2035 Outlook for the Indian Motorcycle Market

Format: PDF (Size A4)

Pages: 103

Price: 221400 JPY

Description

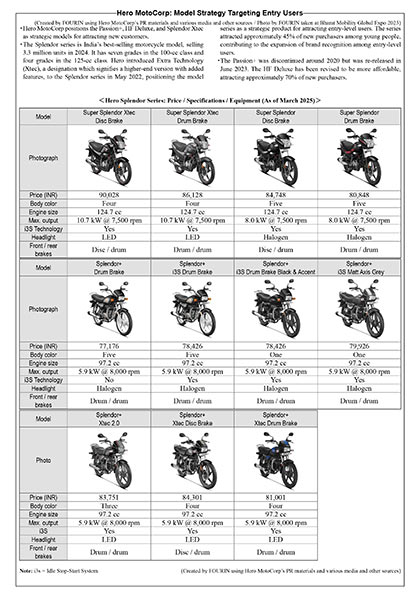

Impact of Social Disparities and Energy Policy on Market Growth and Structural Changes • Indian energy policy: Self-sufficiency, renewable energy, ethanol, biogas and green hydrogen • Business strategy: Hero MotoCorp, TVS Motor, Bajaj Auto, Royal Enfield, Honda Motor, Yamaha Motor, Suzuki Motor, Ola Electric Mobility, Ather Energy, Emerging Players • Current status and 2035 outlook: ICE, CNG, flex-fuel and electric motorcycles

Contents

India’s motorcycle sales (new registration data) increased by 1.84 million units from the previous year to 18.94 million units in 2024. It was higher than 2019’s result before the outbreak of COVID-19, however, the figure was still 650,000 units lower than the record high of 19.59 million units in 2018. The recovery in sales was driven by strong demand for gasoline scooters in 2024, in addition to the market expansion of standard motorcycles over 110 cc but not exceeding 125 cc and electric scooters. However, the recovery of motorcycles 110 cc and below, which is the largest segment in India, is slow, and this may become a drag on the future growth of the country’s motorcycle market. This segment had a peak market size of 8.46 million units in 2018, but due to stricter loan regulations and economic stagnation in rural areas, the market size fell below 5.3 million units from 2020 to 2022, and even in 2024, when demand for motorcycles was strong, it remained at 5.81 million units. In the coming years, if the income levels of those who currently cannot afford motorcycles rise along with economic growth, the scope of the motorcycle market is expected to expand, but the future is still uncertain and social disparities remain large.

India, which aims to become an energy self-sufficient country, has introduced policies to popularize electric motorcycles and promote domestic production of electric parts to curb oil imports. With the aim of promoting industrial development and improving income levels in rural areas, India has introduced policies to encourage the widespread adoption of bioethanol and biogas and the development of these industries. In response to these policies, the motorcycle industry is also working on not only electric vehicles but also on the commercialization of CNG and flex-fuel models. The current development of CNG and ethanol stations will also encourage manufacturers to develop and launch such models.

The industry is naturally interested in how much the Indian motorcycle market, the world’s largest, will expand by 2035, and to what extent electric, CNG, and flex-fuel motorcycles will become widespread. For this reason, FOURIN has published the 2035 Outlook for the Indian Motorcycle Market, which predicts the future market from various perspectives. This report forecasts the 2035 Indian motorcycle market, taking into account the government’s energy policy, the business strategies of major motorcycle and electric vehicle manufacturers, and the latest motorcycle market trends. We hope that this report will help professionals involved in the Indian motorcycle industry and those who are considering entering the sector.

Sample Pages