AAA weekly

2024-03-12

Copyright FOURIN, Inc. 2025

Malaysia’s Automobile Sales Results in 2023

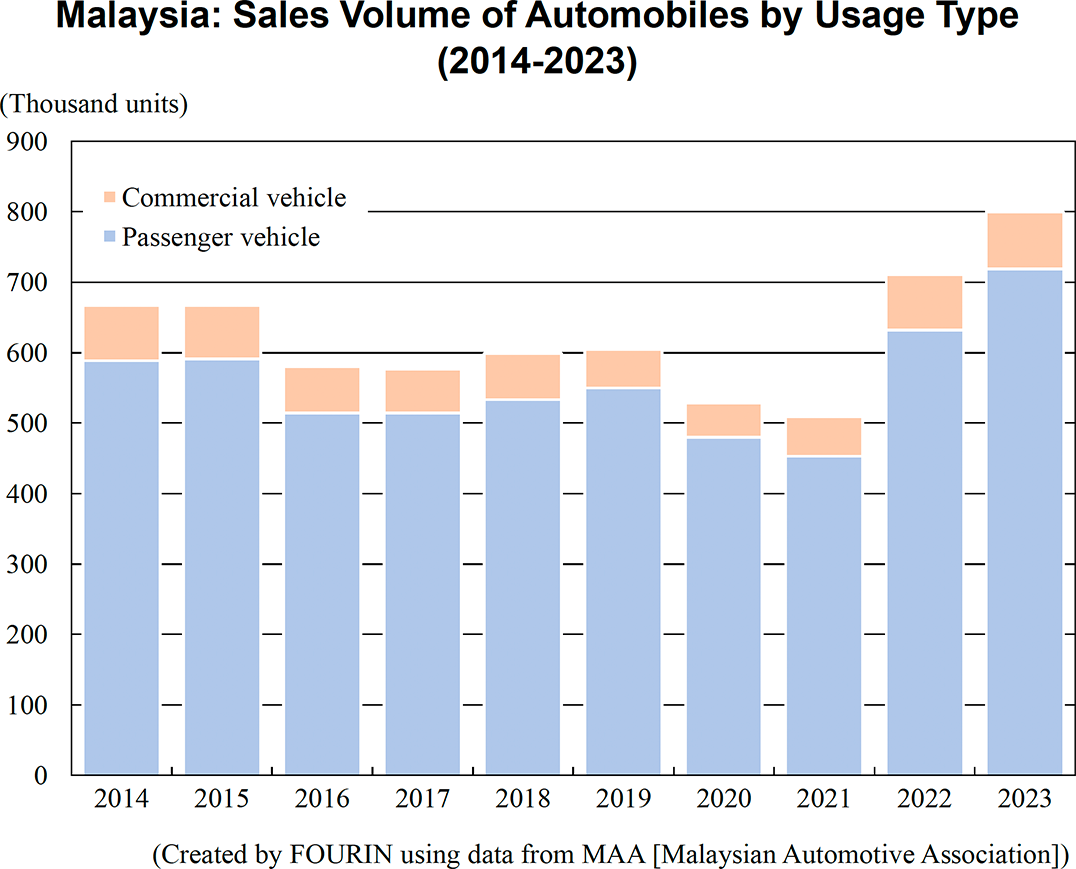

Malaysia’s automobile sales in 2023 increased by 12.5% from the previous year to 799,731 units, reaching a record high level. The automobile sales tax reduction / exemption measures for vehicles registered until March 2023, stable inflation rates, and low policy interest rates appear to have contributed to the strong performance throughout the year. Sales of passenger cars reached 440,305 units, an increase of some 51,000 units from the previous year, and SUV sales rose by around 22,000 units from the previous year to 213,128 units.

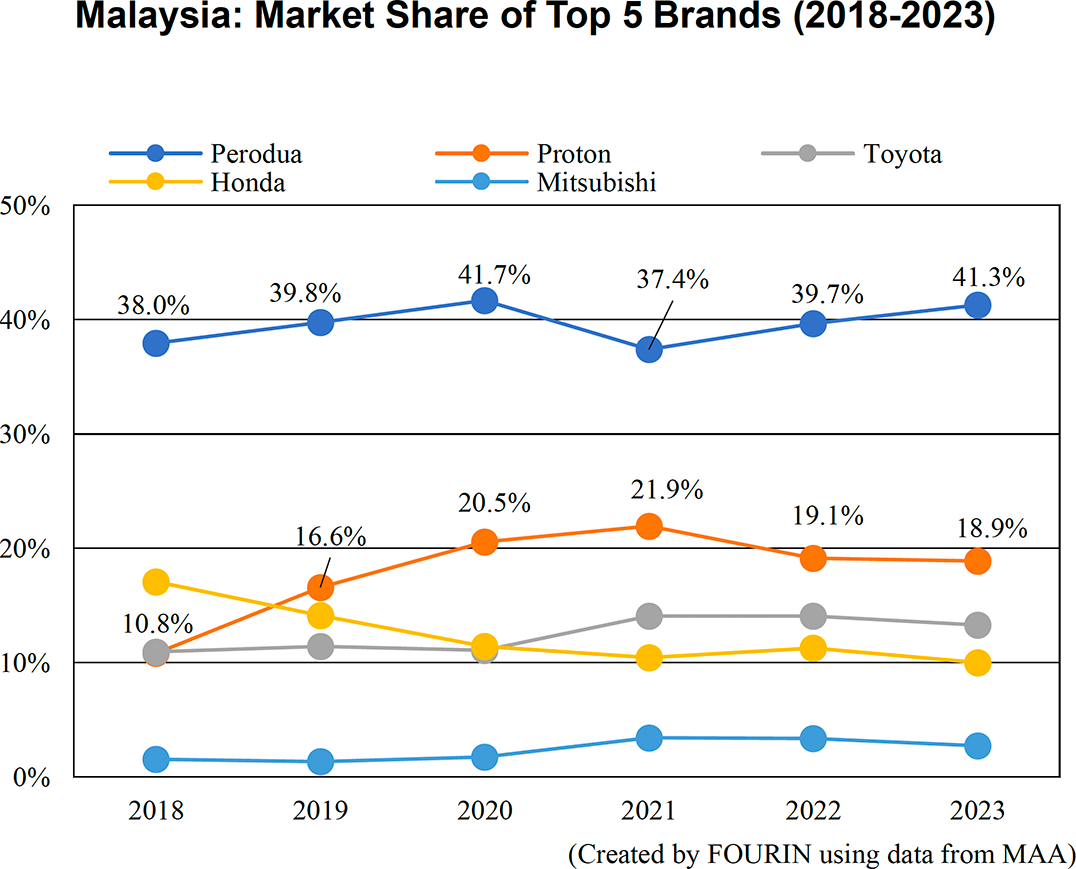

Malaysia’s two national brands Perodua and Proton increased sales double digits. Perodua’s sales rose by 17.1% from the previous year to 330,325 units. Perodua ramped up production capacity by 10,000 units to a new high of 330,000 units in 2023. At the same time, the company’s multi-pronged strategy, such as expanding its used car and vehicle subscription businesses, appear to have led to the increase in unit sales. Proton’s sales went up by 11.0% year-on-year to 150,975 units. According to the company’s announcement, the small sedan Saga led the way as the best-selling model, with sales increasing 25.6% to some 70,000 units. However, sales of SUVs were lackluster at 46,445 units, down 17.6% year-on-year, with sales of the newly launched X90 at around 5,000 units and X70 at 11,000 units.

Looking at Japanese brands, Toyota’s sales in 2023 were 106,206 units, an increase of 6.2% from the previous year. The launch of MPV products was notable, including the release of Innova Zenix in June 2023, and the fully remodeled Alphard and Vellfire in November of the same year. Honda’s sales decreased by 0.3% to 80,027 units. Annual sales of the subcompact SUV WR-V, which was launched in July 2023, exceeded 7,800 units, making up for the decline in MPV sales. Furthermore, Honda announced that HEV sales in 2023 rose to more than 7,700 units, an 87.8% increase year-on-year.

The Malaysian Automotive Association (MAA) has announced its market forecast of 740,000 units for 2024, down 7.5% from 2023. Positive factors for the market included Malaysia's economic growth due to increased domestic demand and the policy interest rate being left unchanged. On the other hand, MAA has pointed to the instability of the world economy due to the war in Ukraine and the decline in consumption activity triggered by the Malaysian government’s planned service tax hike as causes for concern.