AAA weekly

2020-03-30

Copyright FOURIN, Inc. 2025

Rico Auto Industries Enters BEV Parts Sector, Winning Orders from Renault, BMW, PSA

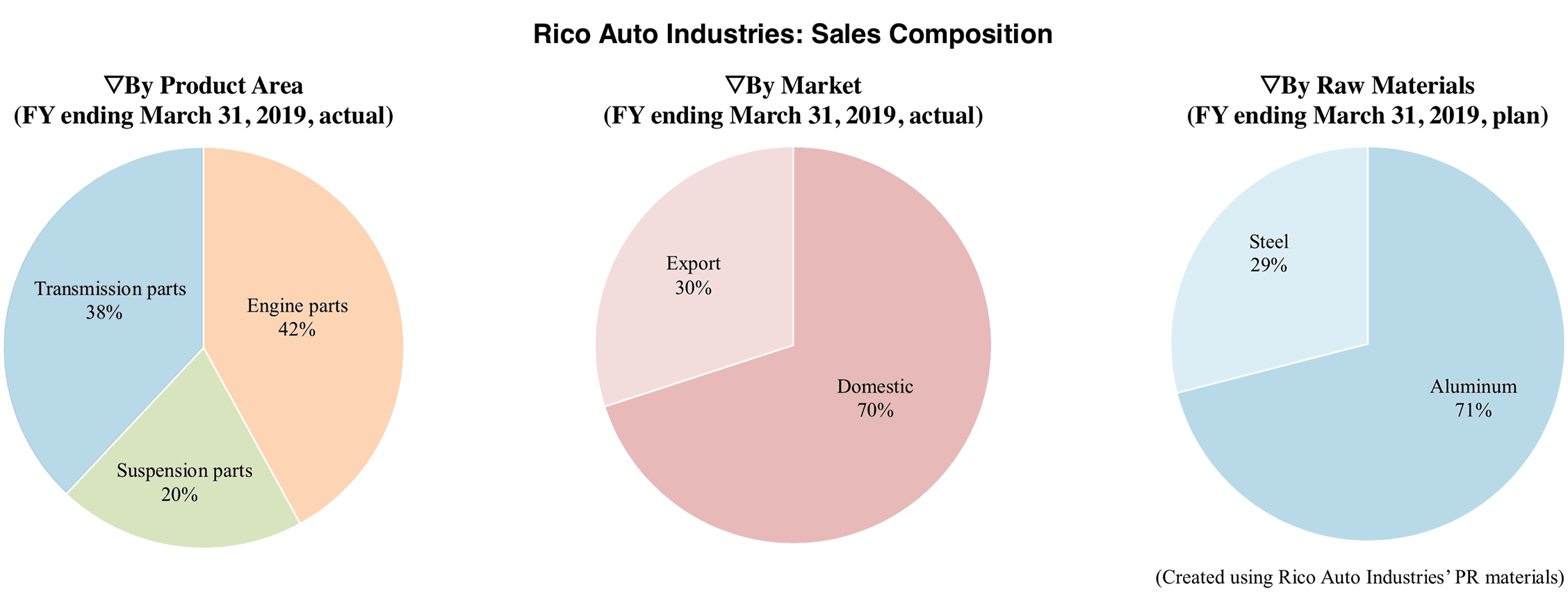

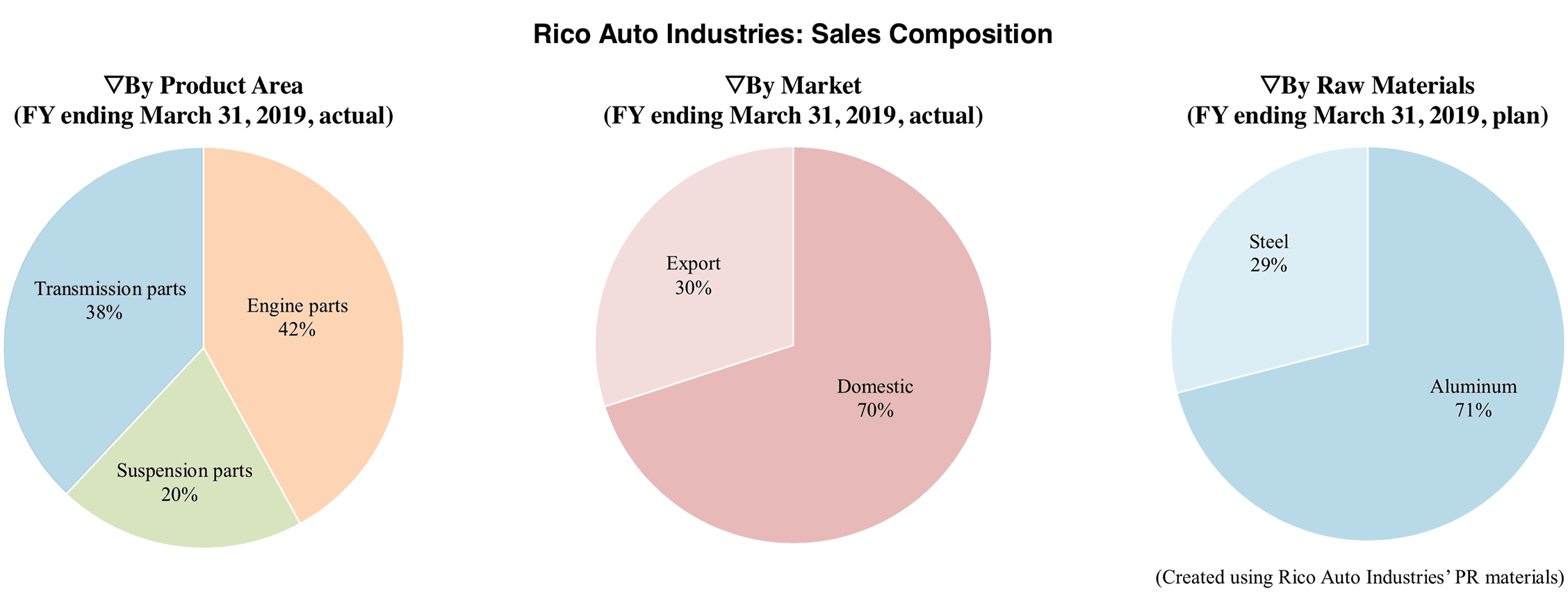

Rico Auto Industries, an automobile casting parts supplier in India, is diversifying its product lineup and business. The company manufactures cast aluminum and iron parts of engines, transmissions and suspensions. The engine parts and transmission parts businesses account for 80% of sales, its operations highly depending on internal combustion engine components. For this reason, the company has expanded its product range to motorcycle safety parts in recent years. Rico Auto Industries is also focusing on the development of BEV components such as motor housings.

The mainstay business of Rico Auto Industries is aluminum casting, and the company is continuing to increase production capacity and efficiency. However, the company has accelerated the development of new products in recent years against the background of tighter regulations in India. In 2018, the company co-developed a combined brake system (CBS) for motorcycles with Indian motorcycle giant Hero MotoCorp in response to India’s mandatory ABS and CBS requirement on motorcycles starting from April 2019. In 2019, the company began production of an improved clutch that complies with India’s next emission regulation BS6 which is scheduled to be launched in April 2020. As another effort to expand its business scope, the company is also considering establishing a joint venture company for CVT production with a Taiwanese company.

As for BEV components, the company has developed motor housings and covers, and has already won orders from automakers. As of August 2019, Rico Auto Industries has received orders from Renault, BMW and PSA worth approximately 11 billion Indian rupees for BEV component-related projects. In the fiscal year ending March 2020, 1% of total sales are expected to be generated by BEV components.

In addition to Rico Auto Industries’ main business, the company also has four auto parts-related production subsidiaries in India. Among these, the former Magna Rico Powertrain, a production subsidiary of oil and water pumps, which was a 50/50 joint venture with Magna Powertrain, became a wholly owned subsidiary of Rico Auto Industries in March 2019. Rico Auto industries acquired all shares owned by Magna Powertrain and made Magna Rico Powertrain a wholly owned subsidiary. Consequently, the company’s name was changed to Rico Fluidtronics.

Rico Auto Industries: Recent Business Trends

Performance

・Consolidated sales for FY2018 (ended March 31, 2019) were 141 million Indian rupees (up 13.3% compared to the previous fiscal year).

・Consolidated sales for the first and second quarters of FY2019 (from April 2019 to September 2019) were 740 billion rupees (up 2.6% compared to the same period of the previous fiscal year).

・As of August 2019, Rico Auto Industries has announced that it has received the following five orders for new customers.

– PSA: 4.41 billion rupees (transmission cases, oil pans, etc.)

– Kia: 4.25 billion rupees cylinder blocks etc.

– Punch Powertrain: 1.8 billion rupees

– Greaves Cotton: 1.08 billion rupees (engine parts)

– Daimler: 370 million rupees

Production-related trends

Construction of new factory

・In April 2019, a new plant started operation in Halol, Gujarat state.

– As of May 2019, production of motorcycle parts has started.

– In the future, the plant plans to produce automobile parts and expand in size according to needs.

– The initial investment up to starting operation was 11 million rupees.

・A new plant, located in Pathredi, Rajasthan state, is scheduled to go into operation in the fiscal year ending March 2020.

– The plant will be a production base for cast iron parts, with an annual production capacity of 300,000 units. It is expected that aluminum casting equipment will be introduced in the future.

– According to the initial plan, the operation was scheduled to start in the third quarter of the fiscal year ending March 2020, but the operation status has not been confirmed.

Increasing production capacity / introducing equipment

・Over the next three years starting from September 2018, the company plans to invest 4 billion rupees to increase production efficiency of the iron and aluminum casting process.

– Fifty new robots will be introduced in the casting and machining processes to promote automation.

・In July 2019, an additional production line for cast aluminum parts was added at the Bawal plant in Haryana state, doubling production capacity.

・In August 2019, the company completed its third investment in the Chennai plant in Tamil Nadu state, doubling production capacity.

– The investment was carried out in anticipation of increased production for Kia, PSA and AVTEC.

Development trends related to casting

・In the aluminum casting process, the company is switching from gravity casting to high-pressure casting for the manufacturing of some parts.

– High-pressure casting allows to perform casting of more complicated shapes in an effort to reduce weight and the number of machining steps.

– Rico Auto Industries has more than 100 high-pressure casting equipment to handle aluminum casting which accounts for 70% of sales. The company is said to have the largest production scale in India. Its annual production scale of high-pressure casting is 50,000 tons.

・While making changes to the manufacturing process, the company is developing a new material casting method for stainless steel and magnesium alloys.

BEV parts business

・The company is strengthening the development of powertrain components for BEVs, in addition to conventional engine and transmission components. Products under development include motor housings, covers, and various cases.

・As of August 2019, the cumulative value of orders for BEV parts was approximately 11 billion rupees. The breakdown of orders is as follows.

- BMW:9.5 billion rupees

- Renault:400 million rupees

- PSA:1.15 billion rupees

・In the fiscal year ending March 2020, 1% of total sales are expected to be generated by BEV components.

Please

register or subscribe to view this report for free.

If you’re already a subscriber, sign in.

Credit card information is not needed for free trial registration.

You are eligible to view one report for free.

Additional reports require subscription.