AAA weekly

2020-06-15

Copyright FOURIN, Inc. 2025

Indonesia’s Automobile Exports Reach a New Record High in 2019

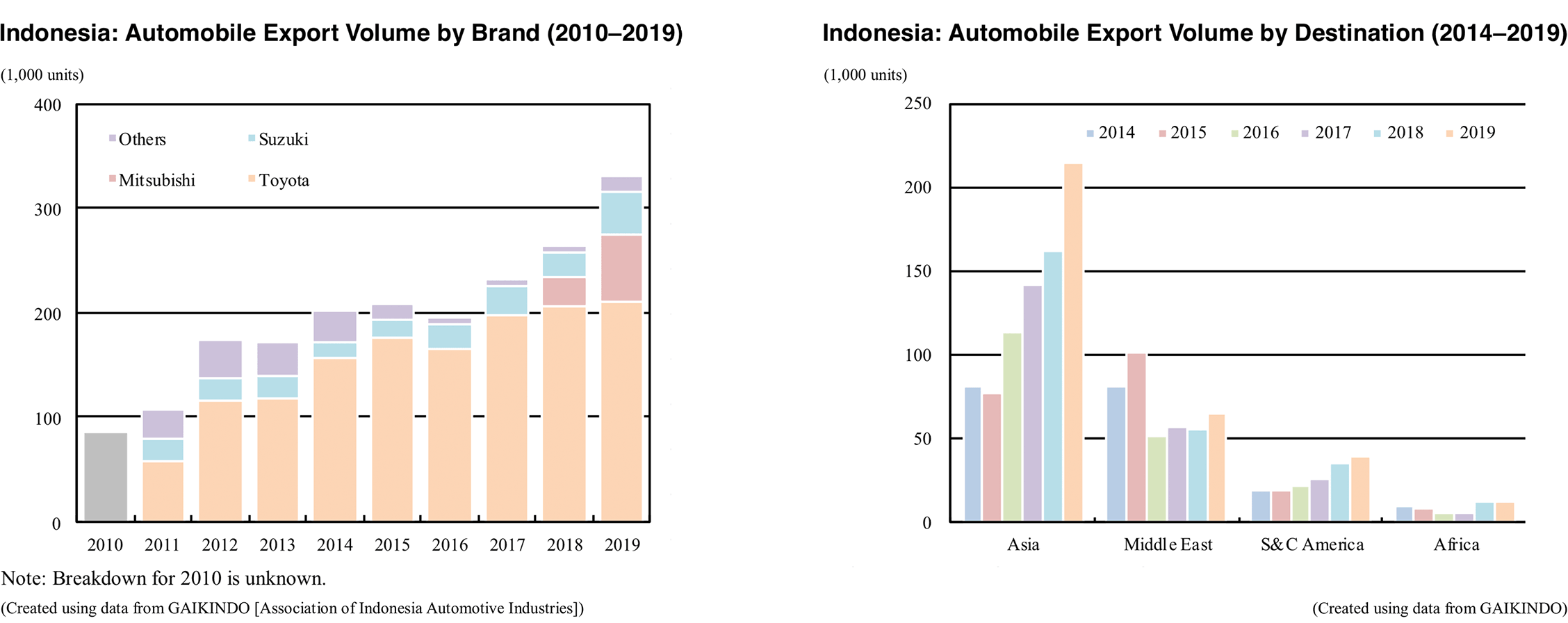

Indonesia’s automobile exports (CBUs only) increased 25.5% year-on-year in 2019 to 332,000 units, setting a new record high for the third consecutive year. Toyota, which is Indonesia’s largest exporter, continued to expand exports, while Mitsubishi and Suzuki drastically increased exports, combined volume exceeding 300,000 units for the first time.

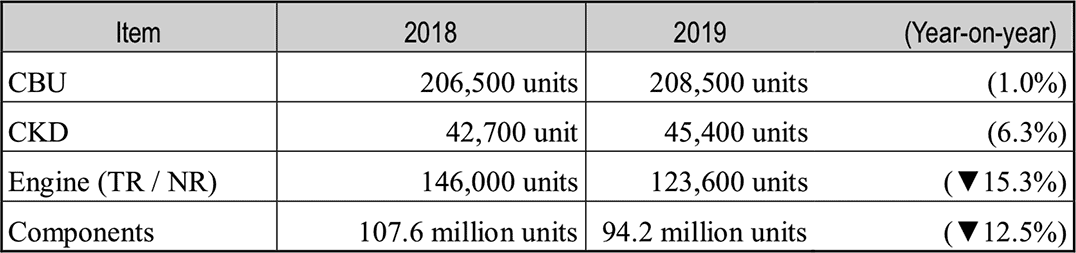

Looking at automobile exports by destination, exports to Asia increased by 31.9% to 214,000 units, to the Middle East by 18.4% to 65,000 units and to Central and South America by 11.7% to 39,000 units. Exports to the Philippines, which is Indonesia’s largest export destination in Asia, remained at a high level, with a slight increase of 1.0% to 87,000 units. Indonesia was followed by Vietnam, up 2.3-fold to 42,000 units and Thailand, up 92.9% to 33,000 units. Strong exports to both markets were driven by brisk sales of the Mitsubishi Xpander. In the Middle East, exports to Saudi Arabia increased 33.2% to 37,000 units aided by growing exports of the Toyota Vios. Looking at automobile exports by brand, Toyota increased 2.6% to 211,000 units. Although the Rush went up 51.3% to 50,000 units and the Vios rose 34.4% to 31,000 units, all other models declined across the board with Fortuner down 9.3% to 47,000 units. Indonesia’s second largest exporter Mitsubishi began exports in April 2018. Twenty-seven thousand units of its sole export item the Xpander were exported in 2018 from April until the end of December. Sixty-five thousand units were exported in 2019, the Xpander becoming Indonesia’s largest export model. Suzuki, ranked third in 2019, increased exports 58.9% to 40,000 units. The 2nd-gen Ertiga went up 2.5-fold to 27,000 units.

In 2019, Honda, ranked fourth in 2019, resumed exports from Indonesia for the first time in five years. The automaker is exporting the Brio to the Philippines and Vietnam.

Indonesia: Recent Major Automobile Export Trends

Toyota Motor

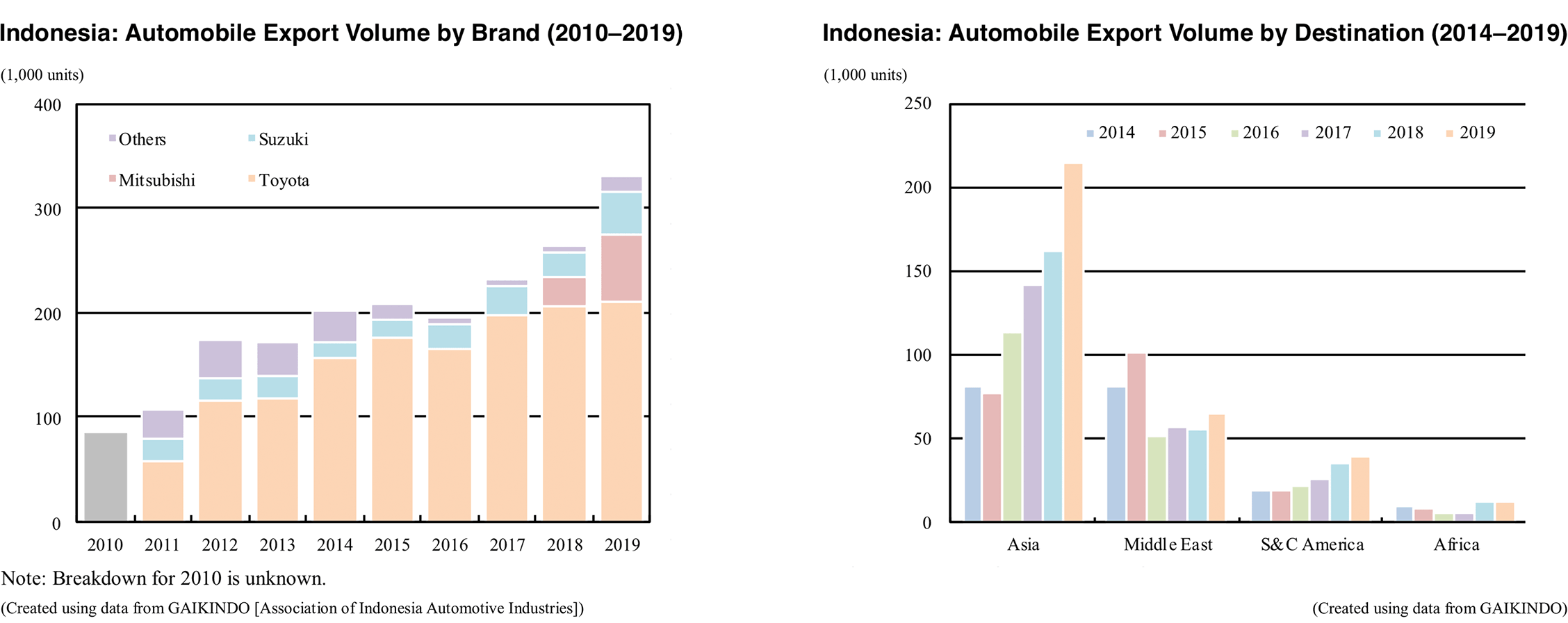

・In January 2020, Toyota Motor Manufacturing Indonesia (TMMIN), a local production subsidiary of Toyota Motor, announced the company’s export results for 2019. Data are as shown in the table below.

・Regarding CKD exports, apparently exports of the Vios to Pakistan in CKD form began in 2019.

– In Pakistan, a locally-produced model of Vios was released in March 2020. It is likely that CKD kits of the Vios are supplied from Indonesia.

– Toyota has so far exported CKD kits of the IMV series from Indonesia. This is the first CKD export of a passenger vehicle model.

Mitsubishi Motors

・In July 2019, Mitsubishi Motors CEO Masuko Osamu announced during a visit to Indonesia that the company plans to increase exports of the Xpander in CBU form from the country to 60,000 units a year and raise the number of destinations to more than 20 countries.

– In 2019, 64,000 units of the Xpander were exported, exceeding the company’s target.

– As of the end of 2019, the number of export destinations of the Xpander was 13 countries (Vietnam, Thailand, Philippines, Peru, Egypt, Bangladesh, Sri Lanka, Cambodia, Mauritius, Brunei, Bolivia, Myanmar, Laos), increasing from seven countries as of the end of 2018.

・It plans to switch some grades of the Xpander exported to Vietnam to local production in 2020.

– Vietnam became the largest export destination for the Xpander in 2019. Mitsubishi is expected to switch to local production due to rising sales in Vietnam which makes local production feasible. CKD kits are likely to be supplied from Indonesia.

Suzuki Motor

・In 2019, Suzuki began exports of the new Carry in CBU form.

– As of April 2019, Suzuki had a plan of expanding the number of export destinations of the new Carry to about 100 countries and regions.

・In February 2020, Suzuki announced its plan to gradually export the new crossover XL7, which was launched in Indonesia in the same month, to Asian countries and Latin America.

– Exports began in March 2020, and total exports are likely to reach 12,000 units by the end of the year. It is believed that the number of export destinations will be increased to 30 countries.

・As of February 2020, the export target for 2020 (total of CBUs and CKDs) is set at 69,000 units.

– Suzuki aims to increase exports by 3.9% from the 2019 result of 66,000 units (of which 39,613 CBUs and 26,820 CKD sets), but this target may be revised in the future due to the impact of the new coronavirus.

Honda Motor

・In 2019, Honda began exports of the Brio in CBU form.

– The model is exported to the Philippines and Vietnam.

– This is the first time in five years for Honda to export a vehicle in CBU form from Indonesia.

SAIC-GM-Wuling

・In September 2019, SAIC-GM-Wuling began exports of the Chevrolet Captiva in CBU form to Thailand, Brunei and Fiji.

– This Chevrolet Captiva is the rebadged model of Almaz which is locally produced and sold by SAIC-GM-Wuling. It is supplied as the Captiva to Chevrolet dealerships in each country.

– It is the first time that SAIC-GM-Wuling exports a vehicle in CBU form from Indonesia.

DFSK

・In 2019, DFSK began CBU export to Hong Kong.

– The company aims to export 1,000 units to Hong Kong in 2020 (as of November 2019).

・In September 2019, DFSK began exports of the Supercab in CBU form to the Philippines. The company plans to sell 3,000 units annually through local dealer and importer QSJ Motors Phils.

Hyundai Motor

・Hyundai’s CBU plant, which is scheduled to start production in the second half of 2021, will produce small SUVs, small MPVs and sedans for Southeast Asia.

– In addition to exporting CBUs, it seems that Hyundai is also considering producing and exporting CKD parts for 59,000 vehicles annually.

(Created using company PR materials and various media sources)

Please

register or subscribe to view this report for free.

If you’re already a subscriber, sign in.

Credit card information is not needed for free trial registration.

You are eligible to view one report for free.

Additional reports require subscription.

・In January 2020, Toyota Motor Manufacturing Indonesia (TMMIN), a local production subsidiary of Toyota Motor, announced the company’s export results for 2019. Data are as shown in the table below.

・Regarding CKD exports, apparently exports of the Vios to Pakistan in CKD form began in 2019.

– In Pakistan, a locally-produced model of Vios was released in March 2020. It is likely that CKD kits of the Vios are supplied from Indonesia.

– Toyota has so far exported CKD kits of the IMV series from Indonesia. This is the first CKD export of a passenger vehicle model.

・In January 2020, Toyota Motor Manufacturing Indonesia (TMMIN), a local production subsidiary of Toyota Motor, announced the company’s export results for 2019. Data are as shown in the table below.

・Regarding CKD exports, apparently exports of the Vios to Pakistan in CKD form began in 2019.

– In Pakistan, a locally-produced model of Vios was released in March 2020. It is likely that CKD kits of the Vios are supplied from Indonesia.

– Toyota has so far exported CKD kits of the IMV series from Indonesia. This is the first CKD export of a passenger vehicle model.