AAA weekly

2020-04-20

Copyright FOURIN, Inc. 2025

Vietnam’s Automobile Market in 2019: Overall Sales Increased to 402,000 Units, Reaching a Record High Level

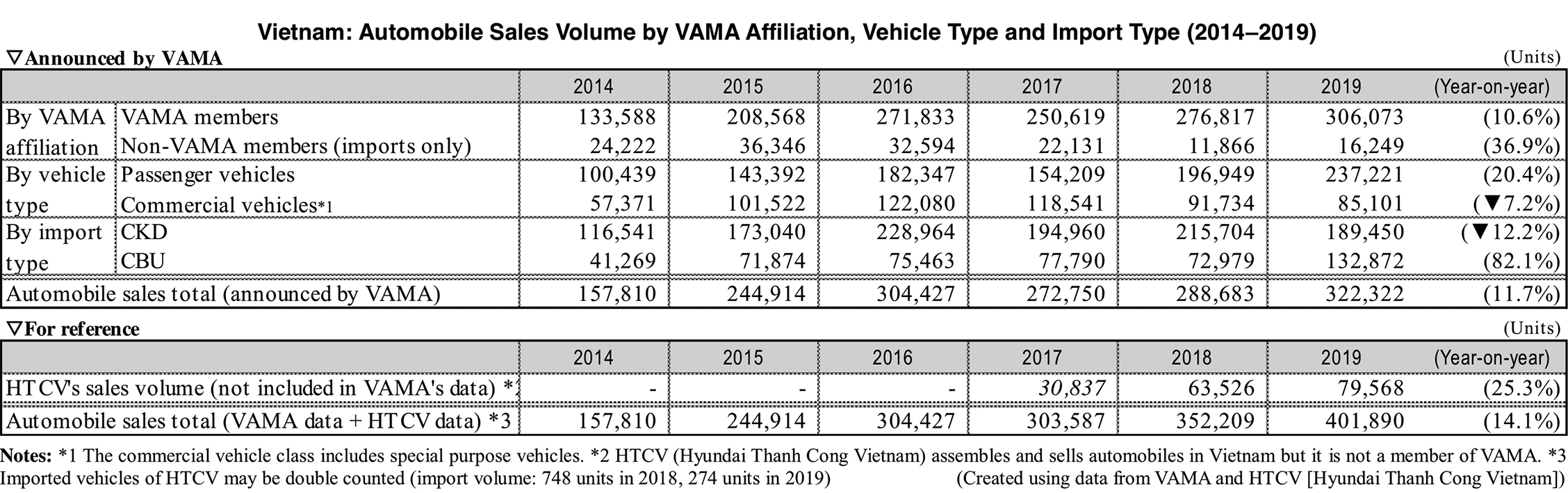

Vietnam’s automobile sales increased 11.7% year-on-year in 2019 to 322,000 units according to Vietnam Automobile Manufacturers Association. The negative effect of Decree No. 116 on automobile imports, which was introduced by the Vietnamese government in January 2018, has gradually declined and the sales of imported vehicles increased 82.1% in 2019, setting a new record high for the first time in three years. In addition, sales volume of Hyundai's local subsidiary Hyundai Thanh Cong Vietnam (HTCV), which is not included in the sales statistics released by VAMA, increased 25.3% to 80,000 units in 2019. The combined sales volume of VAMA members and HTCV was 402,000 units in 2019, indicating that demand for new vehicles is already surpassing 400,000 units.

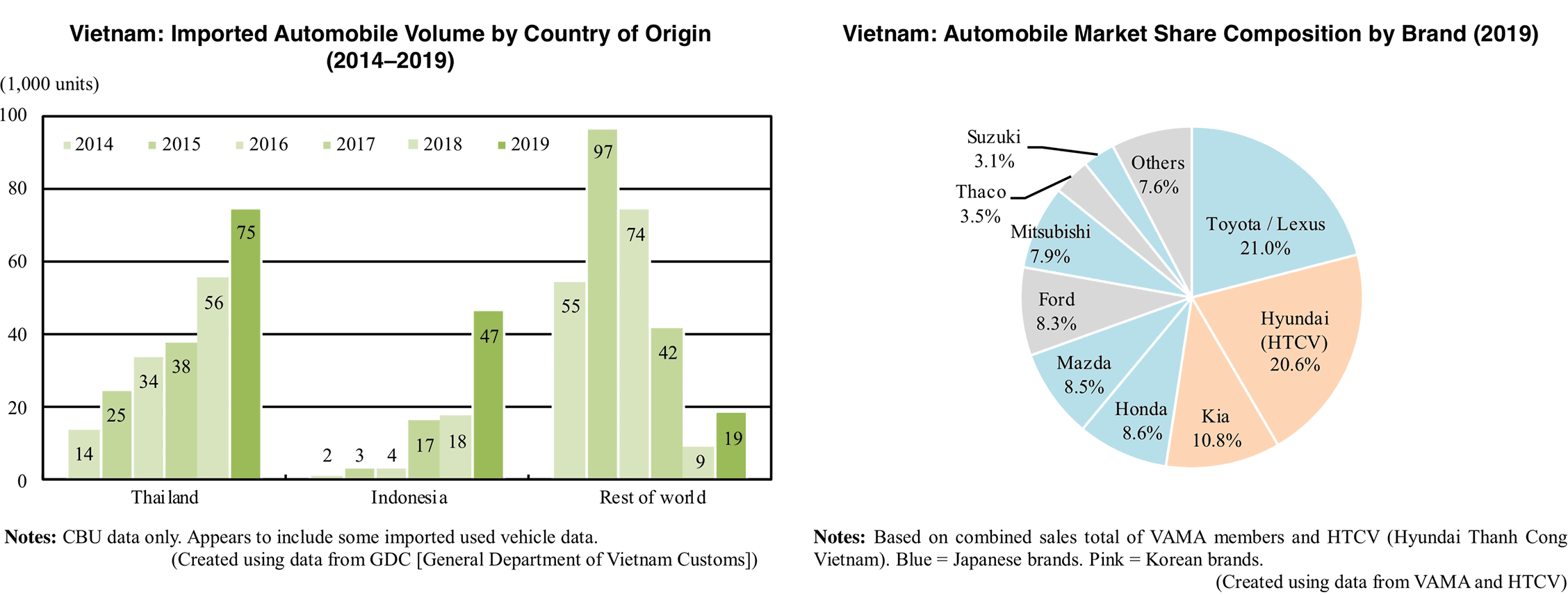

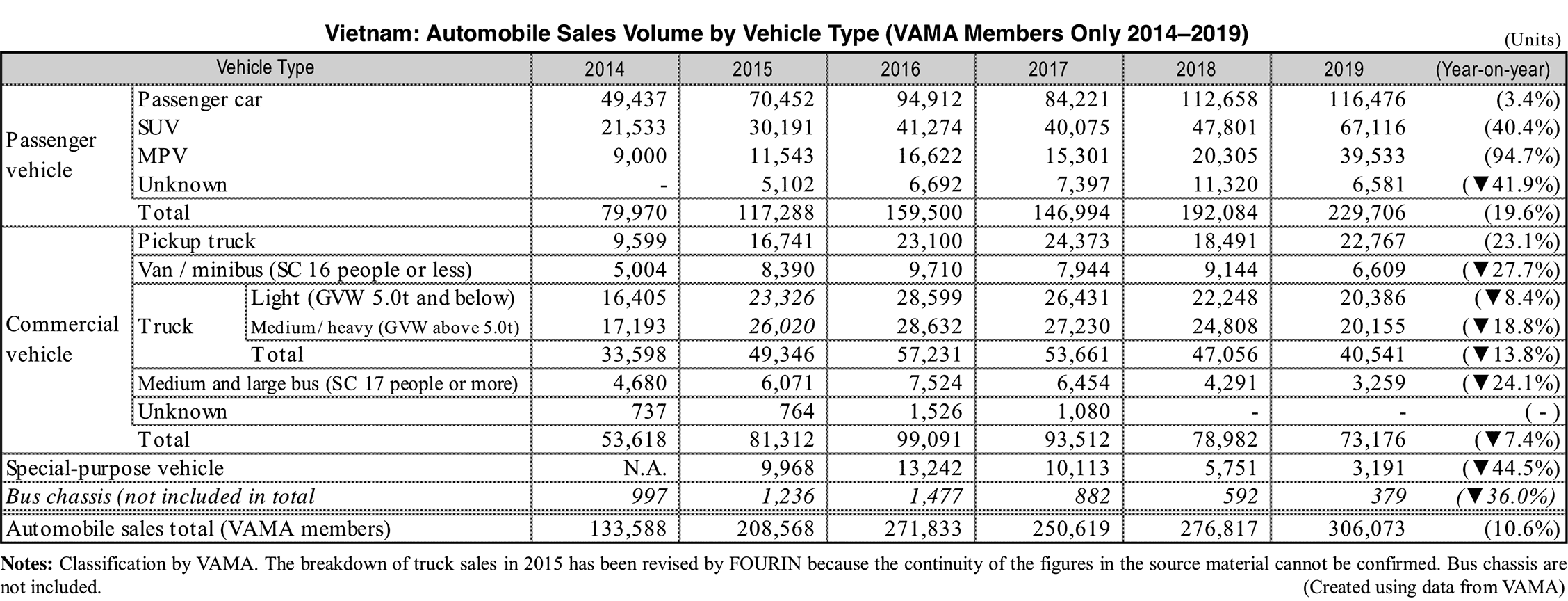

Looking at the breakdown of the 322,000 units sold by VAMA members by import type, vehicles locally-assembled from CKD kits fell 12.2% to 189,000 units, while vehicles imported in CBU form increased 82.1% to 133,000 units. As a result, the ratio of imported vehicles, which had been at 20-30% in recent years, rose to 41.2% in 2019. The abolition of import tariffs on vehicles manufactured within ASEAN resulted in a sharp rise in vehicle imports. For this reason, it is likely that the Vietnamese government will increase localization requirements in the future.

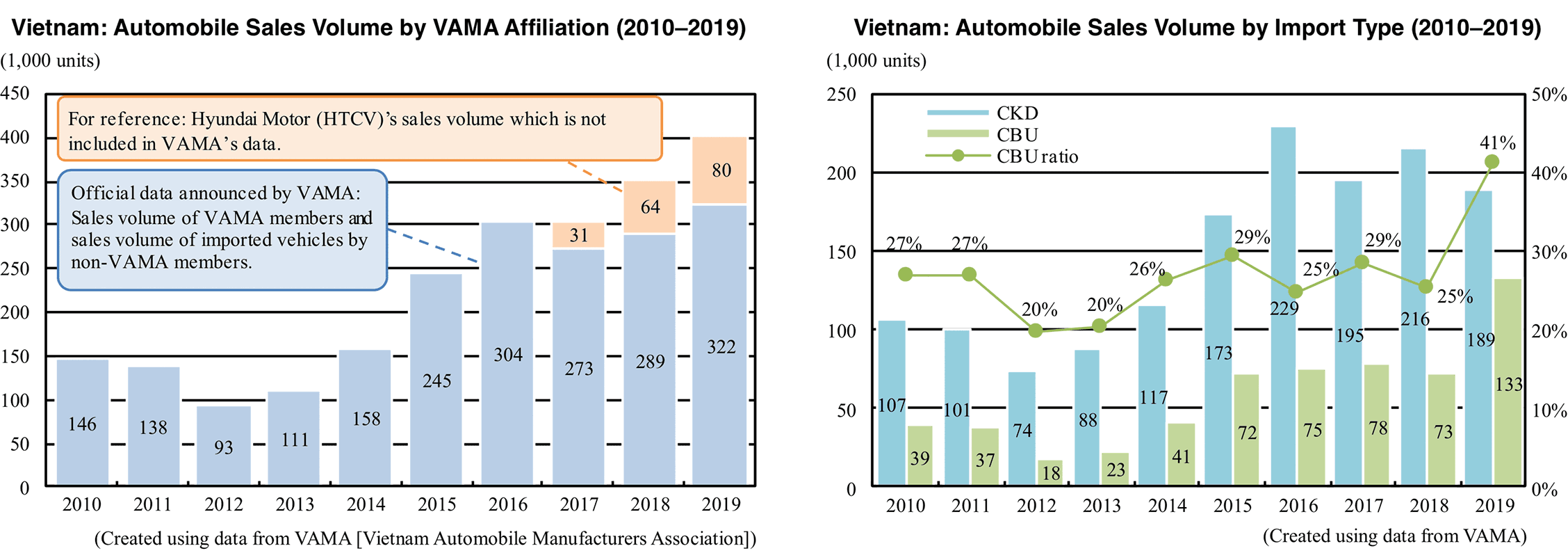

Looking at data by vehicle type, passenger vehicles increased 20.4% to 237,000 units. Many manufacturers boosted their product lineup by launching additional imported products, resulting in a significant increase. Commercial vehicles decreased by 7.2% to 85,000 units, falling for the third consecutive year after peaking at 122,000 units in 2016. Looking at the top two brands, Toyota (including Lexus) went up 21.7% to 81,000 units. Its best-selling model the Vios maintained sales at 27,000 units, the same level as the previous year. The Fortuner, whose local production was reintroduced in 2018, increased 2.1 times to 13,000 units. In 2019, the market share of Toyota (including Lexus) increased 1.5pp to 21.0%. Hyundai went up 25.3% to 80,000 units. Out of the six locally-assembled models, five models increased double digits, enabling Hyundai to close in on Toyota, narrowing the gap between the two brands to a little over 1,000 units.