AAA weekly

2020-10-05

Copyright FOURIN, Inc. 2025

PSA Sees Worsening Decline in China

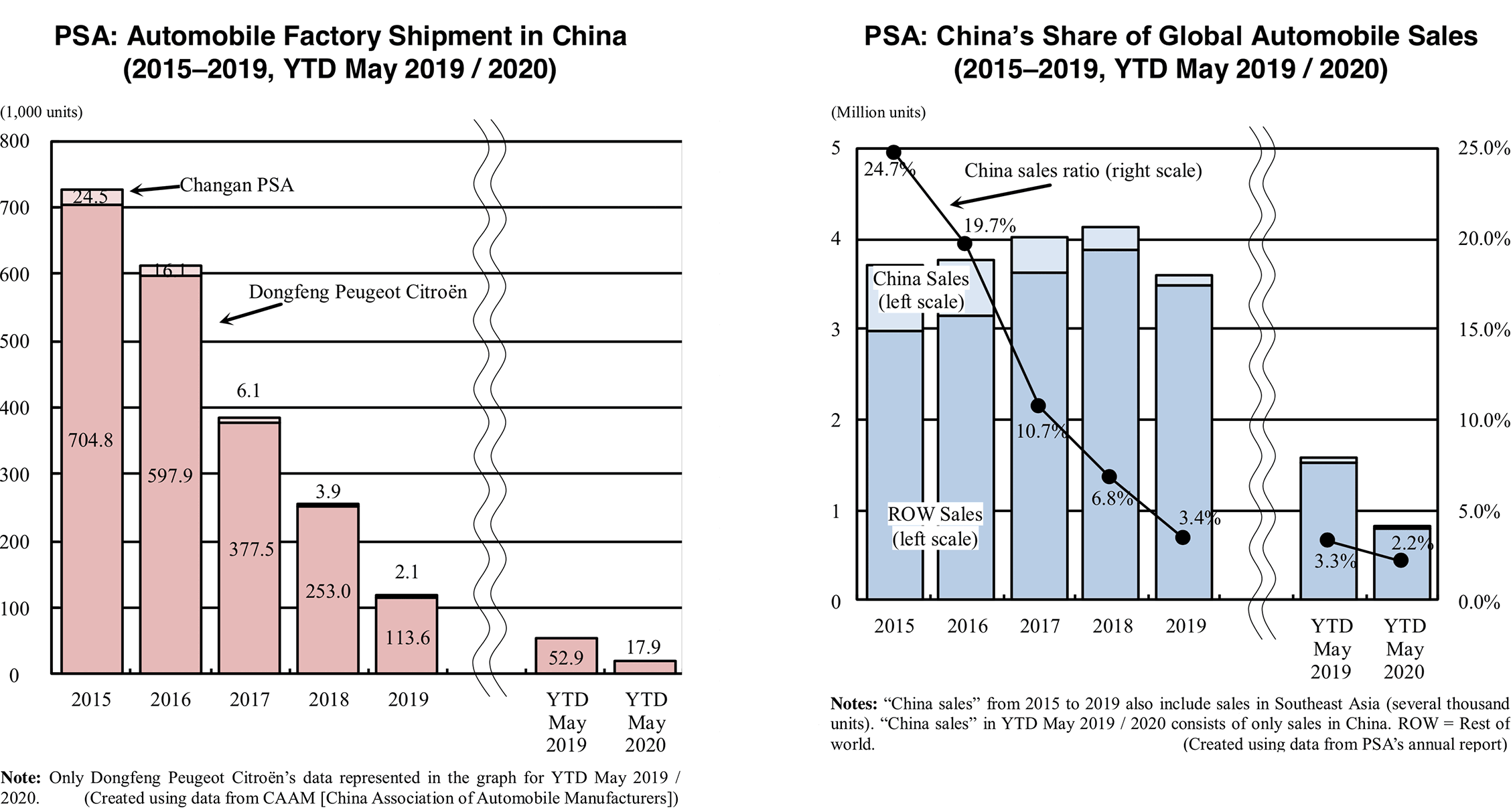

French automaker PSA is facing an ever increasing problem in China. According to the China Association of Automobile Manufacturers, the factory shipment volume of Dongfeng Peugeot Citroën (DPCA), which handles PSA’s Peugeot and Citroën brands, was 114,000 units in 2019, down 55.2% from the previous year. As for Changan PSA, which markets the DS brand in China, factory shipments decreased 46.9% from the previous year to 2,055 units. As a result, the company was forced to withdraw from the Chinese market in November 2019. Coupled with production suspension due to the outbreak of the new coronavirus, PSA is literally fighting for survival in China. PSA’S factory shipments in China peaked at about 730,000 units in 2015 but have been continuing to decline ever since. In the first five months of 2020, factory shipments dropped 66.2%. Due to lack of product promotion and product planning failures, PSA’s products have been abandoned by Chinese consumers in the past five years.

In September 2019, DPCA announced a reconstruction plan spanning until 2025 to overcome the current dire situation. Positioning 2020-2021 as the “period to strengthen business,” DPCA will strive to recover by urgently creating a sales method that combines internal combustion engine vehicles and electric vehicles, and a system to prepare for the introduction of new emission regulations.

PSA: Business Trends in China (As of July 2020)

| Subject | Details |

|---|---|

| PSA’s sales in China | ・In January 2020, PSA announced that global sales in 2019 declined 10.3% compared to the previous year to 3.47 million units of which the China – Southeast Asia market fell 55.4% to 117,000 units. While the China – Southeast Asia market accounted for 24.7% of PSA’s global sales in 2015, its share shrank to 3.4% by 2019. In the first five months of 2020, China accounted a mere 2.2% of PSA’s global sales. – PSA’s decline in the global market was less than 10% in 2019, but the rate of decrease in the Chinese market was close to 60%, indicating a sharp drop in China. |

| Withdrawal from Changan PSA | ・In November 2019, PSA announced that it would sell all of its holdings in Changan PSA, a joint venture with Chongqing Changan Automobile. Chongqing Changan Automobile also announced its plan to sell all of its shares in the joint venture. – In 2019, Changan PSA’s factory shipment was a mere 2,055 units, declining 46.9% compared to the previous year. ・In May 2020, PSA and Chongqing Changan Automobile completed the procedure for selling and changing the registration of Changan PSA. In the same month, Shenzhen Baoneng Automobile announced that it had purchased Changan PSA through its parent company’s investment company and established a new company. – It was reported that the purchase amount was 1.63 billion CNY. Baoneng has announced that it would set up a head office building, a factory and R&D facilities within the premises. |

| Dongfeng Peugeot Citroën’sales results | ・Dongfeng Peugeot Citroën’s factory shipment in the first five months of 2020 declined 66.2% compared to the same period of the previous year to 18,000 units. In 2019, the automaker’s sales fell 55.2% to 114,000 units. – In the first five months of 2020, production was seriously affected by the outbreak of the new coronavirus. However, even in May, when the factory operated normally, shipments were sluggish at 6,250 units, down 28.1% from the same month of the previous year, and the declining trend continues. – The automaker has not set a sales target for 2020. |

| Extending duration of Dongfeng Peugeot Citroën | ・In December 2019, Dongfeng Motor announced that it would extend the joint venture period of Dongfeng Peugeot Citroën by 10 years to 2037 after discussions with PSA. – It was reported that the cumulative deficit of Dongfeng Peugeot Citroën from January 2018 to June 2019 were 6.2 billion CNY. |

| Reconstruction plan until 2025 | ・In September 2019, Dongfeng Peugeot Citroën announced a reconstruction plan until 2025, setting specific goals. – The company’s target for 2019 was to set the break-even point to 180,000 units or less. – The company’s goals for 2020–2021 are to raise the annual sales volume to 250,000 units, set the break-even point to 150,000 units or less and increase cash flow. – The company’s goals for 2022–2025 are to boost the annual sales volume to 400,000 units, expand its product lineup and raise cash flow. – In terms of technology, engine output, torque and control performance of all products will be upgraded, and fuel efficiency will be improved. The company will prepare for China 6b emission regulations by the end of 2020. – New models to be launched in 2020 and after will be available in both internal combustion engine and electric (BEV, PHEV and MHEV) versions to meet the various needs of consumers. – The management organization will be streamlined. The authority of the general manager and deputy general manager will be strengthened, and the authorization system of the representatives of the parent companies will be abolished. The responsibility of the directors will be clarified. – Until now, the Peugeot brand and the Citroën brand had separate stores, but in areas where the company has no sales presence, it will open stores that will handle both brands. |

| Launching six new models in 2020 | ・In 2020, Dongfeng Peugeot Citroën (DPCA) will launch six new models in China four under the Peugeot (2008, e2008, 4008 [PHEV], 508L) and six under the Citroën (C5 [PHEV]), 508 [PHEV]) brand. The company has announced that it will sell a total of 14 models nationwide by 2022. ・In May 2020, DPCA launched the 2008 (gasoline) and e2008 (BEV) small SUVs under the Peugeot brand. – The gasoline version is sold for 109,900–149,900 CNY and the BEV version is sold for 156,000–188,000 CNY (after deduction of subsidies). – Length, width and height are 4,312mm, 1,785mm and 1,545mm. Wheelbase is 2,612mm. – The gasoline version is powered by a 1.2L turbocharged engine. It has a maximum output of 100kW, a maximum torque of 230Nm and a maximum speed of 195km/h. – The BEV version’s drive motor has a maximum output of 100kW, a maximum torque of 260Nm and a maximum speed of 150km/h. Its NEDC driving range is 430km. ・In June 2020, DPCA launched the 4WD version of the C5 Aircross under the Citroën brand. – It is sold for 149,700–236,700 CNY. – The model is available with 1.6L and 1.7L turbocharged engines. It has a maximum output of 123–155kW, a maximum torque of 245–300Nm and a maximum speed of 195km/h. – Length, width and height are 4,510mm, 1,860mm and 1,670mm/1,705mm. Wheelbase is 2,730mm. – The PHEV version of this model is scheduled to be released in 2020. It will be Citroën’s first PHEV model. |

| Impact of the new coronavirus | ・Due to the spread of the new coronavirus infection, the factories under DPCA were forced to adjust production from around the end of January 2020. Production was fully restored on March 25, 2020. According to media sources, the timeline for reopening factories is as follows. – On February 20, 2020, the Chengdu factory partially resumed production. – On February 25, 2020, some production lines of the Wuhan factory resumed production to meet demand from dealers. –The Chengdu plant resumed full production on March 15, 2020 followed by the Wuhan plant on March 25. |

| Nationwide sales promotion campaign | ・Following the declining effects of the new coronavirus infection, Dongfeng Peugeot Citroën launched a nationwide sales campaign in May 2020. – From May 2020, the company began to offer trade-in up to 20,000 CNY to customers who want to replace their vehicle with the Citroën C5 Aircross. In addition to offering upgrade services, the automaker also provided a 24-month interest-free loan. |

In May 2020, the gasoline-powered 2008 and the electric e2008 were launched. This was the company’s first attempt to release a gasoline and an electric version of the same model simultaneously. In the following month, the C5 Aircross entered the market. Dongfeng Peugeot has also launched a nationwide sales promotion campaign. From May 2020, the company began to offer trade-in up to 20,000 CNY to customers who want to replace their vehicle with the Citroën C5 Aircross. In addition, the Peugeot brand and the Citroën brand had separate stores until now, but in areas where the company has no sales presence, it will open stores that will handle both brands.

While the China – Southeast Asia market accounted for 24.7% of PSA’s global sales in 2015, its share shrank to 3.4% by 2019. In the first five months of 2020, China accounted a mere 2.2% of PSA’s global sales. If the current reconstruction policies fail, it is possible that PSA will reconsider whether it is still worth remaining in the Chinese market.