AAA weekly

2020-10-12

Copyright FOURIN, Inc. 2025

Motherson Sumi Systems Aims Improved Efficiency Through Restructuring

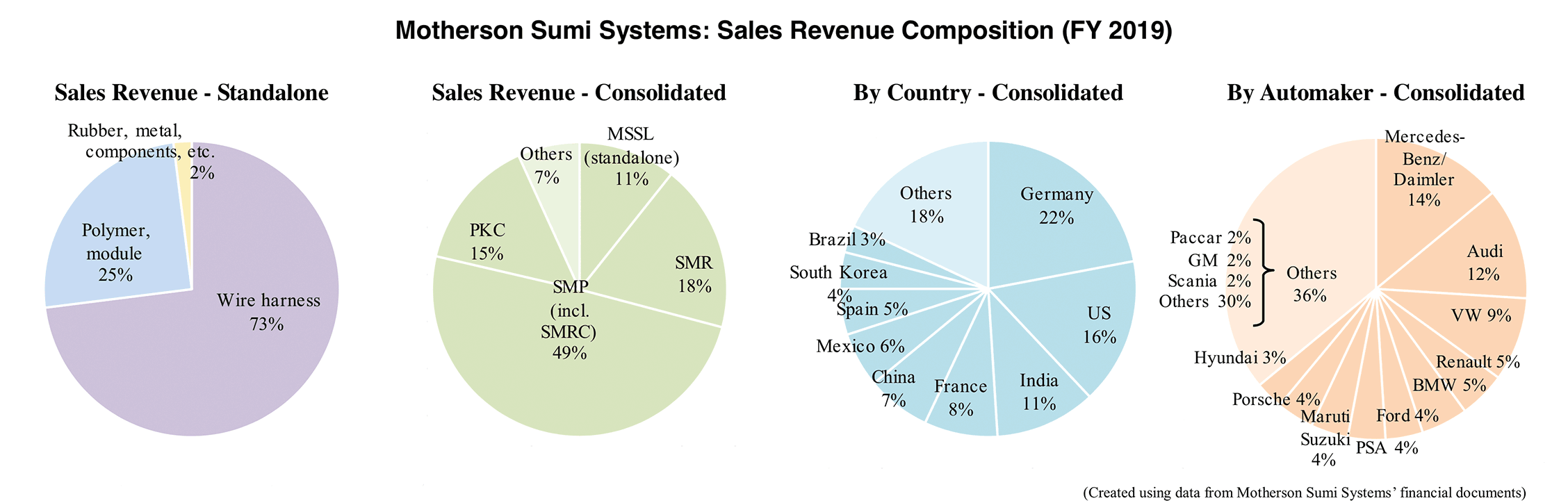

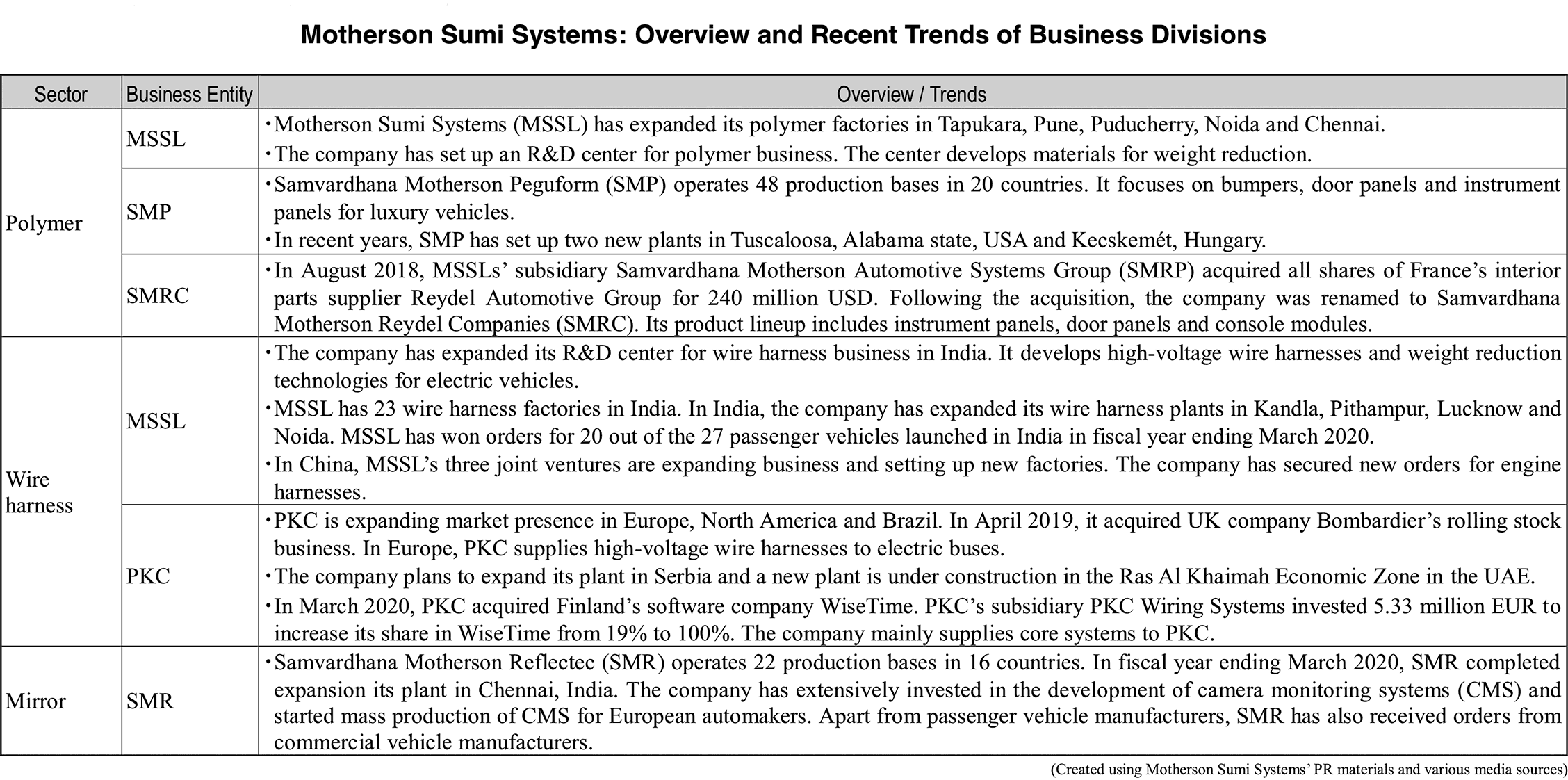

Motherson Sumi Systems (MSSL), India's largest auto parts manufacturer, announced a major restructuring plan for its business structure in July 2020. Initially, MSSL, joint venture between Samvardhana Motherson International (SAMIL) and Japan’s Sumitomo Wiring Systems (SWS), has mainly engaged in domestic wire harness business, but since the 2000s, it has been actively conducting overseas M&As to diversify its product line. As a result, the business scale of MSSL has rapidly grown over the years, but its organizational structure has become too complex. The reorganization plan, which is scheduled to be completed by 2021, will streamline the current management system. In addition, the company has set forth an ambitious goal of boosting sales to 36 billion USD in fiscal year ending March 2025.

The two key points of the plan announced by MSSL is to reorganize the business structure of Samvardhana Motherson Group (SMG) whose core company is MSSL, and to spin off MSSL’s domestic wire harness business. SMG has been conducting automobile parts business through two companies, MSSL and SAMIL. However, the two companies are planned to be integrated to unify the organization. In addition, MSSL’s domestic wire harness business will split from the company and become independent in an effort to reinforce its ties with its Japanese parent company SWS.

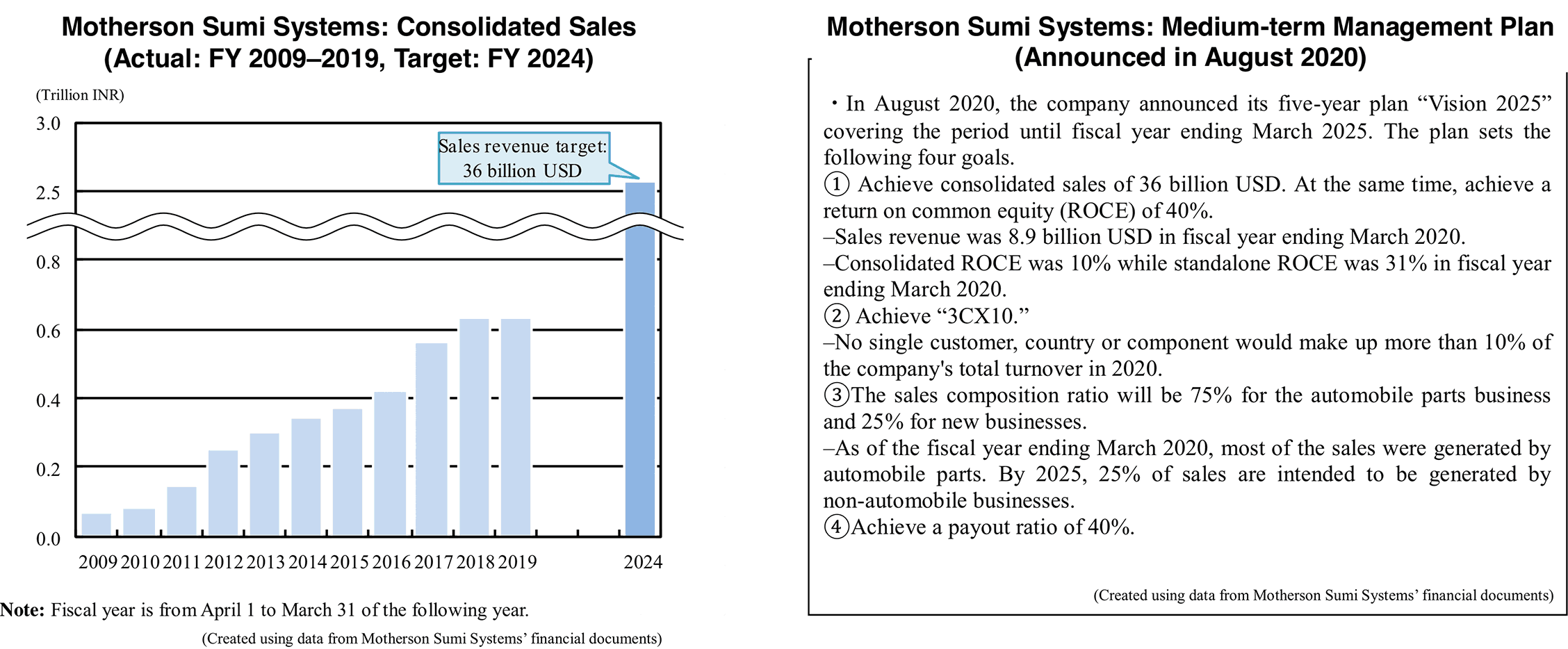

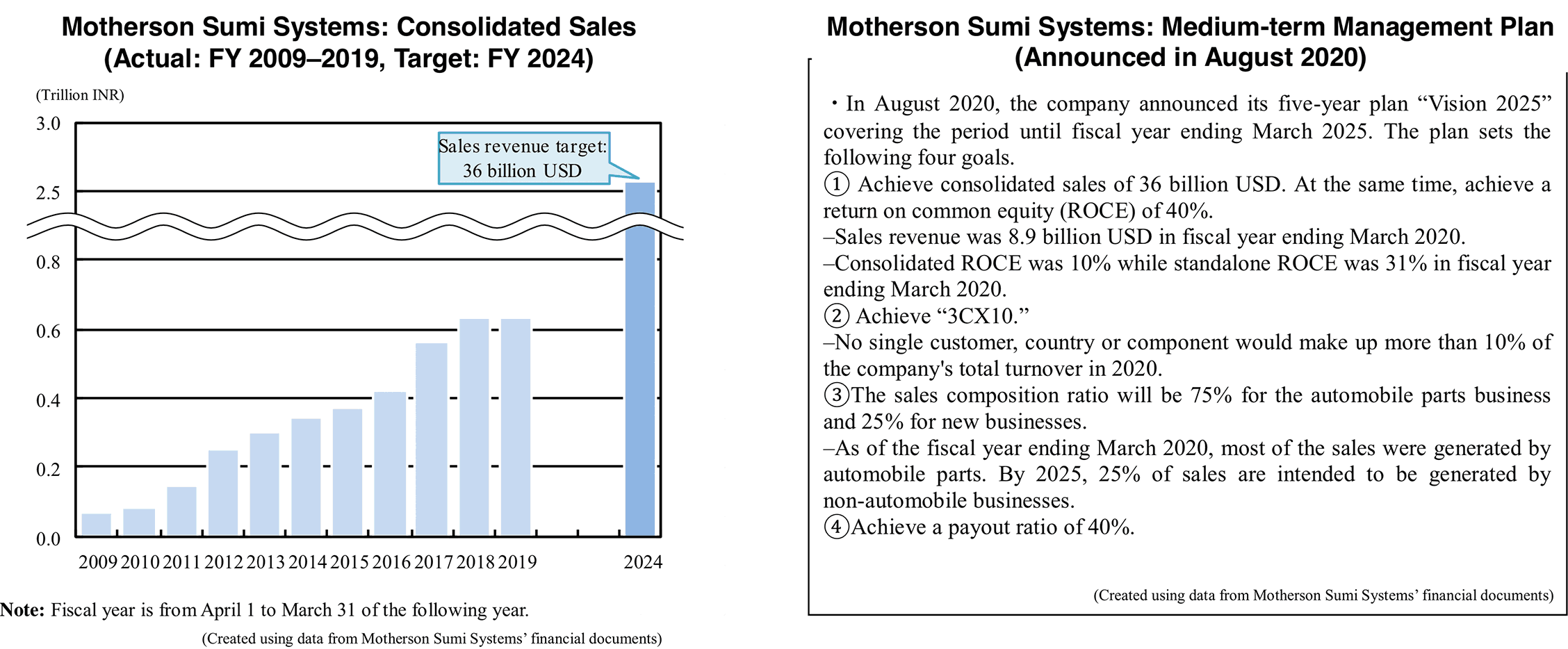

Based on the new medium-term plan “Vision 2025” announced in August 2020, MSSL, which plans to complete the reorganization in 2021, aims increase sales from about 8.9 billion USD in the fiscal year ending March 2020 to about 36 billion USD in the fiscal year ending March 2025. This sales target is extremely ambitious, on a scale comparable to that of Continental and ZF, and is not easy to achieve. However, MSSL has achieved all of its past medium-term targets except for the fiscal year ending March 2020. M&As are likely to be stepped up in the coming years to achieve the company’s sales target.

Motherson Sumi Systems: Outline of Organizational Restructuring Plan (Announced in July 2020)

・In July 2020, Motherson Sumi Systems (MSSL) announced a plan to reorganize the business structure of Samvardhana Motherson Group (SMG) whose core company is MSSL.

– The company is scheduled to obtain approval from the Indian authorities in April 2021 and complete system change in July 2021.

– The reorganization plan which has two key points is as follows.

① Management integration of MSSL and SAMIL

SMG has been conducting automobile parts business through two companies, MSSL and Samvardhana Motherson International Limited (SAMIL). However, SMG plans to integrate the two companies to unify the organization.

– The reorganization is intended to speed up decision-making by simplifying the business structure.

– For reference: SAMIL is an unlisted company in which the founding family, the Sehgal family, holds 90% of the shares. It is a de facto holding company, the largest shareholder of MSSL, and an investor in joint ventures with auto parts manufacturers other than Sumitomo Wiring Systems such as Marelli and Valeo.

・The business integration will be carried out by MSSL absorbing SAMIL.

– MSSL will be the surviving company, but the company’s name will be changed to “SAMIL” after the procedure is completed.

・After the transition to the new system, MSSL will be owned by the Sehgal family with a majority stake of 50.4%. Sumitomo Wiring Systems (SWS), the original joint venture partner, will continue to have a stake in the company. However, SWS’s stake will drop from 25% to 17.7%.

② Spinning off MSSL’s domestic wire harness business

MSSL’s domestic wire harness business will be spun off and relaunched as Motherson Sumi Wiring India (MSWIL).

– Initially, MSSL was established as a joint production company of wire harnesses for the Indian market by SMG and SWS, but its business has diversified following overseas acquisitions that started in the 2000s. The domestic wire harness business was spun off due to the increasing number of business areas outside the collaboration with SWS.

– MSSL’s domestic wire harness sales reached 39.4 billion INR in fiscal year ending March 2020.

Please

register or subscribe to view this report for free.

If you’re already a subscriber, sign in.

Credit card information is not needed for free trial registration.

You are eligible to view one report for free.

Additional reports require subscription.