Asia's Motorcycle Industry 2021

New Trends of Asia's 40 Million Motorcycle Market in the Post-corona Era

Format: PDF (Size A4)

Pages: 135

Price: 198000 JPY

Description

This report provides an overview of Asia's top 8 markets, accounting for 80% of global sales. It summarizes the activities of major Japanese, Indian and Taiwanese motorcycle manufacturers. It includes forecast data for total motorcycle demand in 2025 and 2030, and detailed analysis on the current status of the electric motorcycle industry and market in India, China and Taiwan.

Contents

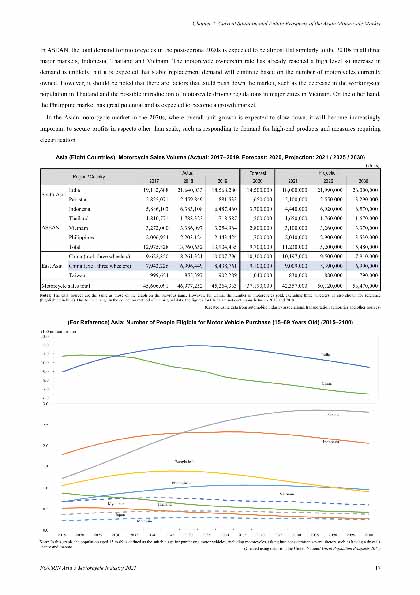

| Chapter 1. | Current Situation and Future Prospects of the Asian Motorcycle Market |

| 1-1. | Introduction |

| 1-2. | Asian Motorcycle Market Forecast |

| 1-3. | Asian Electric Motorcycle Market |

| Overview of the Electric Motorcycle Market (1 India, 2 China, 3 Taiwan) | |

| Overview of the Electric Motorcycle Business of Major Motorcycle Manufacturers | |

| Notable Electric Motorcycle Startups (1 Gogoro, 2 Ather Energy, 3 Okinawa Autotech) | |

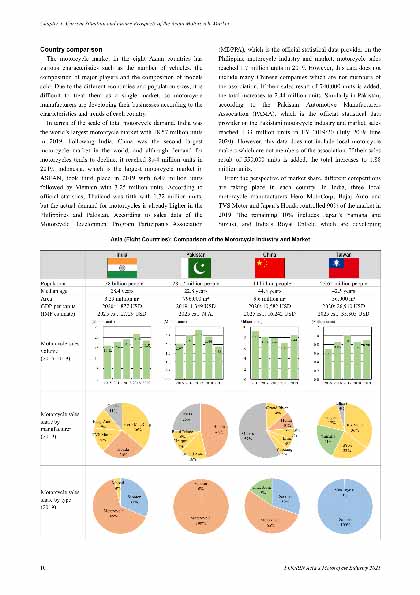

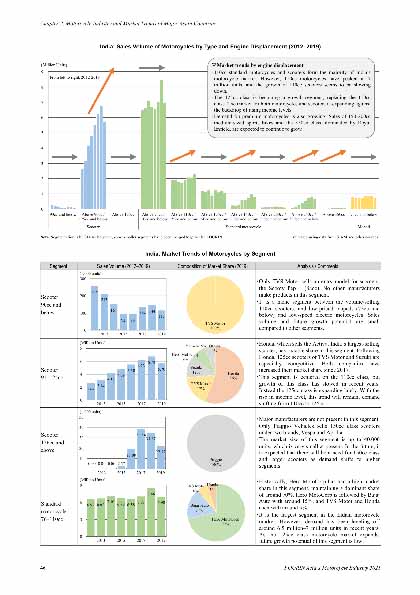

| Chapter 2. | Motorcycle Industry and Market Trends of Major Asian Countries |

| 2-1. | India |

| 2-2. | Pakistan |

| 2-3. | Indonesia |

| 2-4. | Thailand |

| 2-5. | Vietnam |

| 2-6. | Philippines |

| 2-7. | China |

| 2-8. | Taiwan |

| Chapter 3. | Business Trends of Major Motorcycle Manufacturers in Asia |

| 3-1. | Honda |

| 3-2. | Yamaha |

| 3-3. | Suzuki |

| 3-4. | Kawasaki |

| 3-5. | Hero MotoCorp |

| 3-6. | Bajaj Auto |

| 3-7. | TVS Motor |

| 3-8. | Royal Enfield |

| 3-9. | KYMCO |

| 3-10. | SYM |

| Appendix |

Sample Pages