AAA weekly

2021-12-15

Copyright FOURIN, Inc. 2025

Hydrogen / Fuel-cell Technology Alliances Around the World

A hydrogen-based society cannot be realized simply by developing fuel-cell electric vehicles (FCEVs). A comprehensive hydrogen ecosystem must be built from upstream to downstream, from hydrogen production to the construction of transportation and supply systems, and the development of hydrogen filling stations.

In Europe, automakers, which develop commercial fuel-cell vehicles, are working to build a hydrogen ecosystem in partnership with hydrogen and fuel-cell startups. In some cases, these alliances have spread to the United States and Asia.

In the United States, commercial FCEV startups Nikola Corporation and Hyzon Motors are once again in the spotlight following a new policy, Executive Order on Strengthening American Leadership in Clean Cars and Trucks, announced in August 2021. The plan sets an ambitious goal for 2030 that 50 percent of all new U.S. sales of passenger cars and light-duty trucks will be zero-emission vehicles. Both companies have contrasting business strategies.

In Asia, Toyota Motor and Chinese automakers have joined forces to collaborate on technological development of commercial FCEVs for the Chinese market. In South Korea, Hyundai Motor is promoting alliances with startups from hydrogen production to fuel-cell technology in order to diversify its hydrogen business at home and abroad.

Nikola Corporation: Fuel-cell Commercial Vehicle Startup

Company overview

・Headquarters location: 4141 E Broadway Rd, Phoenix, AZ 85040, US

・URL: https://nikolamotor.com

・Established: 2014

・Business scope: Nikola Motor Company is responsible for the development and production of commercial vehicles equipped with original concept designs, environmentally friendly drive systems and driving support systems. Nikola Energy Company is in charge of building a hydrogen station network.

Business strategy

・Active collaboration with OEMs and suppliers to succeed in both the development and production of zero-emission trucks and the quick and cost-effective construction of a hydrogen station network. Follows a fabless business model.

- Software and infotainment system developed in-house.

・The basic transaction form is lease contract. Nikola Two comes with a lease contract of about 1.1 million km or 72 months and includes maintenance and hydrogen fuel costs.

Major partners

・GM (USA): Supplies the Hydrotec fuel cell technology to Nikola. Originally, GM planned to supply the Ultium battery system as well to Nikola, but the plan was scrapped after fraud allegations against the startup’s founder.

・Bosch (Germany): Engages in joint development of powertrain systems. Bosch provides technologies such as eAxle, digital mirror, digital key for fleet management and electro-hydraulic power steering.

・IVECO (Italy / USA): Engages in joint development of the Nikola Tre based on IVECO’s new truck. Nikola also entrusts production to IVECO.

・Fitzgerald Glider Kits (USA): Nikola entrusts production to Fitzgerald Glider Kits.

・OGE (Germany): Supports hydrogen distribution for FCEV refueling in Europe.

・TravelCenters of America (USA): Supports the deployment of hydrogen fueling infrastructure in the USA.

・Wabash Valley Resources (USA): Supplies hydrogen to Nikola in the USA.

Recent developments

・In addition to the four models in the table below, in February 2020, Nikola unveiled the Badger (FCEV and BEV) which is considered to be a competitor of Tesla’s Cybertruck.

- The Badger (FCEV) has a maximum cruising range of about 483 km using batteries only and 965 km when the fuel-cell system also operates, exceeding the Cybertruck’s cruising range of 800 km. The Badger accelerates from 0 to 96 km/h in 2.9 seconds.

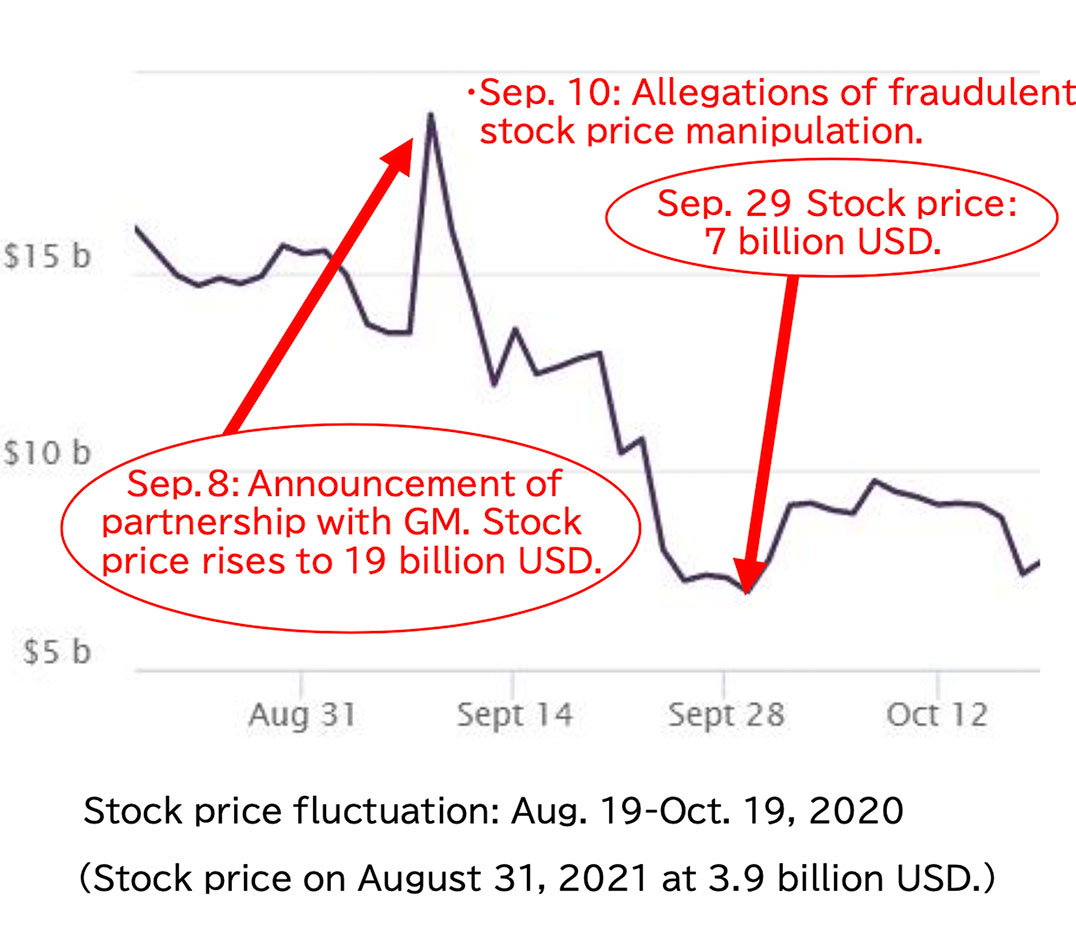

・In June 2020, Nikola was listed on NASDAQ. Despite having no production record, the stock price soared immediately after listing and temporarily exceeded Ford's market capitalization on the third day. The market closing price on the same day reached about 28.6 billion USD.

・In September 2020, GM announced to acquire an 11% stake in Nikola for about 2 billion USD and provide technology for the Badger's development and contract production.

・Shortly after, GM withdrew its investment and technical alliance due to allegations of fraud against Nikola. GM reduced its technical alliance to supply fuel-cell systems only.

・In September 2021, Nikola signed a supply contract for fuel-cell system modules with Bosh. It appears that Nikola’s partnership with GM remains in place.

・Regarding the hydrogen infrastructure, Nikola will install 700 hydrogen stations in North America by 2028 and plans to start supplying hydrogen fuel in Europe by 2022.

- In 2021, in addition to partnerships with OGE and TravelCenters of America, Nikola acquired Wabash Valley Resources for 50 million USD.

- In August 2021, Nikola received 2 million USD in support from the US Department of Energy for the development of Nikola's automated fuel supply system.

Allegations of fraud

・The US Securities and Exchange Commission has begun investigating Nikola after research firm Hindenburg Research accused Nikola of fraud.

・In July 2021, founder Trevor Milton (who retired as CEO at the end of September 2020) was charged with two counts of securities fraud and one count of wire fraud.

Please

register or subscribe to view this report for free.

If you’re already a subscriber, sign in.

Credit card information is not needed for free trial registration.

You are eligible to view one report for free.

Additional reports require subscription.