AAA weekly

2023-08-28

Copyright FOURIN, Inc. 2025

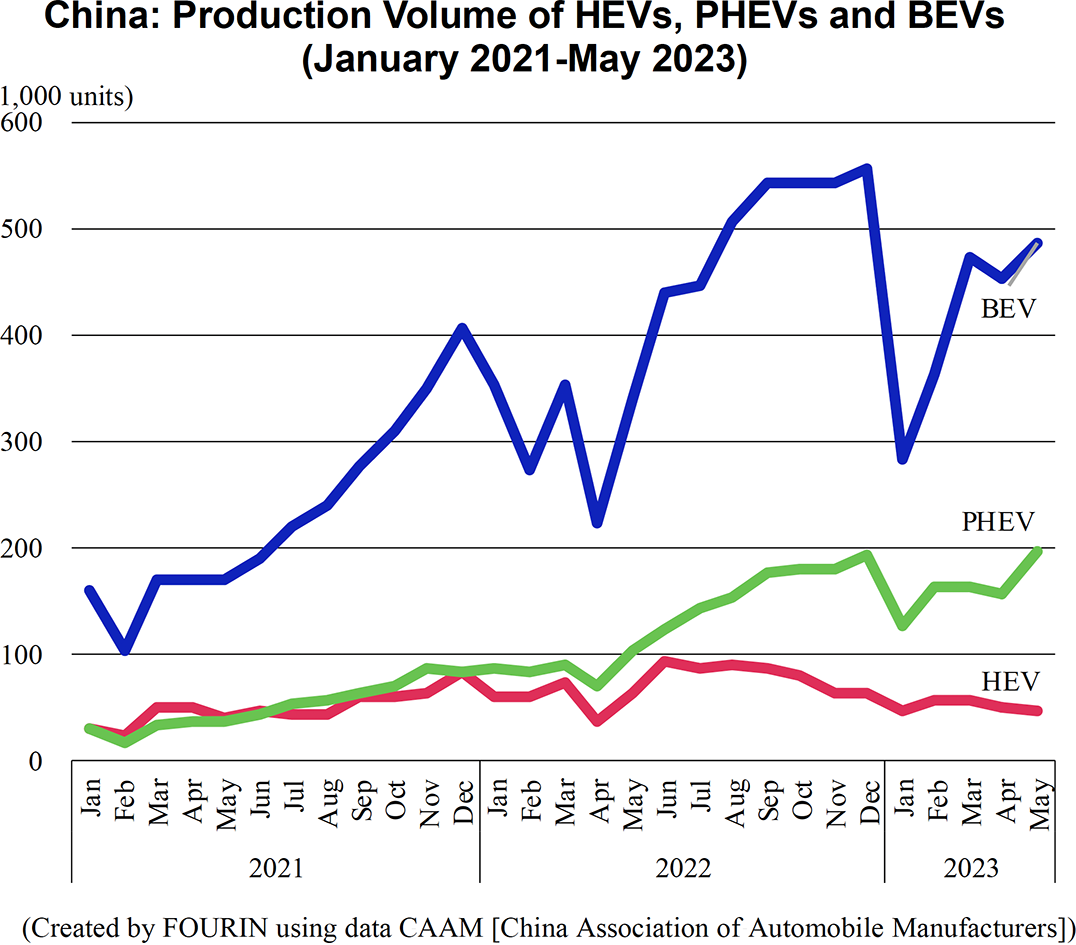

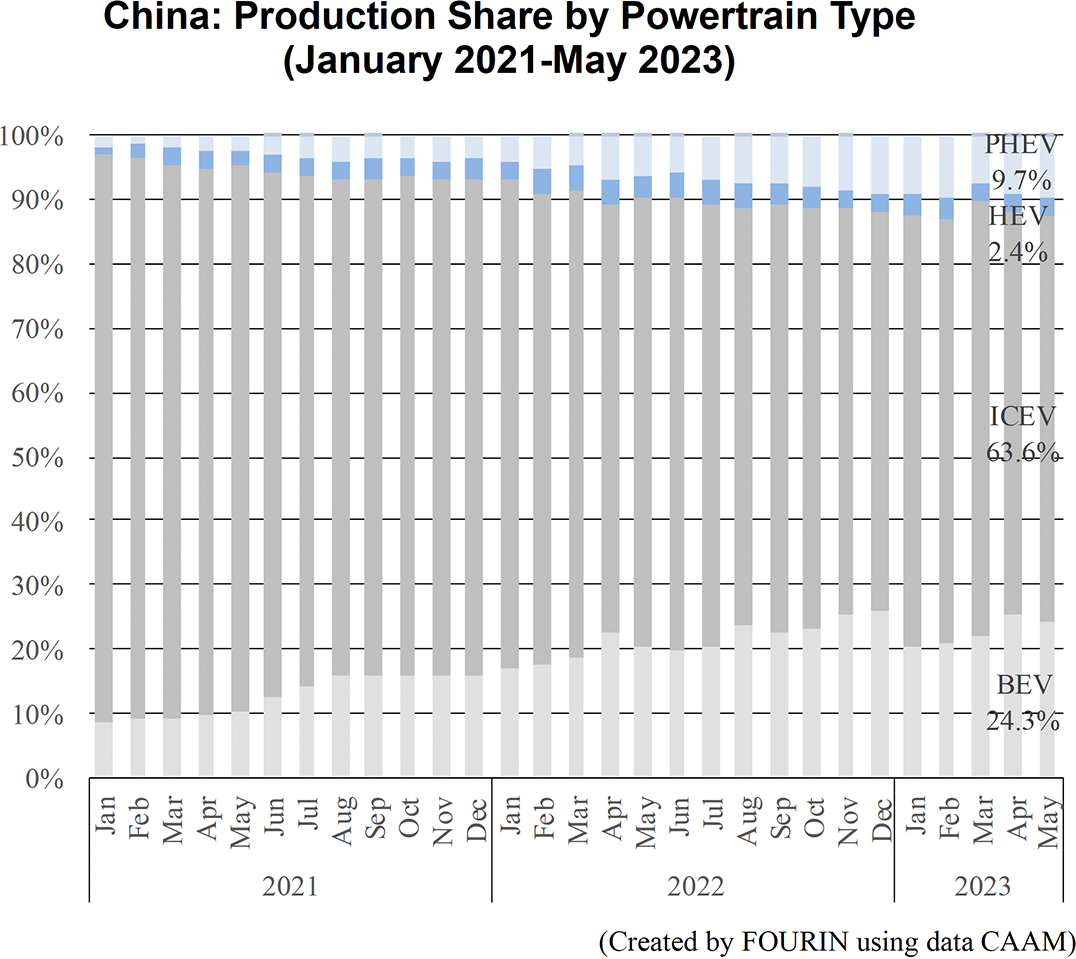

China’s PHEV Market Grows Faster Than BEV, HEV

PHEV sales in China are growing at a higher rate than BEV and HEV sales. The reason for this is that BYD's PHEVs are more price competitive than Japanese HEVs. Other Chinese OEMs are also expanding their PHEV lineups, raising the possibility that the Chinese PHEV market will grow to a market size similar to that of BEVs. On the other hand, Japanese HEV sales were trending downward from the same period of the previous year in the first five months of 2023. It is likely that the market presence of Japanese OEMs in China will further decline.

BYD's entry-grade PHEV model Qin Plus (EV cruising range of 55km) is priced at 99,800 CNY, which is about 30,000 CNY cheaper than Japanese HEVs with an entry price of 130,000 CNY or higher. The mass-market grade BEV Qin Plus has an EV cruising range of 120km, but the price is 125,800 CNY, which is also cheaper than Japanese HEVs. Such pricing has been successful, BYD accounting for nine of the top 20 PHEV models sold in the first five months of 2023. Other Chinese PHEV models Li Auto's L7, L8, and L9, Changan Automobile's Deepal SL03, and Leapmotor’s C11 were also doing well. The PHEV market is expected to expand further as the number of PHEV models increases.

Furthermore, Chinese OEMs are expanding their HEV lineup in addition to PHEVs. GAC Motor's Trumpchi M8 and SAIC-GMWuling's Wuling Asta, which are equipped with Toyota's THS system, are steadily increasing sales.

Meanwhile, in the BEV market, Tesla's price cuts in China in early 2023 prompted Chinese OEMs to cut prices on competing BEV models at the expense of revenue. As a result, some OEMs have already begun to experience financial difficulties. While striving to reduce BEV costs by introducing Gigacasting and adopting Cell-to-Chassis technologies, Chinese OEMs are expected to aggressively launch products in the PHEV market, which Tesla has not yet entered, to secure profits.