AAA weekly

2022-03-11

Copyright FOURIN, Inc. 2025

China’s A-Segment BEV Market in 2021

| This report includes information on the following topics: |

Key images: |

- China

- A-Segment market

- BEV

- electric vehicles

- ev market

- 2021

- Chinese automobiles

- sales increase

- Hongguang MINI

- SAIC-GM-Wuling

- Changan Automobile

- SAIC Motor

- emerging BEV manufacturers

- low-speed BEV

- price range

- safety performance

- parking support systems

- driving support systems

- graphs

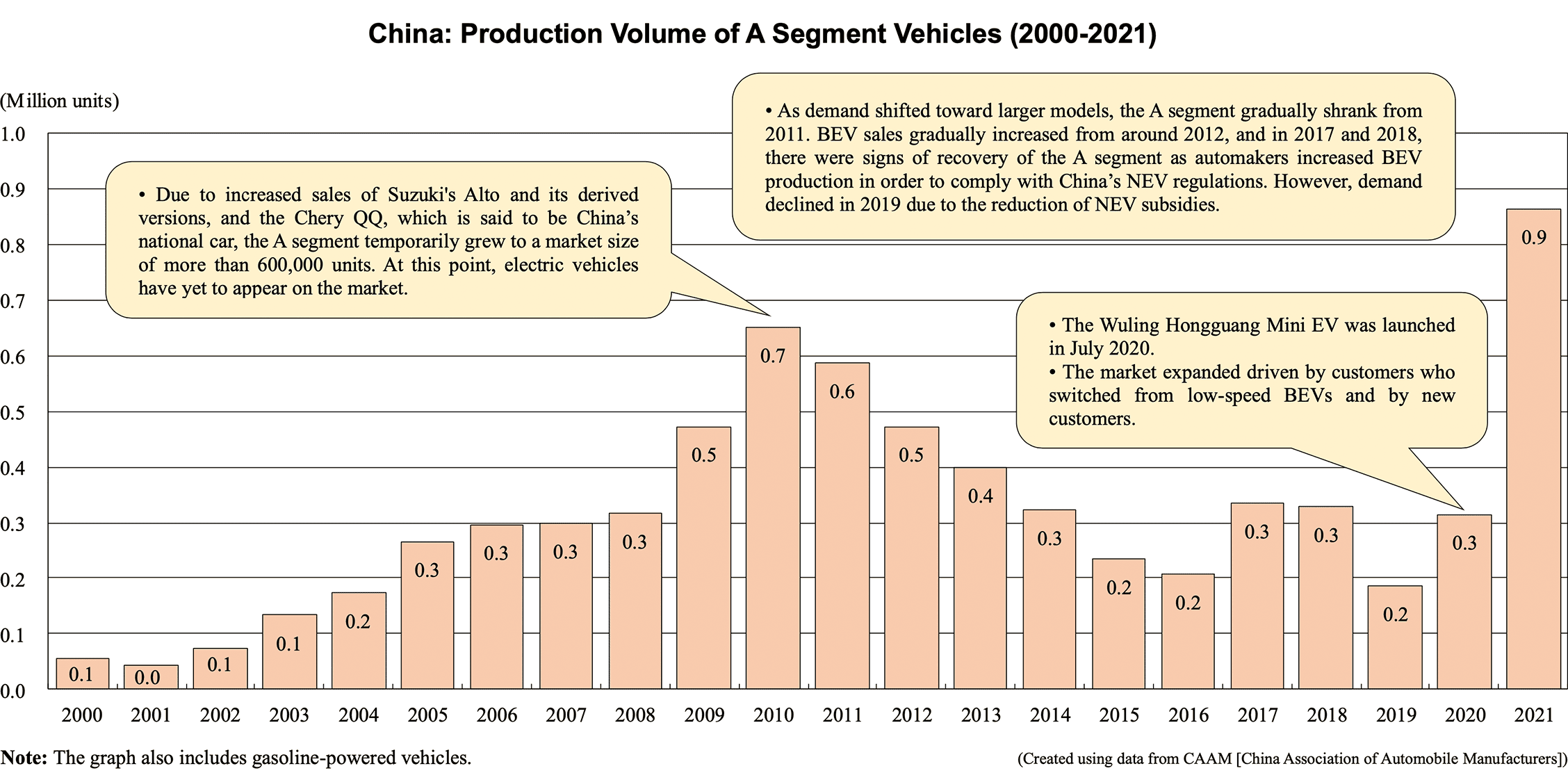

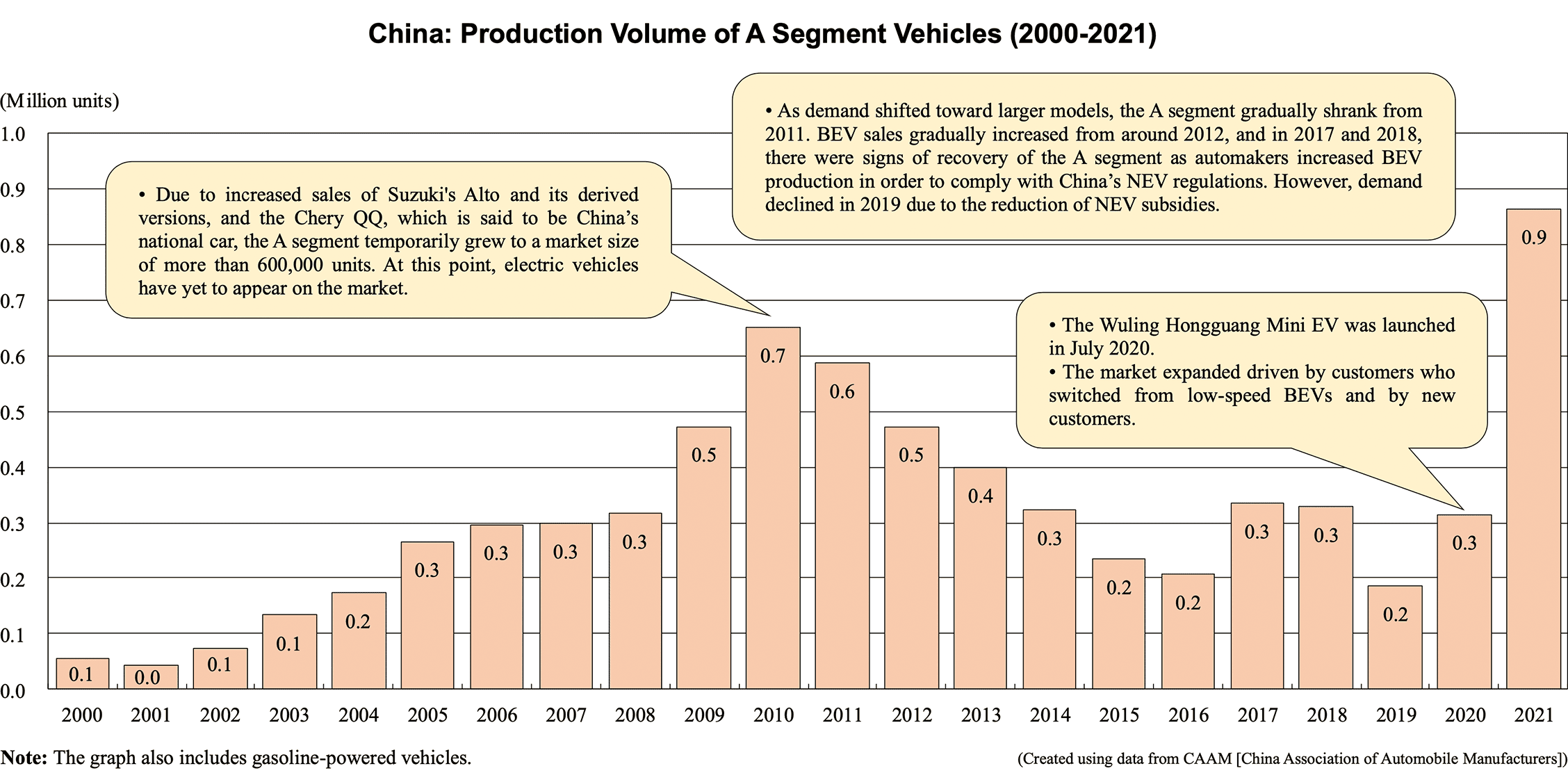

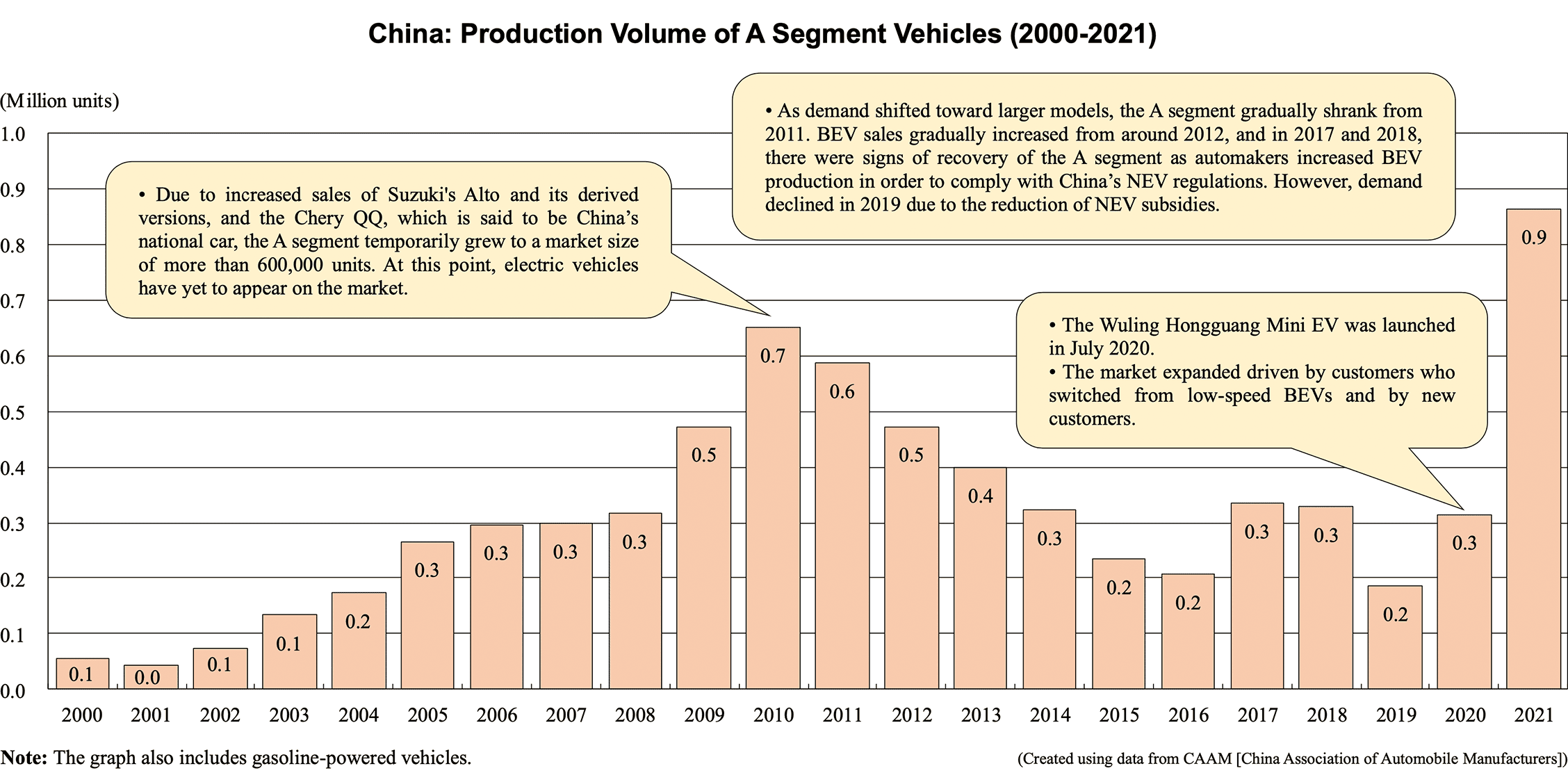

- China: Production Volume of A Segment Vehicles (2000-2021)

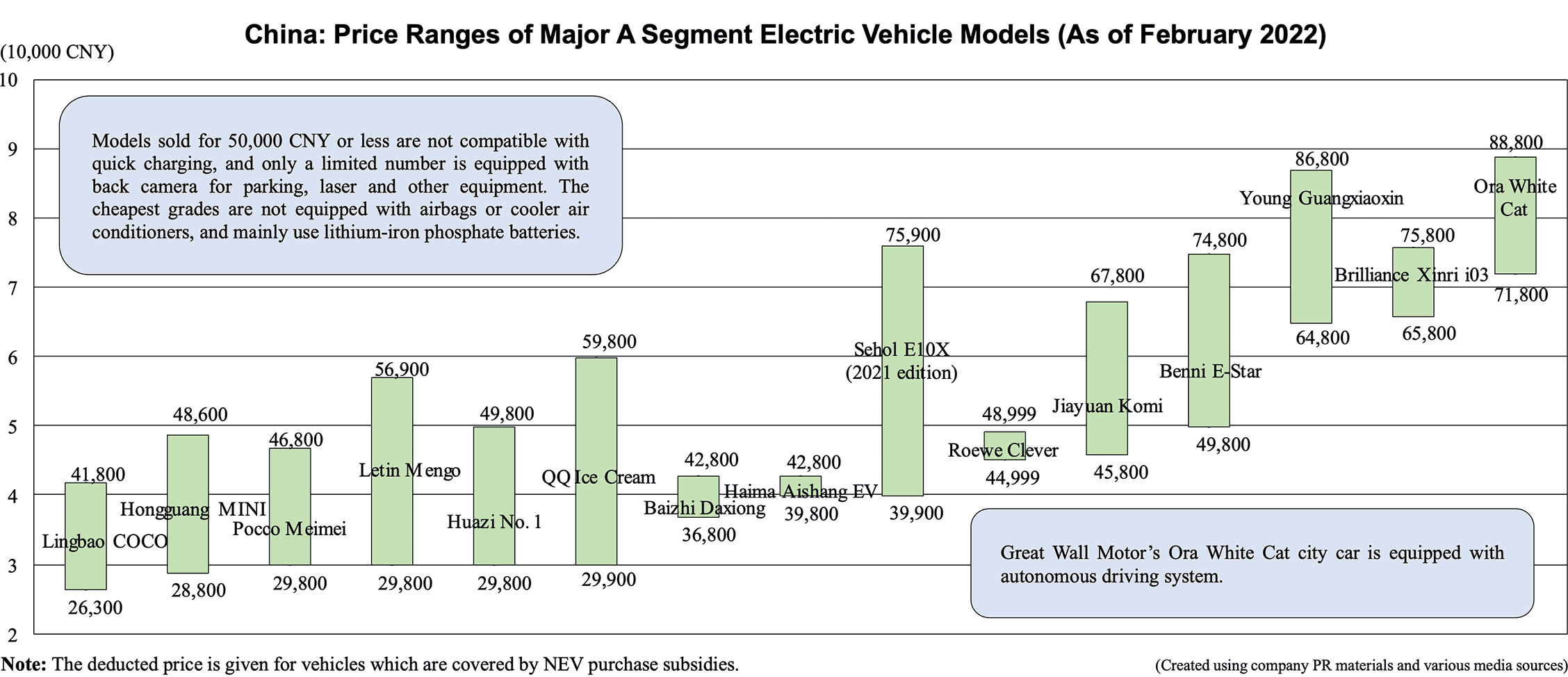

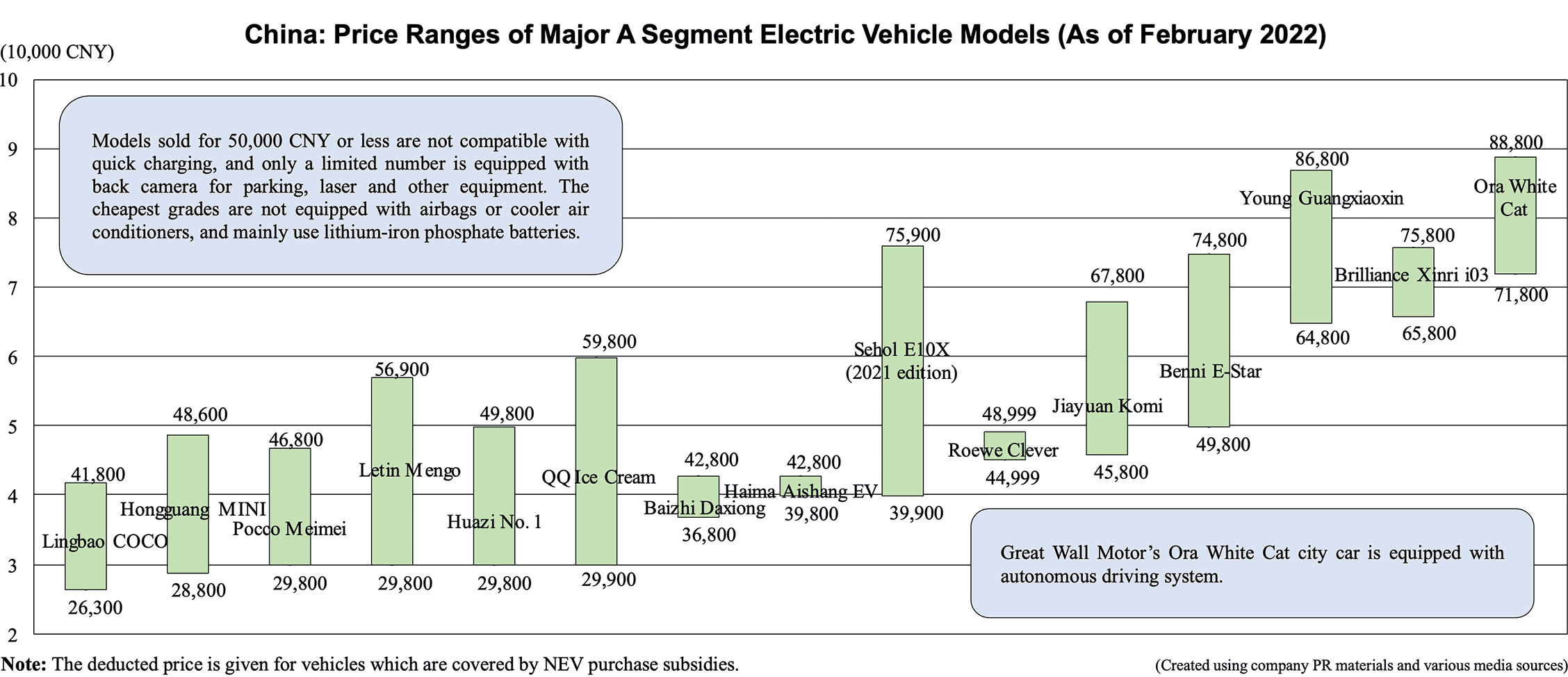

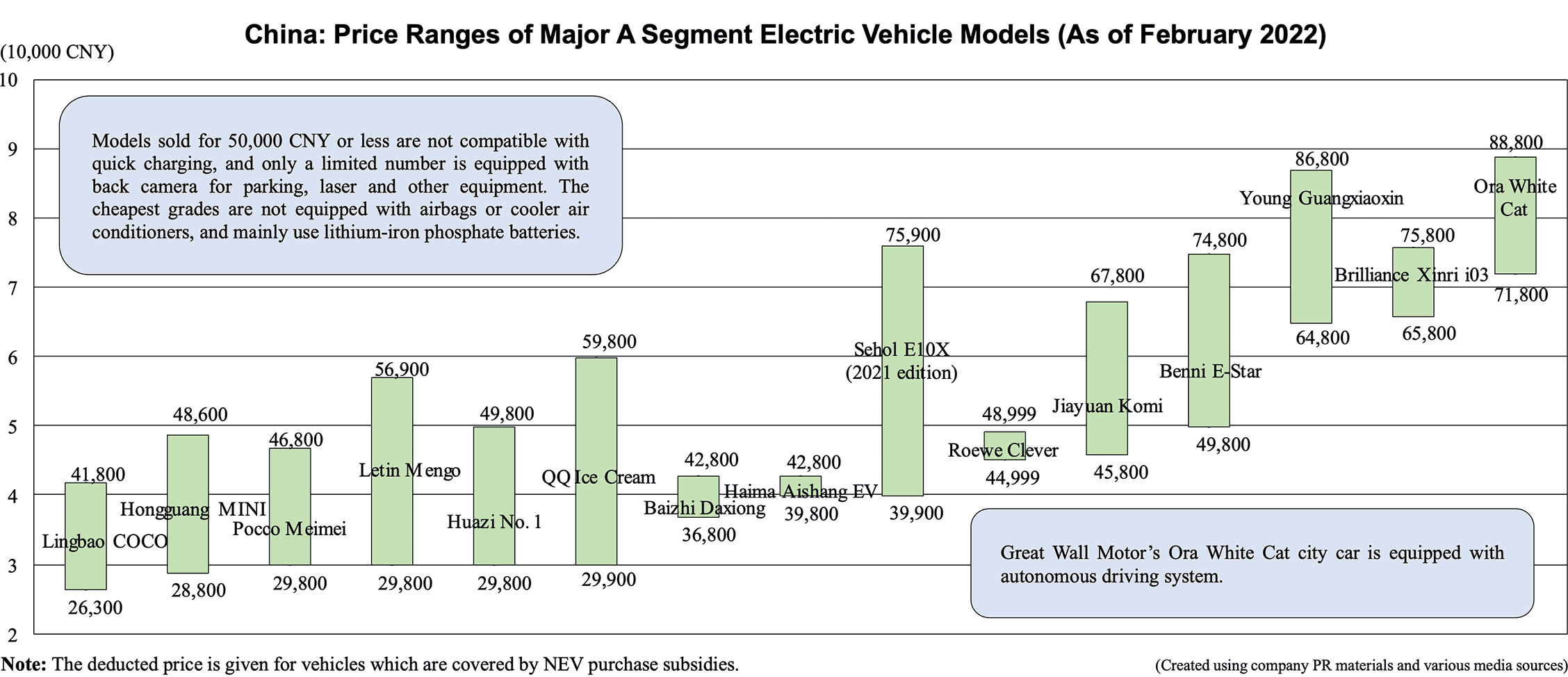

- China: Price Ranges of Major A Segment Electric Vehicle Models (As of February 2022)

- Suzuki's Alto

- Chery QQ

- shift in demand

- China’s NEV regulations

- regulation compliance

- NEV subsidies

- Wuling Hongguang Mini EV

- market expansion

- CAAM [China Association of Automobile Manufacturers])

- quick charging

- back camera for parking

- laser

- airbags

- vehicle air conditioners

- lithium-iron phosphate batteries

- Great Wall Motor

- Ora White Cat city car

- autonomous driving system

- A-Segment BEV Models Launched Since Hongguang MINI

- Macaron

- Cabrio

- Nano EV

- China: Factory Shipment Volume of A Segment Electric Vehicle Models

- Zhengzhou Nissan

- JMEV

- BAIC BJEV

- BAW

- Chery Automobile

- BYD

- Zhidou Auto

- JAC Motors

- Brilliance Jinbei

- Yema Auto

- Haima Automobile

- Jemmell

- Guoji Zhijun

- Leapmotor

- Zotye Auto

- basic specifications

- motor

- battery

- radar

- Diandongwu

- PMSM

- NMC

- SiTech

- rapid charging

- OTA technology

- CCS

- Lane Departure Warning

- Forward Collision Warning

- self-parking system

- PCW (Pedestrian Collision Warning)

|

|

In China, A segment BEV sales skyrocketed in 2021 compared to the previous year, reaching 863,246 units. The small BEV Hongguang MINI released by SAIC-GM-Wuling in July 2020 became a big hit, accelerating the growth of the A-segment market in 2021. Following the success of the Hongguang MINI, other manufacturers are now also releasing small BEV models one after another. In addition to major manufacturers such as Changan Automobile and SAIC Motor, emerging BEV manufacturers are also entering the A segment market. Moreover, there are a number of low-speed BEV manufacturers who are trying to set foot in the BEV market through the acquisition of production qualifications for regular automobiles.

Prices range from around 25,000 CNY to nearly 90,000 CNY. Models in the low-price range meet the minimum safety performance and functions of an automobile and are designed to be limited to daily short-distance travel to keep prices down. On the other hand, high-priced models feature enhanced functions such as parking support and driving support systems. In the low-price range, equipment is limited and models tend to have similar designs, so product differentiation is an issue.

Please

register or subscribe to view this report for free.

If you’re already a subscriber, sign in.

Credit card information is not needed for free trial registration.

You are eligible to view one report for free.

Additional reports require subscription.