AAA weekly

2021-02-22

Copyright FOURIN, Inc. 2025

Malaysia: 14% Decrease in Automobile Sales in 2020, but the Sales Volume Is Expected to Recover Soon

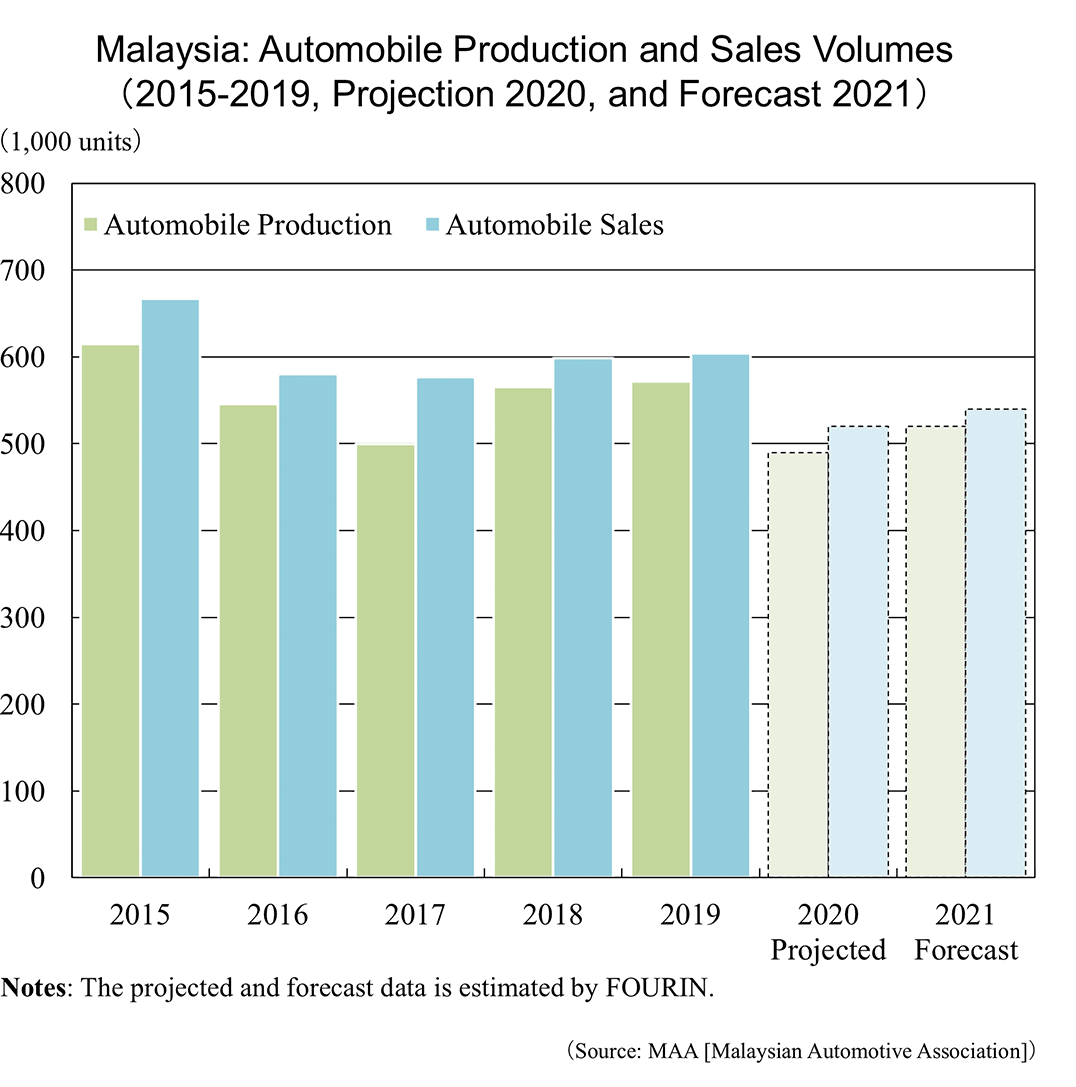

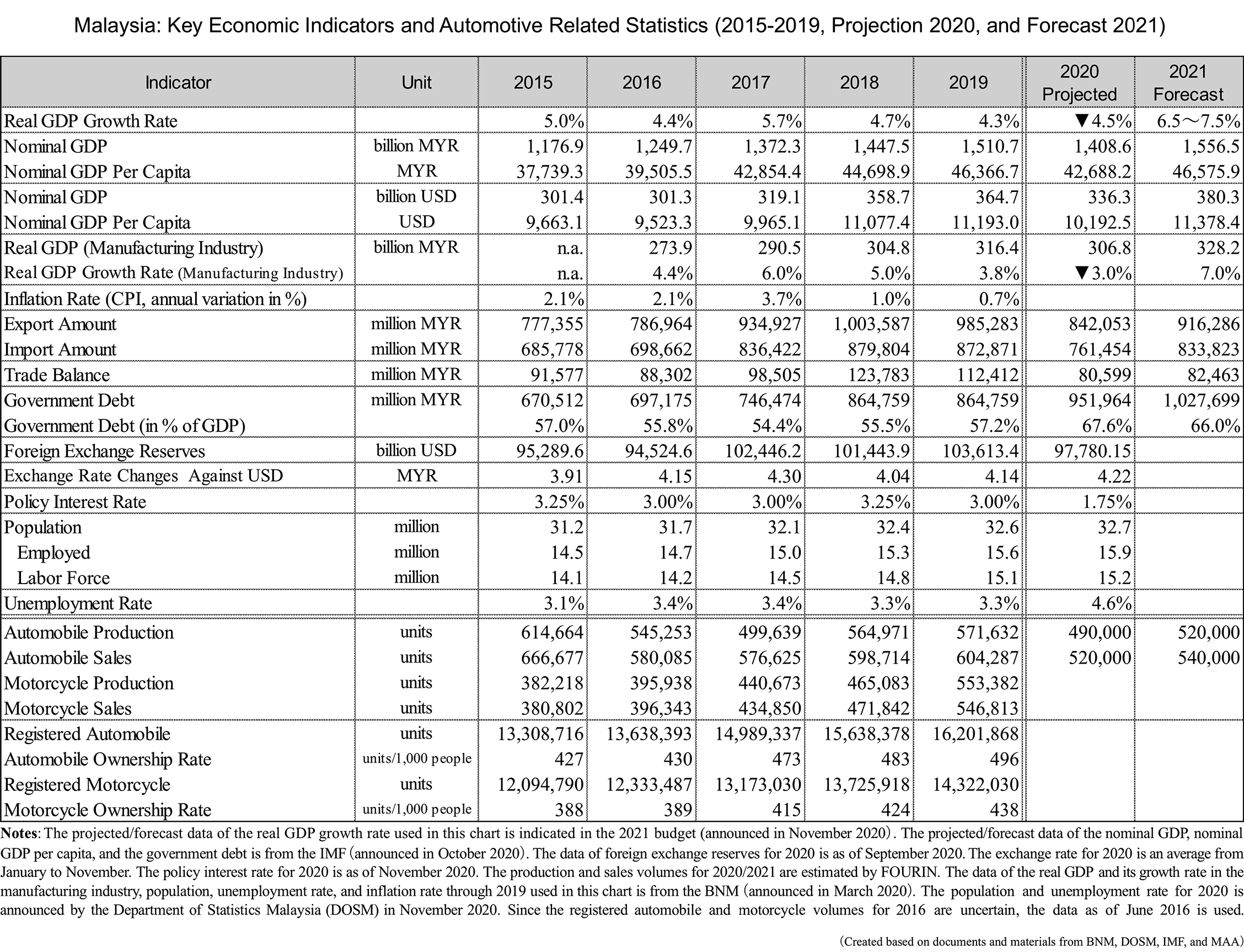

Malaysian vehicle sales are expected to decline 14% year-on-year to around 520,000 units in 2020. Although the Malaysian Automobile Manufacturers Association (MAA) forecasted the total industry volume (TIV) to be 607,000 units at the beginning of the term, the impact of activity restrictions and the weakening economy caused by the spread of the new coronavirus have been grave. However, while the first half of 2020 resulted in a significant reduction of 41% year-on-year, it recovered quickly from sluggish sales in the second half of 2020. It is mainly because the government implemented economic measures, such as the sales tax exemption for passenger cars in June, and demand increased as a reaction to activity restrictions.

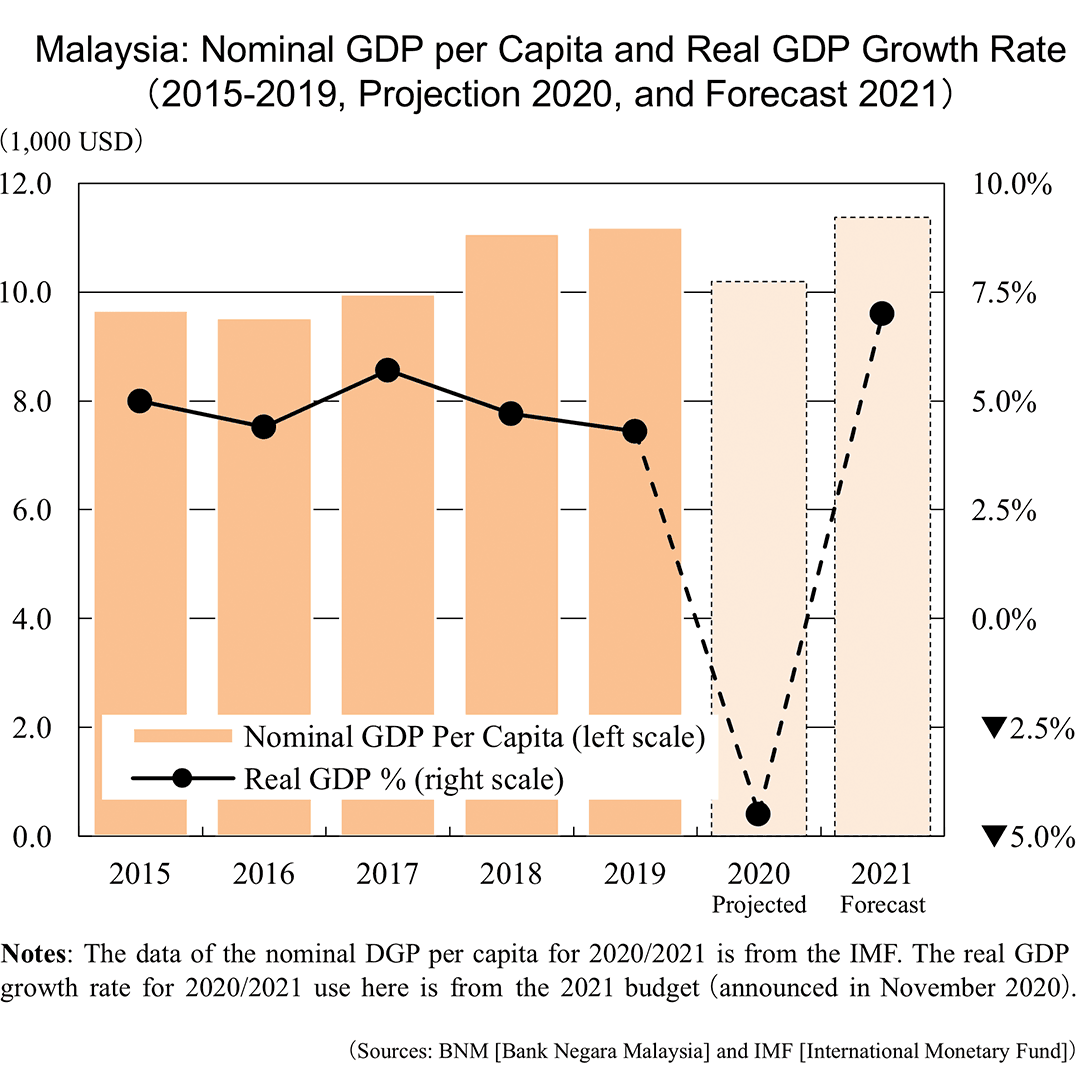

As for the economic situation, the government forecasted the GDP growth rate for 2020 to be 4.8% at the beginning of the term but later announced it to be negative growth of 4.5% as of November 2020. As a countermeasure against the economic downturn, the government has invested MYR 38 billion in economic stimulus measures. Also, the Central Bank of Malaysia (Bank Negara Malaysia) has lowered the policy rate four times, from 3.00% in early 2020 to 1.75% in July 2020. Vehicle sales in 2021 are expected to increase by 4% year-on-year to around 540,000 units. Although demand for new cars is expected to improve against the backdrop of economic recovery, it will likely be a slight increase due to a possible demand pre-emption caused by the sales tax cut in 2020 (some media reports indicate a possibility of extension of this measure, but it is not confirmed yet). On the economic front, the Malaysian government holds a favorable forecast for 2021 with a GDP growth rate of 6.6 to 7.5% on the premise of the spillover effect of implementing economic stimulus measures with the largest budget ever in 2021, the convergence of COVID-19, and the recovery of overseas demand.