AAA weekly

2020-06-15

Copyright FOURIN, Inc. 2025

China’s xEV Passenger Vehicle Production Slows Down Significantly in 2019

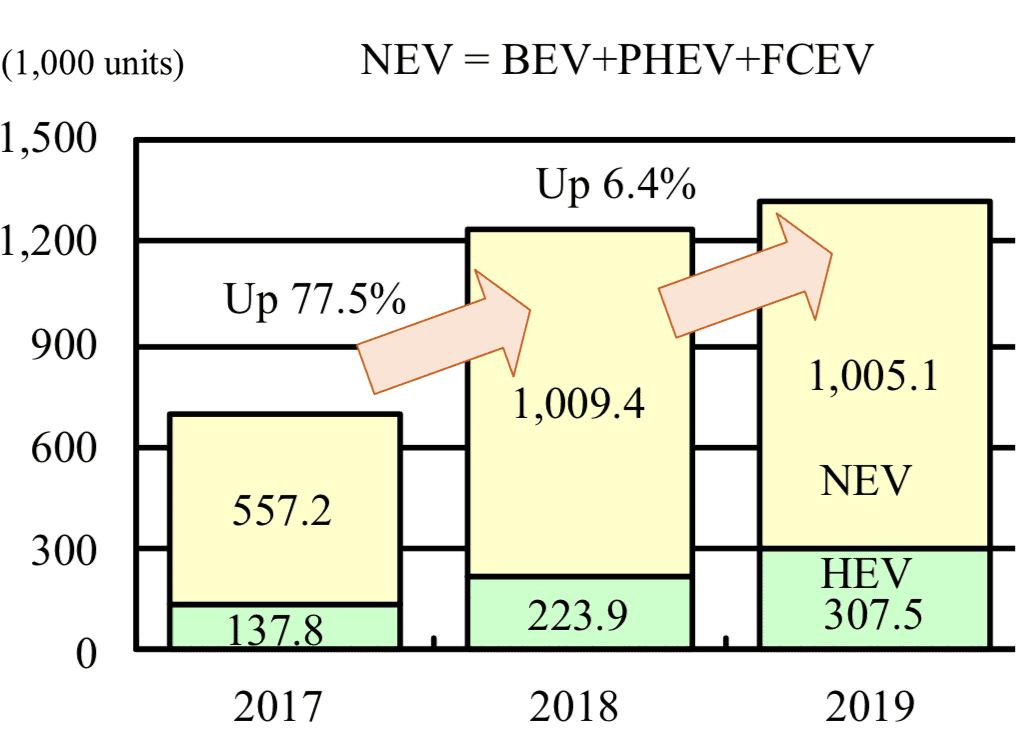

China’s xEV (electric vehicle = BEV, PHEV, FCEV, HEV) passenger vehicle production volume increased 6.4% in 2019 compared to the previous year to 1.31 million units, maintaining growth but the rate of growth slowed down significantly from the previous year’s 77.5%. Of which the production of NEVs (new energy vehicles = BEV, PHEV, FCEV) fell 0.4% to 1 million units due to the reduction of subsidies and the slump in the overall automobile market. Along with the introduction of stricter regulations on emissions and fuel economy, the production of energy-saving and fuel-efficient HEVs increased 37.3% to 308,000 units. One of the characteristics of the xEV market in 2019 was that NEV sales of foreign-affiliated companies and emerging Chinese manufacturers expanded, indicating rising demand for NEVs. Foreign manufacturers such as Toyota, Honda and VW launched NEV products one after another, and Tesla started local production. Meanwhile emerging Chinese manufacturers such as NIO, WM Motors and Xpeng, whose combined production exceeded 15,000 units in 2019, are promoting the use of advanced technologies such as connected and autonomous driving functions.

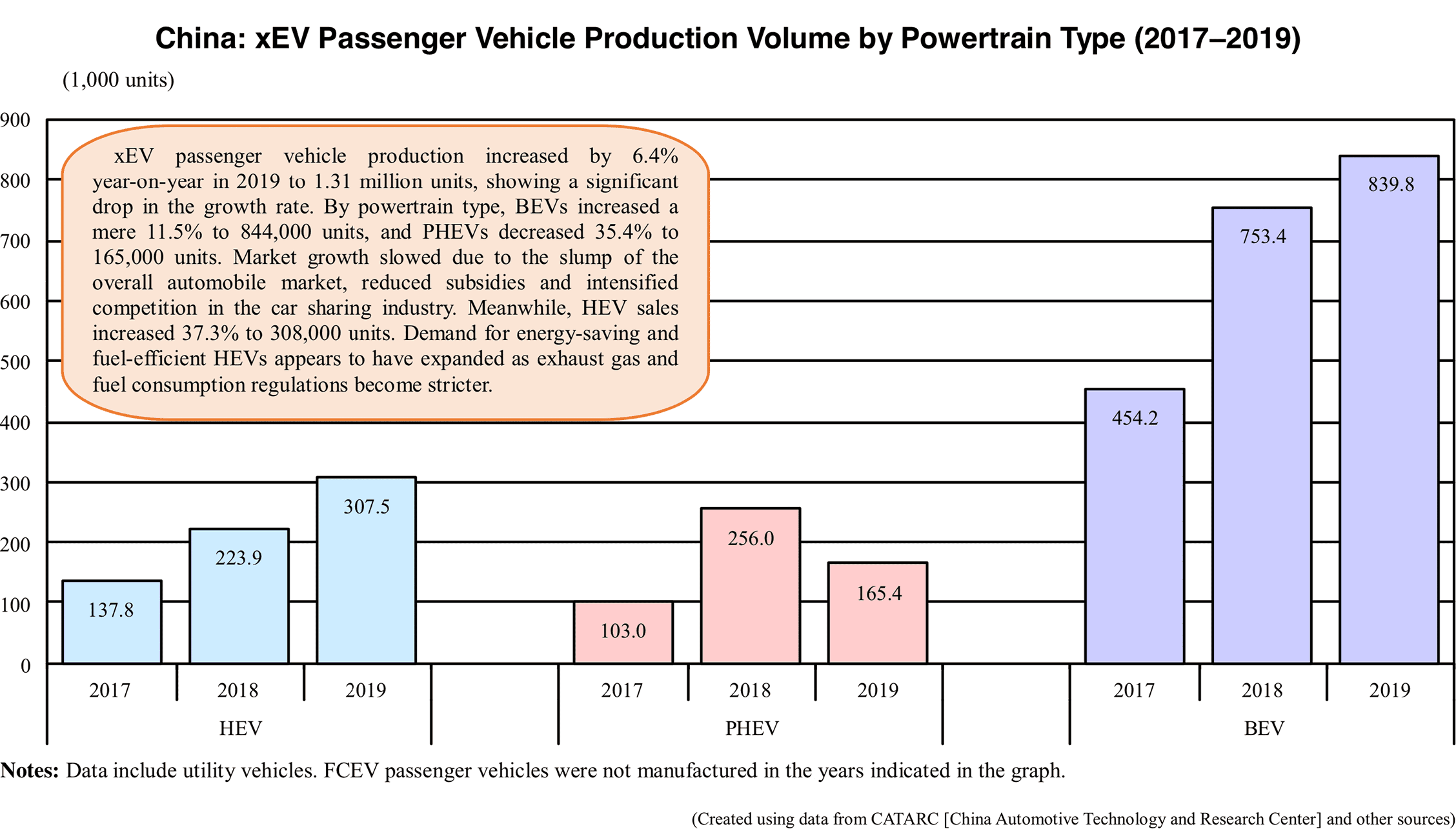

Looking at xEV passenger vehicle production by powertrain type in 2019, BEVs increased 11.5% to 840,000 units but PHEVs dropped 35.4% to 165,000 units. It is likely that the main reason for Chinese manufacturers decreased PHEV production is because PHEVs have difficulty obtaining CAFC and NEV credit which started to be applied in 2019. HEV production increased 37.3% to 308,000 units, with Toyota and Honda remaining the top HEV manufacturers. However, it is also worth noting the good performance of other PHEV products such as SAIC VW’s New Passat and Brilliance BMW’s 5 Series.

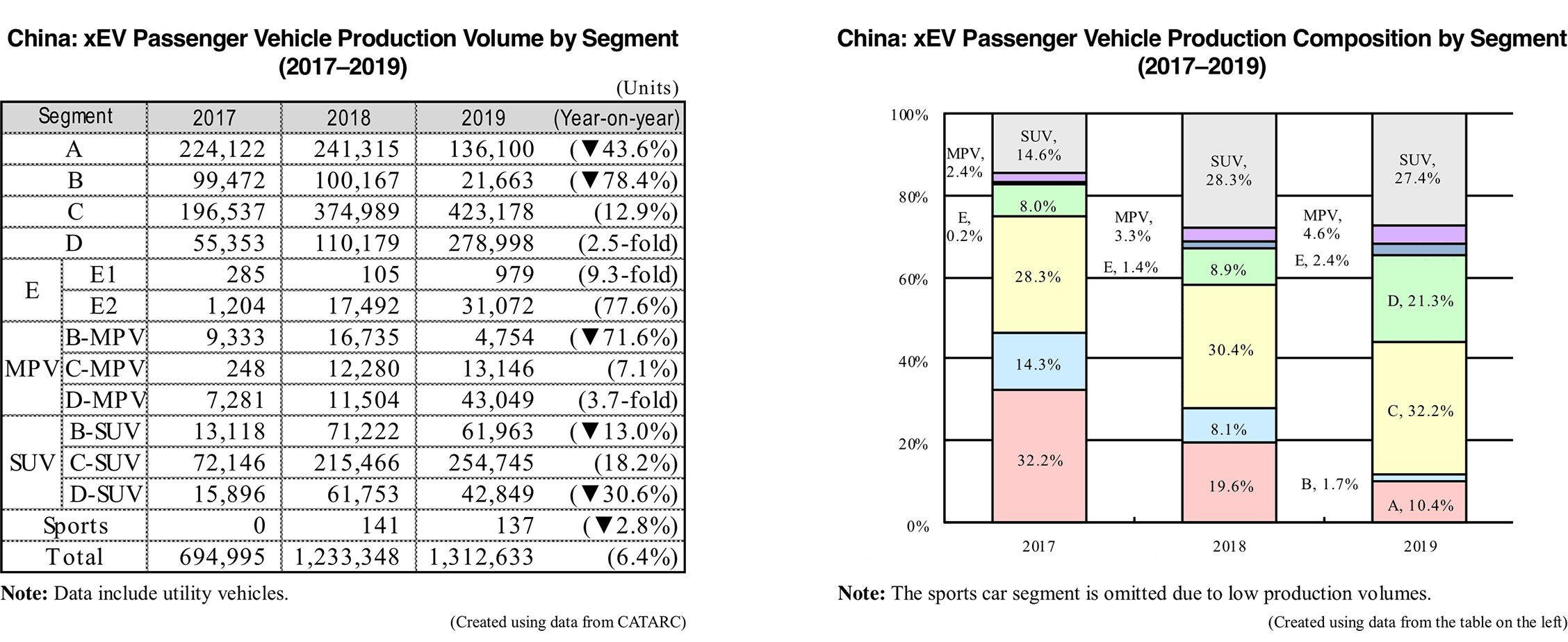

Looking at results by segment, the largest segment, the C segment, was driven by top-selling models such as Toyota’s Corolla and Levin, and BYD’s e5, increasing 12.9% to 423,000 units. The market share of the C segment went up 1.8pp to 32.2%. The SUV segment, ranked second in 2019, increased 3.2% to 360,000 units but its market share went down 0.9pp to 27.4%. On the other hand, the D segment, ranked third in 2019, went up 2.5-fold to 279,000 units driven up by GAC New Energy’s Aion.S, Toyota’s Avalon and Geely’s Geometry A market share rising 12.4pp to 21.3%. The A and B segments continued to decline due to sluggish demand for mini and small xEVs. Their market share dropped 9.2pp and 6.4pp to 10.4% and 1.7% respectively.

BYD, which has the largest share in China’s xEV passenger vehicle market, fell 11.5% to 188,000 units, its market share decreasing 4.3pp to 13.0%. Toyota and Honda, ranked second and third in 2019, manufactured 179,000 units and 135,000 units respectively thanks to solid sales of HEV models. BAIC and SAIC, ranked fourth and fifth in 2019, declined 18.7% to 118,000 units and 12.0% to 117,000 units respectively.

In order to stop the spread of the new coronavirus, economic activity was stagnant in China from late January to mid-February. As a result, xEV production in the first quarter of 2020 fell 50.0% to 148,000 units. In March, production resumed in areas where the infection was less serious, but as of the same month, many companies had operating rates below 50%. Under these circumstances, the cash flow of some manufacturers is expected to worsen, and the consolidation of the industry is likely to speed up after the infection subsides.