AAA weekly

2023-08-30

Copyright FOURIN, Inc. 2025

Mitsubishi Motors’ Global Financial Results in FY 2022

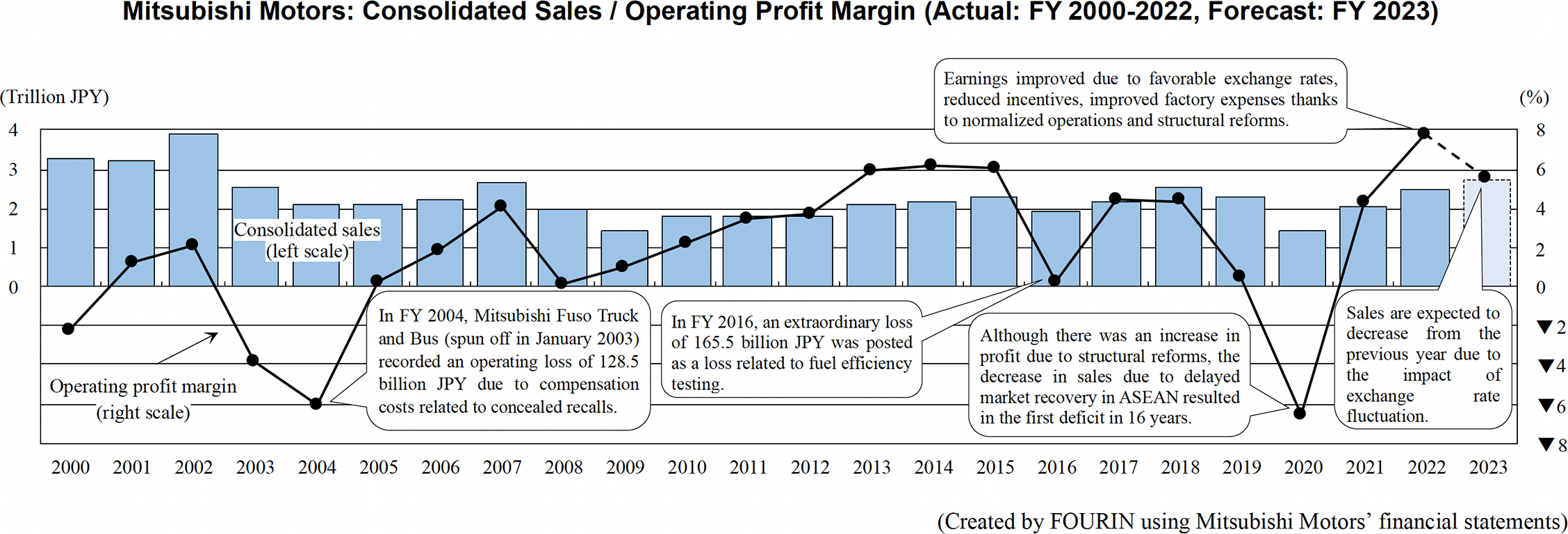

Mitsubishi Motors’ consolidated financial results for FY 2022 were as follows: sales increased 20.6% year-on-year to 2.45 trillion JPY, and operating income surged 2.2-fold year-on-year to 190.5 billion JPY. The operating profit margin improved by 3.5 points yearon- year, reaching a record high of 7.7%. In FY 2022, the insufficient supply of parts, mainly semiconductors, and the increase in costs due to soaring material and logistics costs had a negative impact, but sales increased due to the success of Mitsubishi’s “take-home improvement strategy” and the positive effect of the weaker yen.

Looking at factors that impacted operating profit in FY 2022, MIX / selling price has contributed significantly to the increase in profit. By focusing on segments with few supply constraints in ASEAN and by expanding the lineup of electrified vehicles such as the Outlander PHEV and eK X EV introduced in Japan, the company absorbed the 2.3 billion JPY decline in unit sales. This contributed to an increase of 59.2 billion JPY in total. In addition, although advertising expenses increased due to the introduction of new models, profit increased by 21.4 billion JPY through the reduction of countermeasure costs. Concerning material and transportation costs, cost reduction activities were unable to cover the continuing rise in raw material prices and worsening transportation costs due to a shortage of ships, resulting in a decrease of 75.1 billion JPY in profit. In FY 2022, the exchange rate, following the depreciation of the yen, caused the largest impact on profit, contributing to an increase of 99.9 billion JPY.