AAA weekly

2023-02-03

Copyright FOURIN, Inc. 2025

China’s Passenger Vehicle Market Forecast for 2023 and 2024

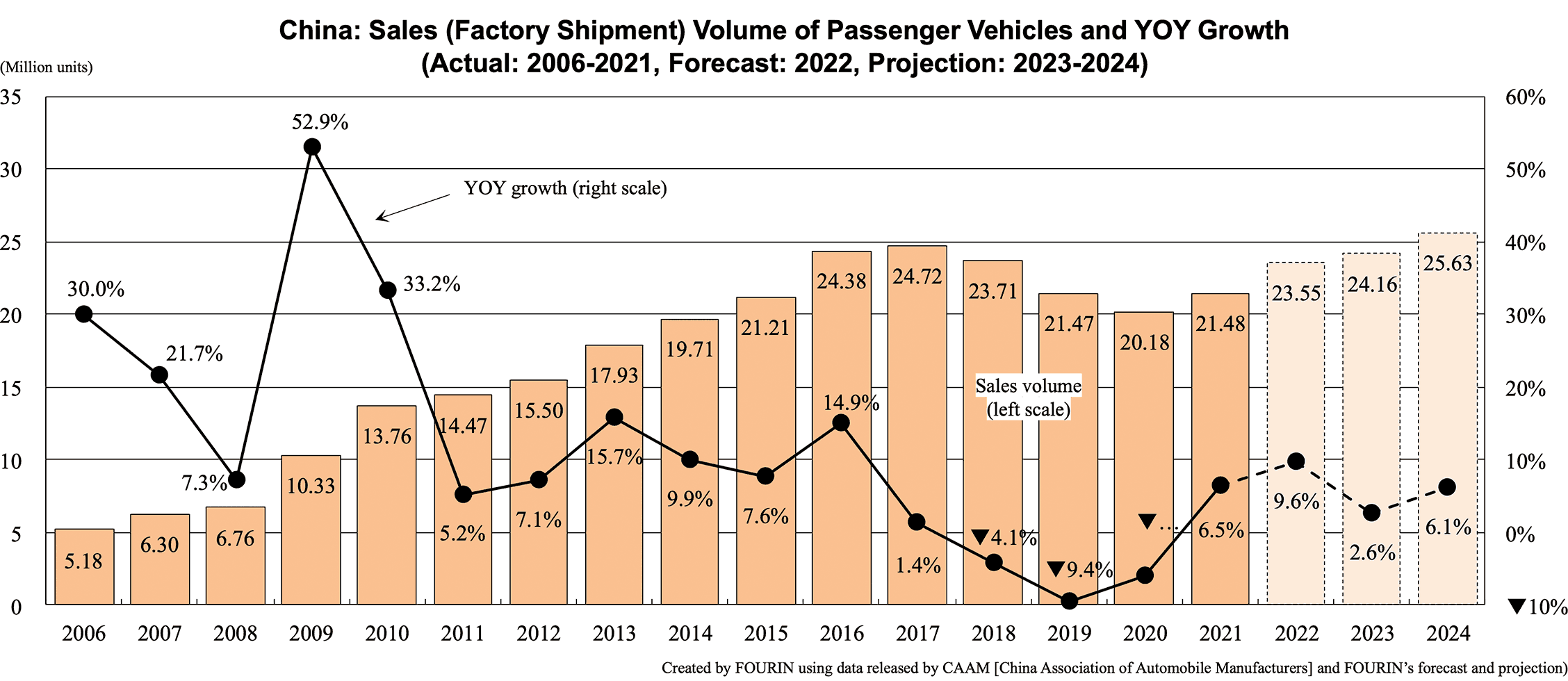

China’s sales volume of passenger vehicles (substituted with factory shipment data) in the first 10 months of 2022 increased by 13.7% year-on-year to 19.22 million units. The full-year outlook is around 23.55 million units, up 9.6%, surpassing the pre-corona level of 2019.

In the first half of 2022, due to the corona lockdown in Changchun from March to May and in Shanghai from April to June, which are clusters of the local automobile industry, sales dropped sharply. From June to December, the central government reduced purchase tax from 10% to 5% for passenger vehicles with a sales price of up to 300,000 CNY and an engine displacement of up to 2.0L. As a result, production and sales volume of passenger vehicles has recovered since June. The passenger vehicle market in 2023 is expected to grow slightly compared to 2022.

Looking at the market environment, business is expected to pick up in 2023 following the full-scale easing of the “zero corona” policy, so an economic recovery can also be expected. The semiconductor shortage is expected to continue in 2023, but it is forecast to improve compared to 2022.

It is difficult for the Chinese economy to maintain the high growth rate seen in the 2010s amid growing global instability. However, if the disposable income in China continues to increase, the country’s new passenger vehicle market is expected to continue to grow, albeit modestly. However, given the strained relationship between China and the United States, attention should also be paid to whether the United States restricts the exports of advanced semiconductors and manufacturing equipment to China which may affect the Chinese automobile industry.

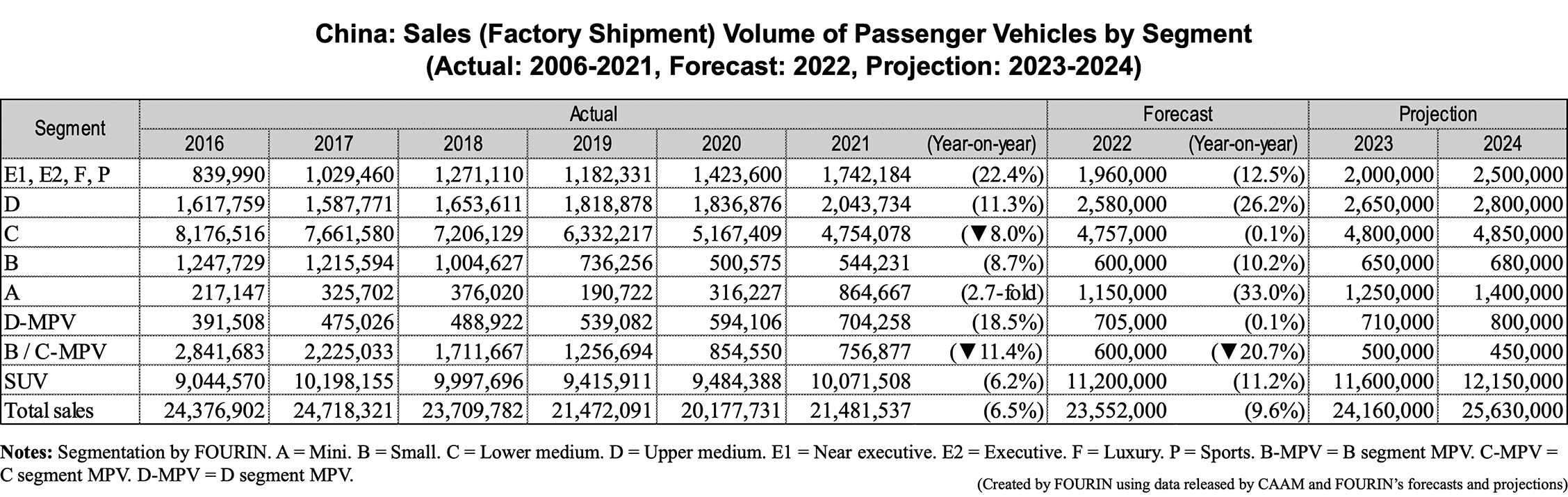

China: Passenger Vehicle Market Forecast by Segment (2023-2024)

| Category / Segment | 2023 | 2024 | |

|---|---|---|---|

| Overall passenger vehicle market | ・China's economy could recover at a relatively fast pace if the “zero-corona” policy will be further relaxed. ・The impact of the semiconductor shortage is expected to continue until the first half of 2023, but it is likely to be less severe than in 2021-2022. ・The new passenger vehicle market in 2023 is expected to grow by around 1.5% year-on-year. | ・As the Chinese economy emerges from the effects of the coronavirus pandemic, disposable income is expected to increase, so there is a possibility that new vehicle purchases will increase. The new passenger vehicle market in 2024 is expected to grow at a higher rate than in 2023. ・The NEV market is expected to continue growing as credit requirements under NEV regulations are strengthened and NEV passenger vehicles are no longer subject to various driving regulations. | |

| Passenger car | E1, E2, F, P | ・Growth is expected to continue in 2023 as the luxury car market is less affected by the economy. | ・It is predicted that replacement demand for luxury cars by wealthy individuals in urban areas will continue to increase. |

| D | ・The D segment is expected to increase slightly compared to 2022. | ・The D segment is expected to grow steadily. | |

| C | ・The C-segment is expected to maintain the scale of 2022. | ・As Chinese consumers' preferences shift to other segments such as luxury cars, small cars, SUVs and MPVs, it is highly likely that the market share of the C segment will gradually shrink. | |

| A, B | ・A to B segment compact BEVs are expected to continue to sell well in both rural and urban areas. Most of these models are priced at 100,000 CNY or less, so the impact of the abolition of NEV subsidies is likely to be limited. | ・It is believed that the pace of growth, albeit a small one, can be maintained, driven by BEVs. | |

| MPV | D-MPV | ・The D-MPV market is expected to grow slightly from 2022. | ・Demand for D-MPVs by businesses, which use them as courtesy vehicles, and by families is expected to continue for some time. |

| B / C-MPV | ・The B / C-MPV market is expected to continue its downward trend which began in 2020. However, the rate of decline may shrink. | ・The B / C-MPV market is expected to shrink slightly from 2024. - In the B / C-MPV market, there is a risk that demand will remain stagnant for a long time. As the segment is saturated, it is thought that demand for comfort is shifting to D-MPVs, and demand for freight transportation is shifting to commercial vehicles. | |

| SUV | ・The new SUV market is expected to exceed the size of the previous year. - If the overall new passenger vehicle market grows, the SUV market, which is the largest segment, is also expected to grow. | ・The SUV market may continue to grow, albeit modestly, in 2024. In addition to continued demand for vehicles in the SUV segment, replacement demand from consumers who purchased SUVs in the 2010s is expected to contribute to growth. ・In this segment, product introductions by foreign companies is increasing, so the competition for market share with Chinese companies is expected to intensify. | |

| Exports | ・Passenger vehicle exports are expected to continue increasing. If the supply of parts such as semiconductors improves, and the global economy recovers from the impact of corona, the export market will likely continue to perform well. | ・Although affected by the economic conditions of major export destinations such as South America, the Middle East and North Africa, exports to countries involved in China’s Belt and Road Initiative are expected to increase. ・NEV exports are expected to continue increasing. | |