Current Status and 2030 Outlook of Electrification in the Global Motorcycle Market

Description

Electric vehicle strategy of global motorcycle manufacturers is challenged by decarbonization, soaring raw material and fuel prices, and the rise of emerging players. This report contains: ・Sales forecast of BEV motorcycles in major motorcycle markets from 2022 to 2030 ・Reports on BEV motorcycle sales trends from 2017 to 2021 in 38 countries around the world ・Outline of policies related to electric vehicles and overview of tightened exhaust gas regulations in major motorcycle markets ・Detailed information on business development trends and business strategies of major emerging BEV motorcycle manufacturers ・Reports on the business strategy of global motorcycle manufacturers and their BEV business trends and plans

Contents

Chapter 1. Current Status and Future Prospects of Electrification in the World's Major Motorcycle Markets

- BEV Motorcycle Promotion Measures in Major Markets

- Promoting Motorcycle Electrification by Decarbonizing in Developed Countries and Curbing Oil Imports by Emerging Countries

- Sales Trends of BEV Motorcycles in Majors Markets

- BEV Motorcycle Sales in 38 countries Reached 3.6 Million Units in 2021

- Sales Forecast of BEV Motorcycles Until 2030 in Major Markets

- BEV Motorcycle Demand Varies Greatly from Country to Country Depending on Various Factors Including Market Characteristics, Environment, Energy and Industrial Policies

- Rise of Emerging BEV Motorcycle Manufacturers and BEV Business Development of Global Motorcycle Manufacturers

Chapter 2. Trends and Prospects for Motorcycle Electrification in Major Markets Around the World

- India

- Promoting Electrification of the Transportation Sector, Including Motorcycles, Is Centered on Climate Measures and Reduction of Oil Imports

- PLI Scheme Benefits EV Production, While FAME-India Program Supports EV Purchase

- Electric Motorcycle Sales in 2021 Surged to a Record High of 143,000 Units

- BEVs Are Expected to Advance Ahead of Scooters in Urban Areas; the Key to BEV Penetration in the Entire Market is Motorcycles

- Indonesia

- Acceleration of Electrification Is Centered on Major State-owned Resources and Energy Companies

- BEV Motorcycle Sales Depend on BEV Business Development of Market Leader Honda

- Thailand

- Promoting ZEV Use to Reduce GHG Emissions by 45% by 2030

- BEV Motorcycle Sales Are Expected to Increase Driven by the Government's Electrification Promotion Policy and Soaring Gasoline Prices

- Vietnam

- Limited Efforts in the Transportation Field Toward Carbon Neutrality

- Expansion of Demand for BEV Motorcycles Depends on Market Leader Honda and Motorcycle Entry Regulations in Urban Areas

- Philippines

- Aiming to Foster the EV Industry to Stop Rising Trade Deficit Triggered by Increasing Crude Oil Imports

- China

- The World's Largest Market of BEV Motorcycles Where Used as the Popular means of Travel of the Common People

- The Shift from Electric Bicycles to Electric Motorcycles to Accelerate in the 2022-2024 Period

- Taiwan

- BEV Motorcycle Market Supported by Purchase Subsidies Equivalent to 30-40% of Vehicle Prices

- BEV Ratio in the Motorcycle Market May Rise to Around 30% in 2030

- Europe

- Europe Aims to Reduce GHG Emissions by 55% by 2030; Countries Moving to Ban Sales of Gasoline Motorcycle

- Major European Markets Provide 1,000-3,000 EUR in Subsidy to Promote BEV Motorcycle Purchase

- Europe Increasingly Restricts Vehicle Entry into Cities; France to Ban Gasoline Motorcycles in Paris in 2030

- BEV Ratio Exceeded 7% in 2021 in the European Motorcycle Market Aided by Strong Demand Primarily in the Netherlands and France

- Europe to Accelerate Electrification with Low-displacement Products Through the Introduction of Euro 5+ in 2024

- United States

- Promoting Electrification While Aiming to Reduce GHG Emissions by at Least 50% by 2030

- In Addition to the 10% Federal Tax Deduction, California Among Other States also Subsidize the Purchase of BEV Motorcycles

- Emerging Manufacturers Such as Zero Motorcycles and NIU Lead in BEV Motorcycle Sales

- BEV Motorcycle Demand in 2030 ill Depend on Zero Emission Policies in Major Cities

- Brazil

- Aiming to Reduce GHG Emissions Through Biofuels and Planting Trees

- BEV Motorcycle Startup Voltz Motor Rapidly Expands Business

- Japan

- Promoting the Introduction of BEVs to Reduce GHG Emissions by 50% by 2030

- Market Launch of BEV Motorcycles for Commercial Use Is Gaining Momentum; Mainly Chinese Products Are Purchased for Private Use

- Electrification to Progress in the 2022-2027 Period Driven by New Motorcycle Companies and Stricter Emission Regulations

Chapter 3. Outline and Growth Strategy of Electric Motorcycle Business of Startup Companies

- Gogoro

- Aiming to Build a HaaS Business Model with Swapping Batteries

- Becoming the De Facto Standard for BEV Motorcycles in Taiwan

- Professing Strength in In-house Powertrain Solutions Such as Swapping Batteries and Drive Units

- Full-scale Overseas Business Expansion in China, India and Indonesia from 2022

- Ola Electric Mobility

- Aiming for the Production of 10 Million BEV Motorcycles in 2027

- Introduced the In-house BEV Scooter Ola S1 Series in December 2021

- Niu Technologies

- Sold 1 Million Electric Mobility Units Worldwide and Raised Annual Production Capacity to 2 Million Units in 2021

- Aiming to Expand Overseas Business with a Focus on Europe by Strengthening Electric Mobility Products for Various Areas Including Last One Mile

- Super SOCO

- Expanding Sales Mainly in Europe in Partnership with Australia’s Vmoto

- Strengthening Electric Motorcycle Products with New Launches; Introducing Battery Swapping System for Scooters

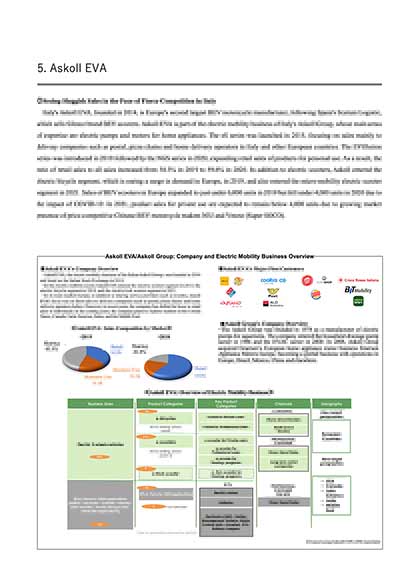

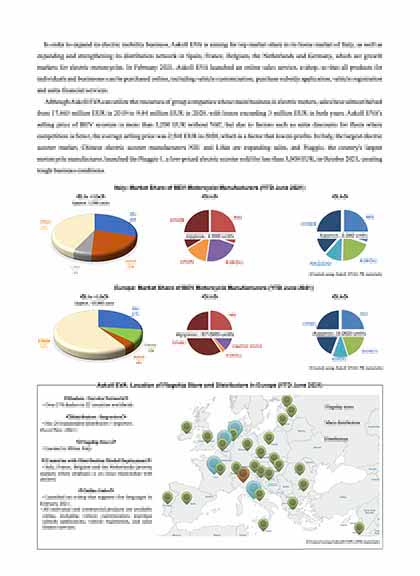

- Askoll EVA

- Seeing Sluggish Sales in the Face of Fierce Competition in Italy

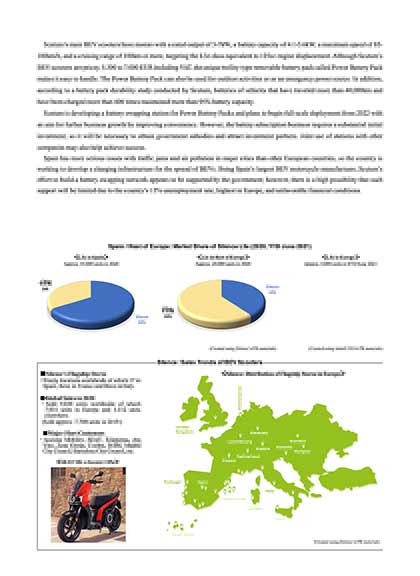

- Scutum Logistic, S.L. (Silence)

- Europe's Largest BEV Motorcycle Manufacturer

- Zero Motorcycles

- Leading BEV Sports Motorcycle Maker with Presence in Over 100 Countries

- Yadea Technology Group

- The World's Largest Electric Bicycle and BEV Scooter Manufacturer

- Aiming to Expand Overseas Sales of Premium BEV Scooters with a Focus on Europe

Chapter 4. Electrification Strategy of Global Motorcycle Manufacturers

- Honda Motor

- Strengthening Businesses in Core Global Markets ASEAN and India

- Launching Three Models of the Honda e: Business Bike Series for Private Use Until 2024

- Yamaha Motor

- Increasing Profitability with Premium Strategy and Strengthening Carbon Neutrality

- Aiming for a 90% BEV Ratio Of All Motorcycle Sales in 2050

- Suzuki Motor

- Aiming for Global Sales of 2 Million Units in the Fiscal Year Ending March 2026 Under the New Medium-term Management Plan

- Electric Motorcycle Business Faces Challenges While Profitability of Motorcycle Business Is Set as Top Priority

- Kawasaki Motors

- Aiming for Sales of 1 Trillion JPY and an Operating Profit Margin of at Least 8% in 2030

- Introducing Over 10 Models of Electric Motorcycles by 2025

- Hero Motocorp

- Developing BEV Business Based on Its VIDA Brand and Its Startup Subsidiary Ather

- Bajaj Auto

- Following the Launch of the Chetak BEV Scooter, an Electric Motorcycle Jointly Developed with KTM to Be Launched

- TVS Motor

- Entered the BEV Motorcycle Sector with the iQube; Launched e-bike Business in Europe

- BMW Motorrad

- Accelerating Electrification to Realize Sustainability 2030 Group Strategy

- Aiming to Be the Top Premium BEV Motorcycle Maker by Expanding the Lineup of Next-generation Urban Mobility Products

- Piaggio

- Strengthening Leadership Position in Europe’s Motorcyle Market

- Developing Full-scale BEV Scooter Business Including Swapping Battery System

- PIERER Mobility AG

- Aiming for Global Sales of 400,000 Units in 2022 Using a Three-brand Strategy

- Developing a 48V Low-voltage Electric Motorcycle with India’s Bajaj Auto

- Harley-Davidson (LiveWire)

- Restructuring by Focusing on Competitive Product Segments and Potential Growth Markets

- Electric Motorcycle Brand LiveWire Is Merging with a SPAC to Go Public

- KYMCO

- Expanding Electrification Solution iONEX to Catch Up with the Gogoro Alliance

Sample Pages