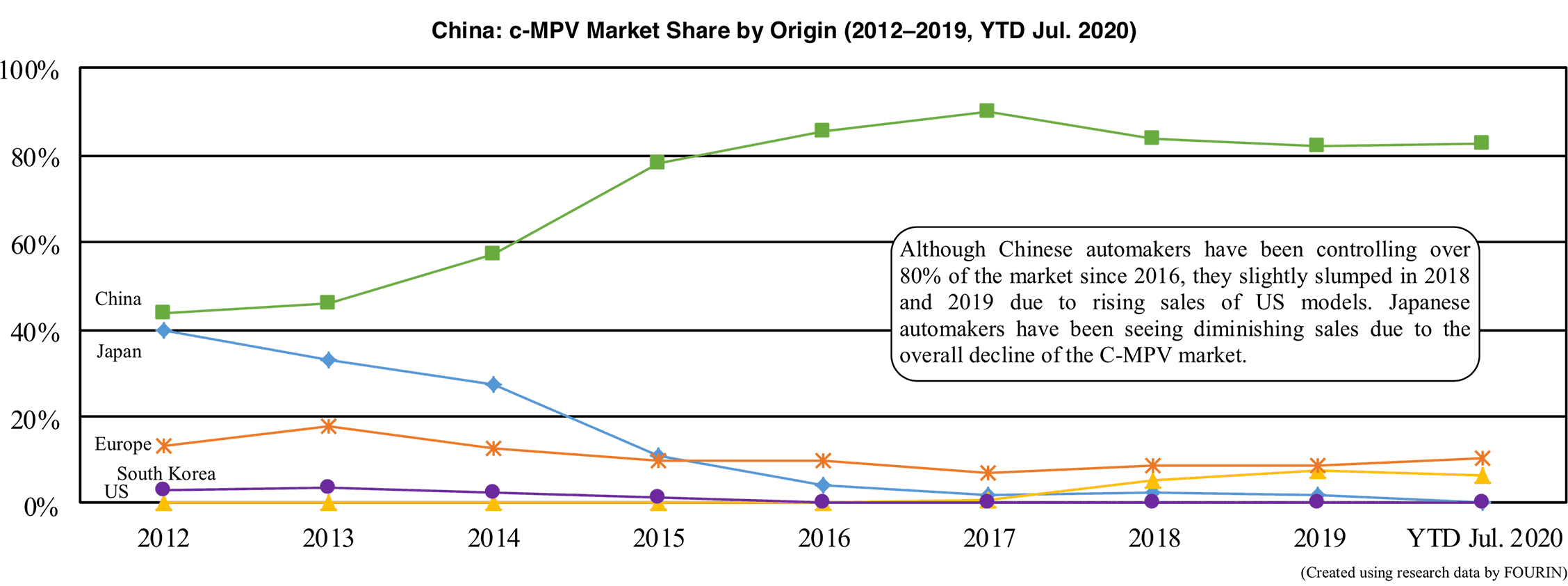

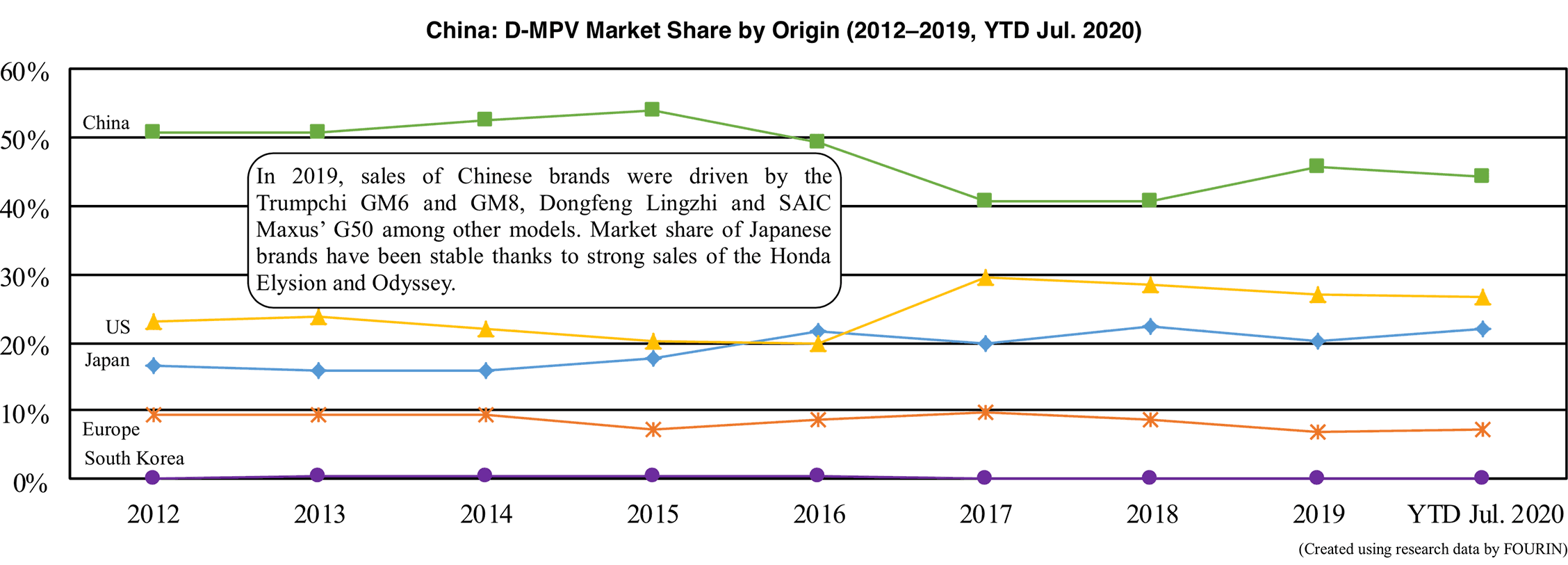

Looking at data by brand origin, the size of the B-MPV market, which is overwhelmingly dominated by low-price Chinese models, has been declining in recent years due to market saturation. In the C-MPV market, Chinese companies boast an over 80% market share. The growing presence of Chinese automakers in the C-MPV market came in the wake of weakening sales of B-MPV models. In response to the decline in demand in the B-MPV market, Chinese have shifted their focus to C-MPVs which offer relatively high convenience and comfort. In the D-MPV market, although Chinese share has been over 40%, Chinese models are far from being superior. US and Japanese brands each control over 20% of the D-MPV market and their models remain popular in China, possibly intensifying competition in the coming years.

Looking at the MPV market by region, the coastal area of China, consisting of the central, south and east regions, remains the primary market of MPVs, accounting for 60% of all sales. However, sales declined in 2019 in all administrative units of China except Beijing.

Looking at the top 10 models of 2019 in terms of sales volume, three B-MPV models of the SAIC-GM-Wuling’s Wuling brand made it to the top 10. The Wuling brand is popular in the suburbs of big cities, small and medium-sized cities, and rural areas. Two C-MPV models of the Baojun brand, also manufactured by SAIC-GM-Wuling, were also ranked among the top 10. While this model excels in convenience and comfort, strong sales are attributed to its competitive price which is kept around 100,000 CNY. The best-selling model sold under a foreign band was SAIC GM’s Buick GL8. It has a large interior and trunk space which is sought after by business people and families. Two Japanese models the Honda Odyssey and Elysion were also among the top 10. Apart from being popular among families, the HEV versions of the two models are also considered to be one of the reasons for their popularity.

In the first seven months of 2020, the MPV market declined 34.9% compared to the same period of the previous year. The rate of decline of MPVs exceeded the decrease of the overall new passenger vehicle market. For the full year of 2020 is expected to decrease double digits from the previous year.