AAA weekly

2020-07-27

Copyright FOURIN, Inc. 2025

SsangYong is at Risk Due to Deficit in 2019 and Withdrawal of Capital Injection by Mahindra

SsangYong is in a business crisis since the global financial crisis (GFC). SsangYong's consolidated financial results for 2019 showed a 341.3 billion KRW net loss. The bottom line has been worsened for the 3rd consecutive year. In response to the red, parent company Mahindra & Mahindra (hereinafter Mahindra) decided in February 2020 to inject 230 billion KRW into SsangYong. However, Mahindra withdrew this financial assistance plan in April 2020 due to a drastic change in the business environment in India following the spread of COVID-19. SsangYong is now standing at a crossroads because of the financial turnaround.

SsangYong filed for bankruptcy protection in 2009 after being affected by the GFC. The company has been rebuilding its operations with the financial support of Mahindra since being acquired by the Indian company in 2011. Mahindra has invested a total of 1.5 trillion KRW in SsangYong so far, but SsangYong has yet to improve its deficit. Besides, due to the stricter environmental regulations and the increased development costs for next-generation technology, the South Korean automaker recorded a large deficit in 2019. What is worse, the impact of the pandemic has been hitting the automaker even harder for 2020; its business continuation is at stake.

Mahindra withdrew the injection of 230 billion KRW into SsangYong and reduced the financial support to 40 billion KRW. However, SsangYong requires 450 billion to 500 billion KRW over the next 3 years in order to put its finance back on a sound footing. To overcome the financial difficulties, the company has applied for assistance from the South Korean government and financial institutions. SsangYong’s business depends on it.

SsangYong: Recent Business/Achievements

Business Performance and Achievements in 2019

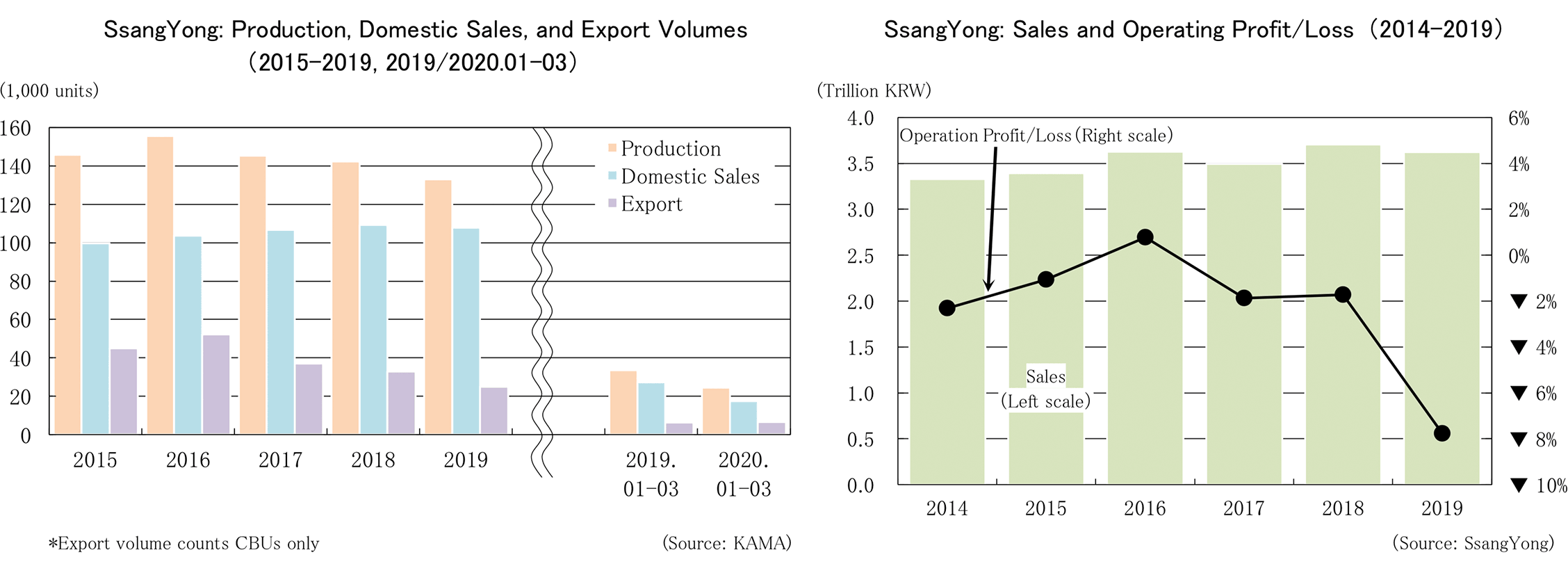

・Global sales for 2019 were 135,235 units, which falls by 5.6% compared to the previous year.

- The target announced in January 2019 was set at 163,000 units.

- Domestic sales decreased by 1.2% year on year to 108,000 units and overseas sales of Completely Built Units (CBU) fell 23.9% to 25,000 units.

: Domestic sales reached 100,000 units/year for the 4th consecutive year thanks to all-new Korando(former Korando C) whereas overseas sales fell by 20% due to a decrease in exports to South America.

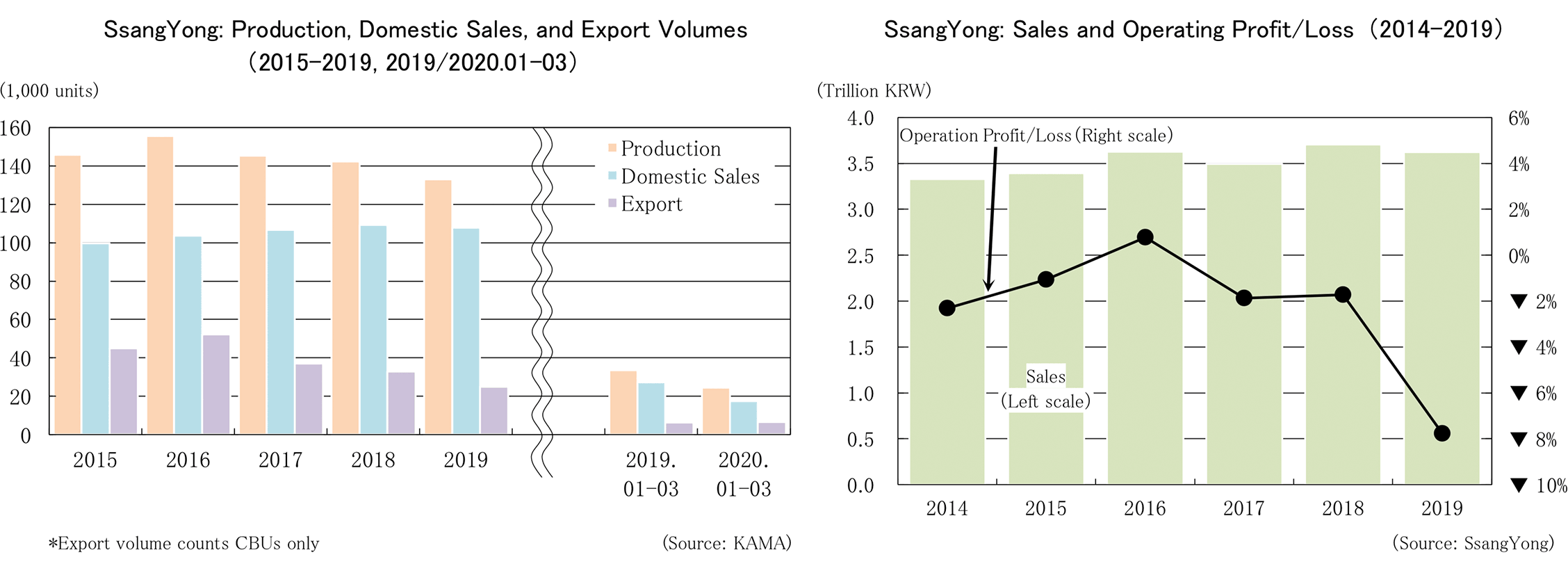

・According to the consolidated financial results for 2019, sales decreased by 2.2% to 3.6 trillion KRW, operating loss was 281.9 billion KRW (cf. 2018: 64.2 billion KRW), and net loss was 341.4 billion KRW (cf. 2018: 61.8 billion KRW).

- Deterioration in performance due to a decrease in overseas sales and an increase in development costs for new models.

- SsangYong has been showing a loss/deficit in all accounting periods except 2016 ever since the company was acquired by Mahindra in 2011. Net loss in 2019 hits the record high after the acquisition.

SsangYong's Management Reconstruction Plan by Parent Company Mahindra

・In February 2020, Mahindra announced that it will provide SsangYong with 230 billion KRW (198 million USD) in funding.

- Mahindra estimated the management reconstruction cost for the next 3 years at 450 billion to 500 billion KRW (380million to 425 million USD). Mahindra will inject 230 billion KRW and expects the rest from domestic financial institutions in South Korea.

- In parallel with capital injection, SsangYong aims to achieve an operating profit ratio of 3% in 2022 by reducing raw material costs by 80 billion to 90 billion KRW annually.

・In April 2020, Mahindra announced withdrawal of the funding of 230 billion KRW to SsangYong.

- Mahindra plans to significantly reduce the amount of capital injection from the initial plan and to contribute up to 40 billion KRW (one time only) in the next 3 months.

- Due to the difficulty of securing financial resources on the Mahindra side because of the pandemic.

- Instead, Mahindra will support SsangYong as follows:

: Allowing use of Mahindra's new platform free of charge

: Support for technology programs to control the capital expenditure of SsangYong

: Support for an ongoing material cost reduction program :Support for finding new borrowers

- SsangYong decided to request financial assistance from the South Korean government and financial institutions after the cancellation of the capital injection plan by Mahindra.

・Reference Information: According to some reports, Mahindra is considering incorporating SsangYong into the alliance with Ford in order to rebuild the management of SsangYong.

- Mahindra and Ford are planning to start production of jointly developed vehicles (e.g. C-SUV) at a joint venture company in India in 2020. Mahindra is also considering to produce them at a SsangYong facility in South Korea.

New Models (except EVs)

・Launched a mid-sized SUV model, Korando in February 2019.

- Korando (Code: C300) is developed based on Korando C, with an investment of 350 billion KRW.

- Korando has a choice of 1.5-liter turbo petrol engine and 1.6-liter diesel engine. The petrol engine was co-developed with Mahindra (1.5GDI-Turbo). Combined with either 6-speed automatic transmission (AT) or 6-speed manual transmission (MT).

- The exterior has also been redesigned, including a front grill design and a floating roof.

- As a safety feature, Intelligent Adaptive Cruise Control (IACC), which works in tandem with the Lane Center Following Assist, was added. It won five stars in the Euro NCAP collision safety test in September 2019.

- Price: Korando with 6-speed MT starting at 22 million KRW, Korando with 6-speed AT starting at 25 million KRW, and Korando with AWD starting at 28 million KRW.

- The sales target for 2019 was 30,000 units. Domestic sales were 16,957 units.

- Export was started in April 2019. The volume of exports was 6,048 units. Destinations are considered to be Europe, South America, Oceania and the Middle East.

・In June 2019, a compact small SUV, Tivoli was redesigned.

- Tivoli is the first model to be powered by 1.5GDI-Turbo, which replaced the existing 1.6-liter engine. It keeps the 1.6-liter diesel engine as a diesel choice.

- Global sales of Tivoli had reached a cumulative total of 300,000 units in June 2019 since its launch in January 2015.

・In June 2019, the model name of Tivoli Air was changed to Tivoli XLV.

- Tivoli Air is a long body type of Tivoli. The model name has been changed in accordance with the redesign of Tivoli in June 2019, and the total length has been changed to 4,400 mm (215 mm longer than Tivoli).

- As for the engine, a 1.5-liter turbo petrol engine has been added, similar to the redesigned Tivoli. 1.6l Diesel engine is continued.

New EV Models

・SsangYong plans to launch a battery electric vehicle (BEV) version of Korando in the first half of 2021.

- Korando E100 will be the first electric vehicle (EV) for the brand. -Powered by a single 120 kW motor with a 61.5kWh battery pack (LG Chem). An NEDC-rated range of 4520 km. It will be based on MESMA (Mahindra Electric Scalable Modular Architecture), and its powertrain will be manufactured at Mahindra’s EV facility in Chakan.

- Unveiled at the Geneva Motor Show in March 2018 as a concept car, e-SIV (electric-Smart Interface Vehicle).

- Expected to be launched in the Australian market.

・In 2022, there is a possibility to introduce a 48V mild-hybrid (MHEV) version.

Production

・In October 2019, SsangYong signed a contract to outsource vehicle production to Saudi National Automotive Manufacturing(SNAM, Saudi Arabia).

- SNAM will produce Rexton Sports and Rexton Sports Khan with CKD kits imported from the Pyeongtaek factory in South Korea. The production will start by 2021. The target production volume is 30,000 units.

- SsangYong will supply parts and support factory construction and production line installation.

・As of December 2019, SsangYong seems to be in talks with Thanh Cong (Vietnam) to outsource local production (CKD) for the company.

(Created based on PR materials from SsangYong and Mahindra, and various media sources)

Please

register or subscribe to view this report for free.

If you’re already a subscriber, sign in.

Credit card information is not needed for free trial registration.

You are eligible to view one report for free.

Additional reports require subscription.